Intel Rules Chip Market: Share Jumps to a 10-Year High

Intel once again topped the chip maker ranking of 2011.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

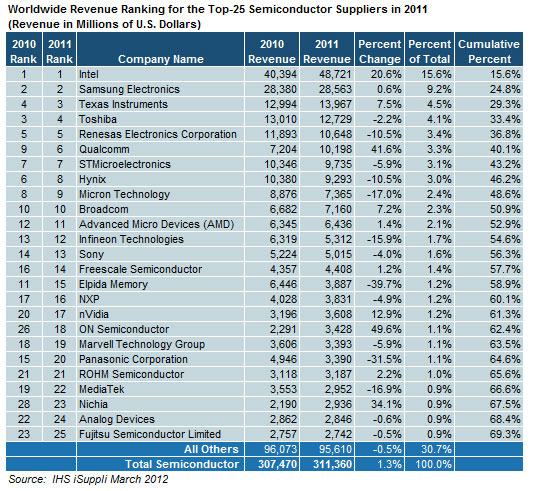

On top of with the strongest growth of any of the top 23 semiconductor companies listed by IHS, Intel held a higher share of the industry than it has in the past ten years. Revenue of $48.7 billion for the year was up 20.6 percent over 2010 and gave the company a 15.6 percent market share. Samsung gained slightly too from $28.3 billion to $28.6 billion and 9.2 percent share, followed by TI, which surpassed Toshiba and climbed from $13.0 billion to $14.0 billion for 4.5 percent market share.

Among the winners of the year are Qualcomm, which jumped from ninth position to sixth with a gain from $7.2 billion to $10.2 billion and 3.3 percent share; ON Semiconductor with a jump from position 26 to 18 and a share of 1.1 percent as well as Nichia, which climbed from 28 to 23 and holds 0.9 percent share. On the loser side, Elpida revenue dropped 39.7 percent, which caused the company to fall from rank 11 to 15 and Panasonic lost 31.5 percent of sales and declined from position 15 to 20. Among other notable companies, AMD climbed one spot from 12 to 11 and saw its sales rise from $6.3 to $6.4 billion. Nvidia gained three spots from 20 to 17 and increased its chip sales from $3.2 to $3.6 billion.

“Intel in 2011 captured the headlines with its major surge in growth,” said Dale Ford, head of electronics and semiconductor research for IHS. “The company’s rise was spurred by soaring demand for its PC-oriented microprocessors, and for its NAND flash memory used in consumer and wireless products. Intel’s revenue also was boosted by its acquisition of Infineon’s wireless business unit. The company’s strong rise helped it to stave off the rising challenge mounted by No. 2 semiconductor supplier Samsung Electronics, which had been whittling away at Intel’s lead in recent years.”

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

trumpeter1994 Good to see some market growth. I love Intel but I really think AMD needs to step there game up because the competition might help push the boundaries. Not to mention some price wars might be nice :PReply -

ksampanna Surprising ... considering that two days ago, Apple was expected to surprass Intel as the world's top "chip maker"Reply -

mitunchidamparam look at Qualcomm and On semiconductors, they have a big jump in market share.Reply -

Lord Captivus Dispite what many are saying, I have to say that this market looks quiet good for consumers. You dont this in many industries.Reply

The number 1 company "only" has 15.6% of total market, thats almost perfection.

And having 23 companies with almost 70% is amazing. Its a shame it doesnt say how many companies are "All Others", but still from my perspective this is very good maket distribution.

Of course we dont see if companies are dependant of each other or if a company in the list owns another company also from the list.

-

shafe88 trumpeter1994Good to see some market growth. I love Intel but I really think AMD needs to step there game up because the competition might help push the boundaries. Not to mention some price wars might be niceGive amd some time and they wiil. right now Amd and their bulldozer is like Intel and the pentium4.Reply -

spleenbegone ksampannaSurprising ... considering that two days ago, Apple was expected to surprass Intel as the world's top "chip maker"Came here to post that. Looks like Apple might have some work to do.Reply -

trumpeter1994 shafe88Give amd some time and they wiil. right now Amd and their bulldozer is like Intel and the pentium4.Even as an intel guy. I still just hope they don't continue to fall generations behind, but i do think there is meaning to what they say about bulldozer being in it's infancy. I hope so because as consumers we need the competition.Reply -

silverblue ksampannaSurprising ... considering that two days ago, Apple was expected to surprass Intel as the world's top "chip maker"From the same author, no less.Reply -

Yeah, LOL, I was just about to post the Apple comment. It was simply one of the most ridiculous things I had ever heard. This just confirms it!Reply