Intel Q4 earnings reveal rocky path to recovery following weakest full-year revenue since 2010 — Intel Foundry losses continue as 18A begins ramp, but supply challenges set to ease in Q2 2026

But there is a major catch about it.

Intel's shares fell sharply on Friday morning ahead of market open, after the company published its financial results for the final quarter of 2025 as well as for the whole year. The company's earnings contracted both in Q4 and for the year, so Intel's full-year revenue dropped to $52.9 billion, which is Intel's weakest result since 2010.

Despite dropping earnings, the company has managed to shrink its losses in the back half of the year, so the company only lost $300 million for the whole of 2025, which is a good result given that it lost $18.8 billion in 2024. There are a couple of catches with the result, though. Furthermore, it looks like Intel has a looming challenge for 2026, namely, meeting demand for its products. Intel's shares fell 13.5% on Friday morning following the news.

Intel's losses shrink to $300 million, but only with cash injections

For the fourth quarter of 2025, Intel reported $13.7 billion in revenue, down from $14.3 billion in the same quarter a year prior, representing a 4% year-over-year (YoY) decline. During the quarter, Intel lost $0.6 billion on a GAAP basis as its gross margin dropped to 36.1% from 39.2% in Q4 2024. Meanwhile, the company exceeded its expectations in Q4 amid a very tight supply of products due to its inability to get enough wafers from internal and external suppliers, which is a good sign for Intel as it signals strong demand.

"We exceeded Q4 expectations across revenue, gross margin, and EPS even as we navigated industry-wide supply shortages," said David Zinsner, Intel CFO. "We expect our available supply to be at its lowest level in Q1 before improving in Q2 and beyond. Demand fundamentals across our core markets remain healthy as the rapid adoption of AI reinforces the importance of the x86 ecosystem as the world’s most widely deployed high-performance compute architecture."

As for the whole fiscal year 2025, the company recorded revenue of $52.9 billion, which is more or less flat compared to the $53.1 billion posted in 2024. Yet, in 2024, the company lost some whopping $18.8 billion on a GAAP basis, and its gross margin was at 32.7%.

If we consider Intel's financial results for the year from a pure numbers point of view, then Intel did pretty well in 2025. However, a closer look reveals that the company received $2 billion from SoftBank, $4.46 billion from Silver Lake (for a 51% stake in Altera), $5 billion from Nvidia, and $8.9 billion from the U.S. government. In total, Intel got some $20.36 billion, and yet it still lost a moderate $300 million.

Intel re-allocates wafers to data center products, but still cannot meet demand

When it comes to segment reporting, the results were a mixed bag: Intel's Client Computing Group (CCG) somewhat disappointed, whereas Data Center and AI Group (DCAI) performed better than expected, which was likely an effect of the company's deliberate steering of capacity toward higher-margin products, which are, of course, data center CPUs. Meanwhile, Intel Foundry unit traditionally remains in the red.

Intel's CCG delivered $8.2 billion in revenue in Q4 2025, down 3.5% from $8.5 billion in Q3 2025 and down 6.8% from $8.8 billion in Q4 2024. Operating income of the group was $2.2 billion, down from $2.7 billion sequentially and $3.2 billion from the same quarter a year ago, as margins declined to 27%.

Traditionally, sales of Intel consumer products grow in the fourth quarter. However, although demand for Intel's CPUs for client PCs was strong, CCG revenue declined sequentially in Q4 2025 because the company prioritized constrained internal wafer supply toward higher-demand data center products, thus relying more on externally sourced wafers for client CPUs, which tends to hurt margins significantly.

"While maintaining support for our client OEM partners, where possible, we are prioritizing our internal wafer supply to data center and leveraging an increased mix of externally sourced wafers," said Zinsner.

Intel's DCAI group, which produces server parts, delivered $4.7 billion in revenue, up sequentially from $4.1 billion in Q3 2025 and up from $4.4 billion in Q4 2024. The unit's operating income reached $1.3 billion, compared with $1.0 billion in the prior quarter and $0.4 billion a year earlier, resulting in an operating margin of 26.4%, up from 23.4% in Q3 2025 and skyrocketing from 8.6% in Q4 2024.

Intel's efforts to reallocate internal supply from CCG to DCAI paid off, and DCAI's earnings grew 15% quarter-over-quarter and 7% year-over year. Interestingly, according to Zinsner, unit demand for server CPUs skyrocketed beyond expectations in the second half of the year.

"If you go back about six months and look at customer signals, core counts were expected to increase, but unit volumes were not," noted Intel's chief financial officer. "Every hyperscaler we spoke with was signaling that. Over the third and fourth quarters, unit demand increased rapidly, and in conversations just before this call, it became clear that this is likely a multi-year demand trend."

Although Intel is investing in additional production capacity for existing CPUs, the company admits that demand for its Xeon processors exceeded supply, and this will continue into 2026 as demand for data center CPUs is driven by AI infrastructure buildout.

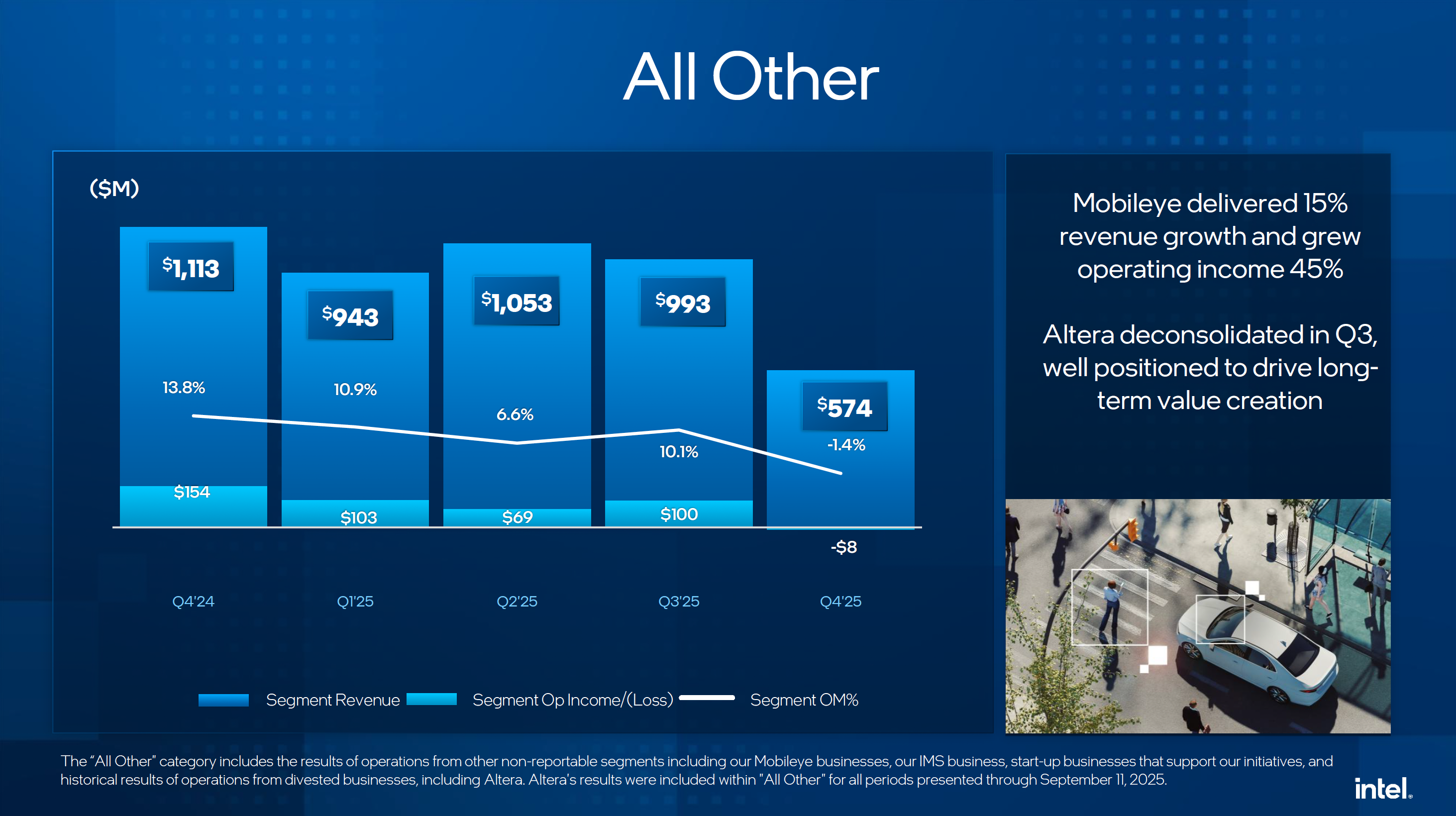

Intel's All Other segment — which now includes its Mobileye business, IMS photomask printing operations, and some startups — posted $574 million in revenue in Q4 2025, down sequentially from $993 million in Q3 2025 and down from $1.113 billion YoY. For the first time in quarters, the All Other segment turned red, losing a modest $8 billion with a negative operating margin on 1.4%.

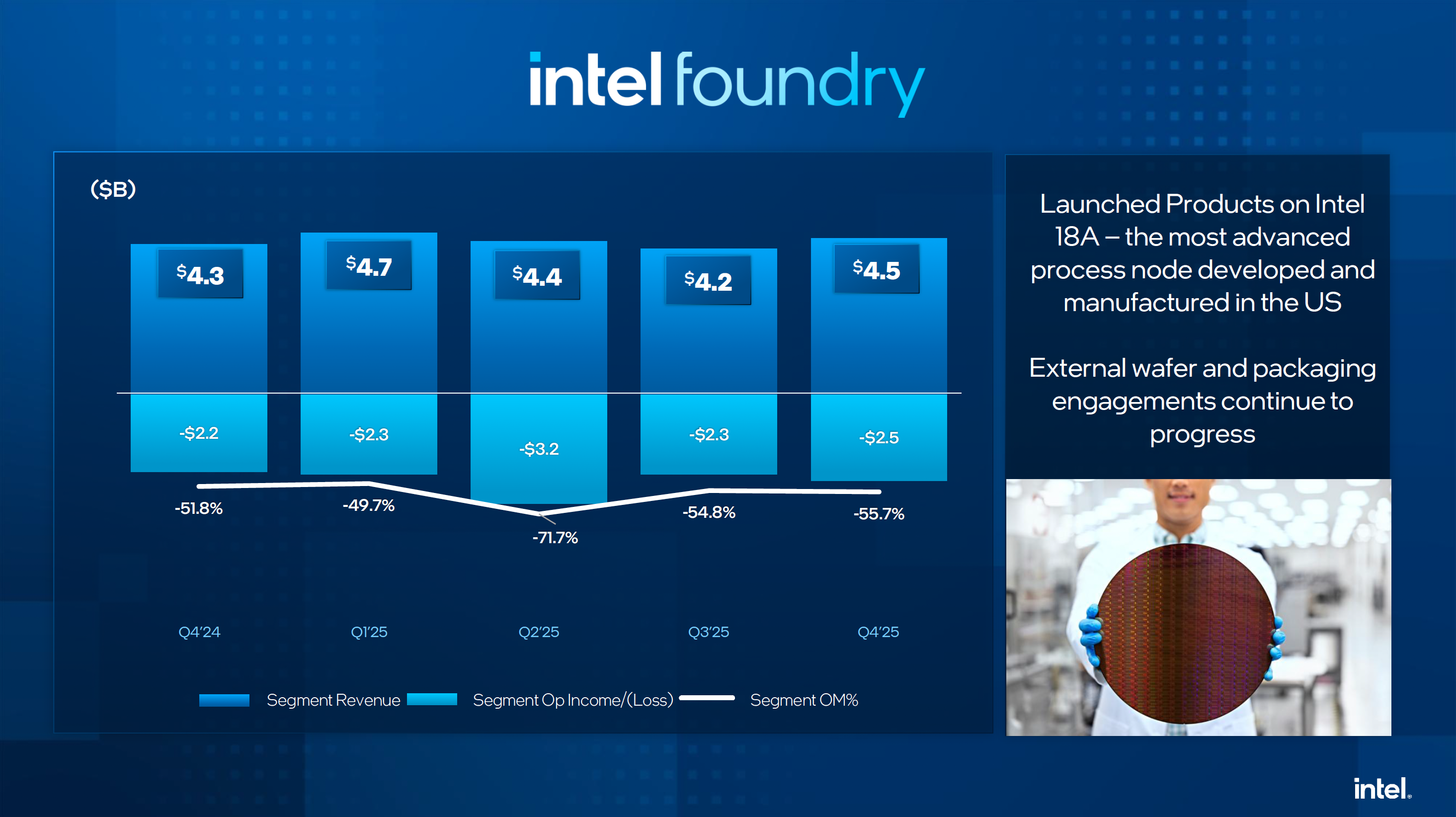

Intel Foundry: Making Intel products, absorbing all the losses

Intel Foundry posted $4.5 billion in revenue in Q4 2025, up 6.4% sequentially, driven by a higher mix of advanced manufacturing amid an increase in EUV wafer revenue due to increased supply of Intel 3-based Xeon 6 CPUs, high demand for Intel 4-based Arrow Lake offering, and early sales of Panther Lake wafers.

Speaking of EUV-based nodes, they now represent over 10% of Intel Foundry's revenue. To put the number into context, TSMC's EUV-based N5 and N3 process technologies and derivatives accounted for 63% (35% and 28%, respectively) of TSMC's wafer revenue in Q4 2025.

"EUV wafer revenue grew from less than 1% of wafers out in 2023 to greater than 10% in 2025," Zinsner said.

External foundry revenue totaled $222 million in the quarter, which was supported by U.S. government projects and the post-deconsolidation structure of Altera.

Still, Intel Foundry recorded an operating loss of about $2.5 billion, which reflects the early ramp of Intel 18A as well as continuous investments in internal capacity for existing process technologies.

Q1 2026 outlook

For the first quarter of 2026, Intel expects revenue of $11.7 billion to $12.7 billion, which means a year-over-year decline of about $0.5 billion.

This expectation reflects Intel being severely supply-constrained in Q1 as it sold its buffer inventory in the second half of 2025, and from now on, it can only rely on wafers that it can get from its own fabs as well as from TSMC's fabs.

"As we enter 2026, our buffer inventory is depleted," Zinsner admitted. "We do not have that [finished goods inventory] to rely on. So it is just literally hand to mouth — what we can get out of the fab and what we can get to customers is how we are managing it."

Meanwhile, Intel expects supply constraints to ease later in the year. "We expect our available supply to be at its lowest level in Q1 before improving in Q2 and beyond," Zinsner said.

The company also guides GAAP gross margin of 32.3%, which seems very low given the company's significant shipments of server CPUs and prioritization of high-margin products. Yet, given the severe supply constraints (particularly in the DCAI segment), it is a paradoxical yet possible situation.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.