'We can't completely vacate the client market' says Intel amid wafer supply shortages — Nova Lake still on-track for late 2026 release, 14A in 2028

Intel wafer supply is shifting toward the data center, however.

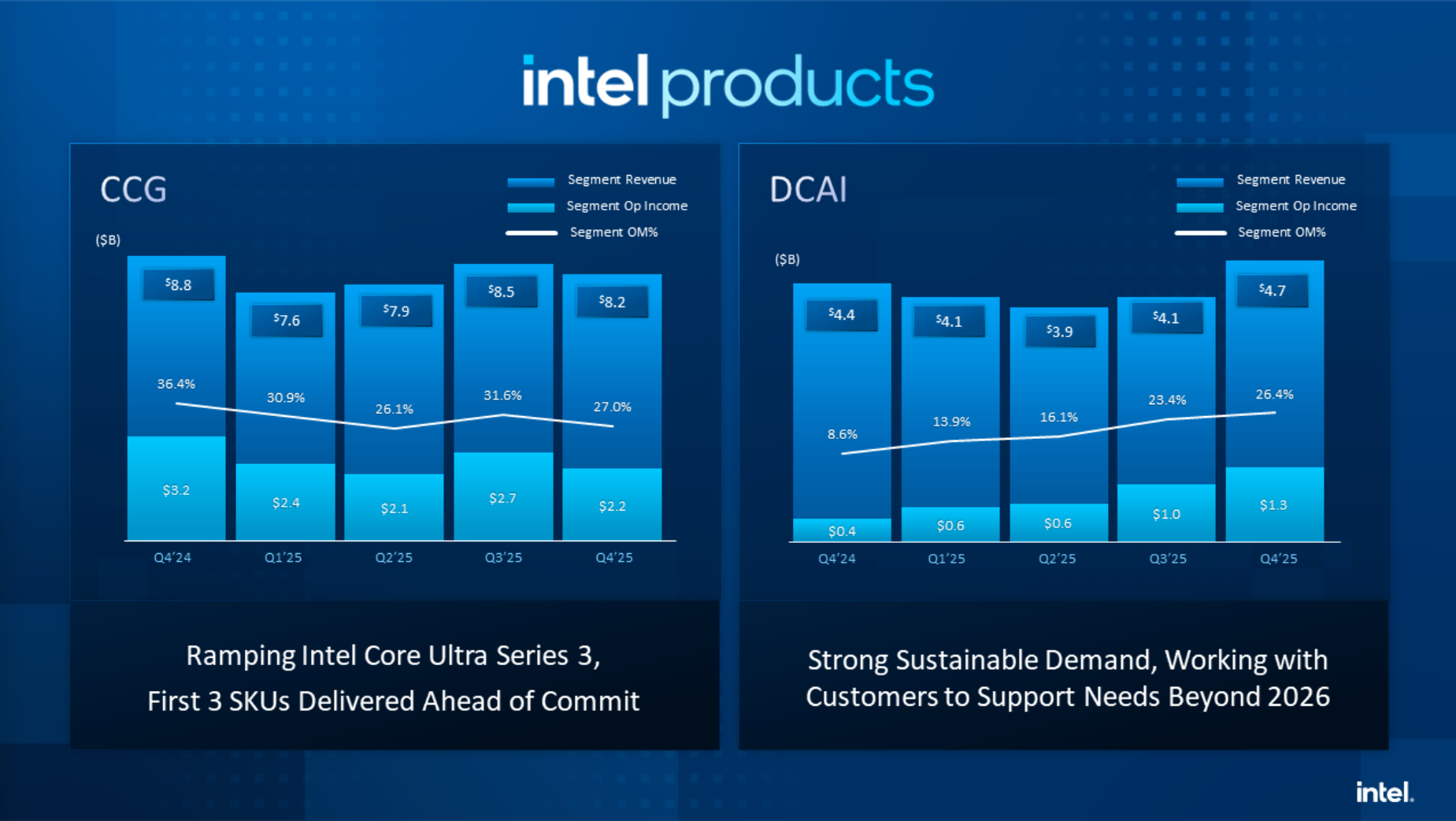

Intel reconfirmed its commitment to the consumer market during its Q4 2025 earnings, despite a heavy focus on wafer supply shortages and increased demand from the data center and AI markets. The company is shifting its internal wafer supply to the DCAI segment while relying on external wafer supply for CCG (Client Compute Group).

Responding to a question about weaker-than-expected DCAI outlook, David Zinsner, Chief Financial Officer at Intel, said: "We're shifting as much as we can over to the data center... we can't completely vacate the client market." Intel CEO Lip-Bu Tan also highlighted shortages affecting other areas, saying, "The industry is facing a very big challenge, you know, the memory constraints and the pricing."

Intel's focus for the last quarter of 2025 was Panther Lake, now known as Core Ultra Series 3, which is set to arrive in-market for customers on January 27. Despite a big push for client, Intel says that its "client CPU inventory is lean," and that "rising component pricing... could limit our client opportunity this year."

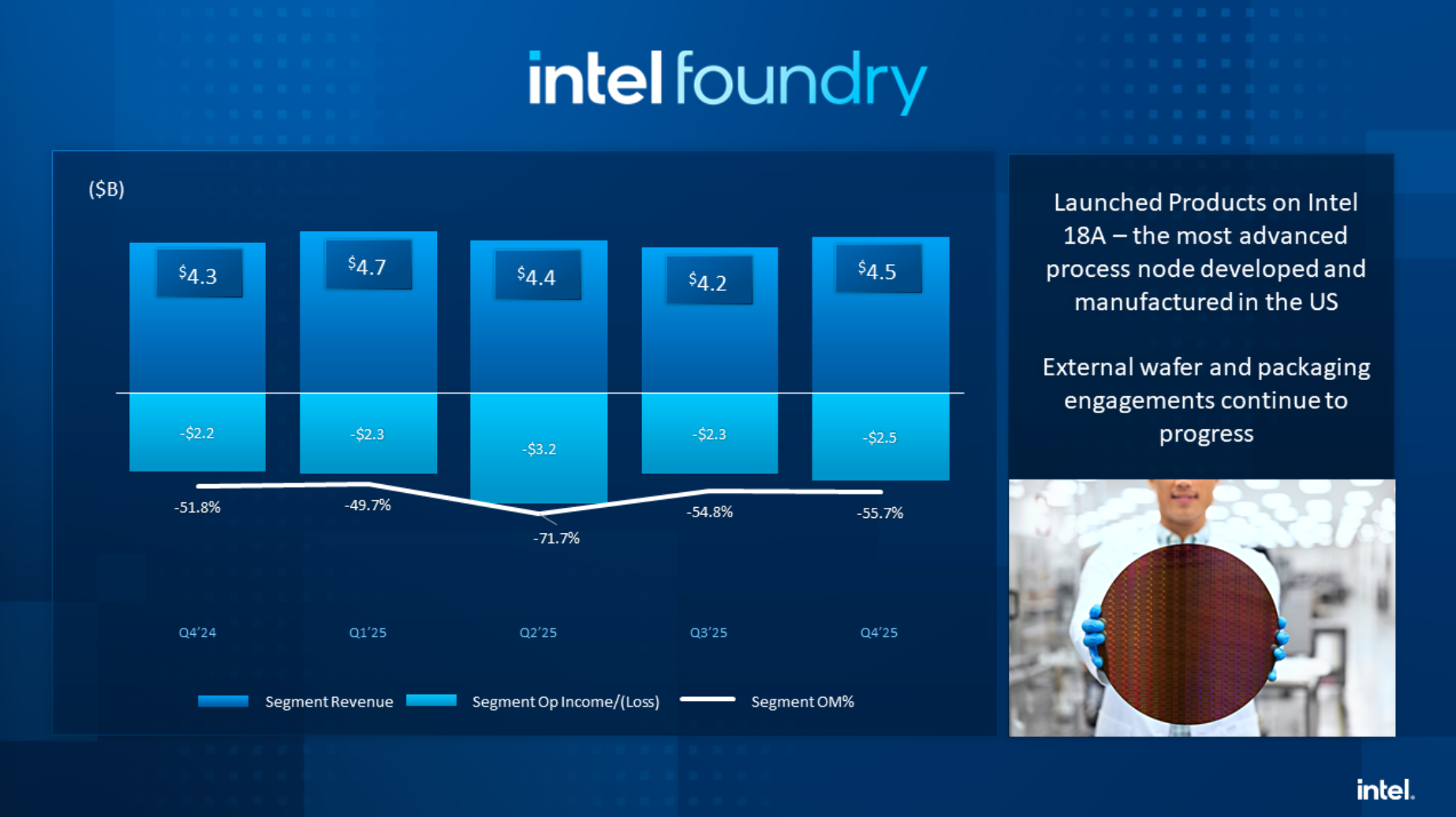

On the client front, Tan once again said that next-gen Nova Lake desktop CPUs are on-track for release in late 2026 where it will face off against AMD's upcoming Zen 6 CPUs, which are also expected later this year. Nova Lake will be the first desktop CPU to use Intel's 18A process. Its successor, 14A, will enter risk production in late 2027 and full production in 2028, says Tan.

Although Intel has technically shipped 18A, Tan still recognized yield shortfalls facing Intel's cutting-edge node. "I'm disappointed that we not able to fully meet the demand of our markets... yields are in-line with our internal plans, [but] they're still below where I want them to be," the executive said. Tan said yields are improving for 18A month-over-month, targeting a 7% to 8% improvement each month — a pace that Intel hopes will reduce per-unit pricing.

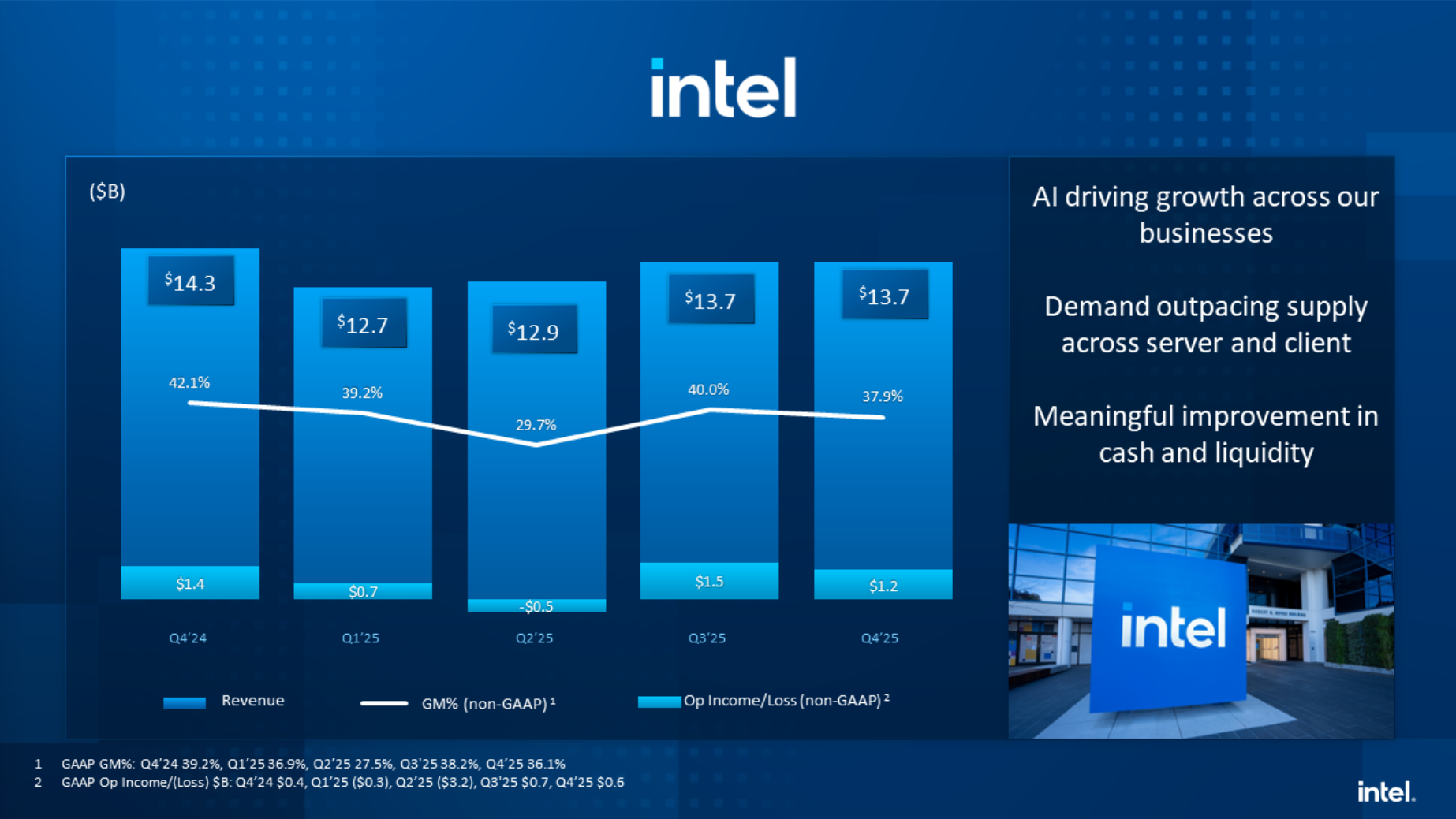

Overall, Intel's Q4 revenue was $13.7 billion, down 4% year-over-year. For full-year 2025, Intel is flat year-over-year. More interesting are the business unit splits. For CCG, Intel posted $8.2 billion for Q4, which is down 7% year-over-year, dragging down CCG's year-over-year revenue for the full year of 2025 by 3%.

Although the DCAI business group represents about half of the revenue of CCG, it saw growth in Q4. With revenue of $4.7 billion for the quarter, it's up 9% year-over-year. For the full year, DCAI revenue came in at $16.9 billion, which is up 5% year-over-year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

It's a growing business unit, though not growing at nearly the rate of Intel's competitors. AMD hasn't shared full-year earnings for 2025 yet, but it posted a 22% year-over-year growth in its data center segment in Q3 2025. Meanwhile, Nvidia posted 25% improvements quarter-over-quarter and a 66% boost in year-over-year revenue for its data center segment.

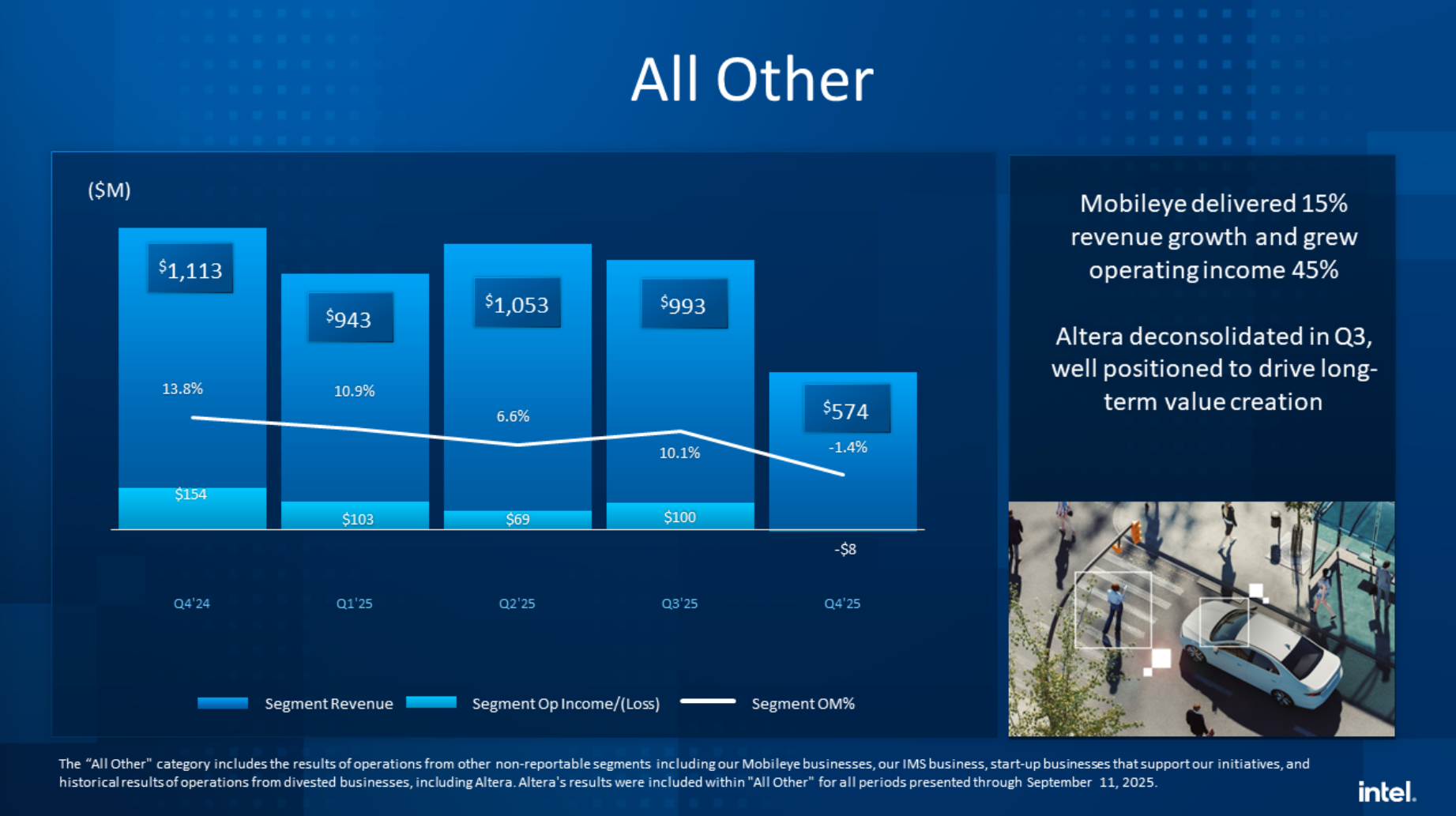

For Intel Foundry, despite an improvement in segment revenue of 4% year-over-year, the operating margin for the quarter was -55.7% , with $2.5 billion in losses. For Intel's other businesses, which it rounds up under the "All Other" segment, Intel posted a loss of $8 million dollars and revenue that is down 48% year-over-year, primarily driven by the deconsolidation of Altera — an FPGA subsidiary that Intel wholly owned until September 2025.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Jake Roach is the Senior CPU Analyst at Tom’s Hardware, writing reviews, news, and features about the latest consumer and workstation processors.

-

hotaru251 man nvidia investing in em really made em follow suit and just "frick the client server pays more" mentality which is 100% correct business choice but a poor brand choise.Reply -

pug_s Intel has plenty of capacity for producing wafers from the 14nm and 22nm era. I wonder why they didn't produce memory or nand using these fabs?Reply -

bit_user Reply

Does this have anything to do with the partial Diamond Rapids cancellation?The article said:Tan said yields are improving for 18A month-over-month, targeting a 7% to 8% improvement each month — a pace that Intel hopes will reduce per-unit pricing.

https://www.tomshardware.com/pc-components/cpus/intel-cancels-part-of-its-next-gen-diamond-rapids-xeon-lineup-report-claims-xeon-7-will-drop-models-with-8-memory-dimms-to-focus-only-on-16-channel-cpus-for-extra-memory-throughput

I wonder if they'll have viable yields, in time for the launch of that or Clearwater Forest. -

bit_user Reply

Intel got out of the DRAM market, a long time ago.pug_s said:Intel has plenty of capacity for producing wafers from the 14nm and 22nm era. I wonder why they didn't produce memory or nand using these fabs?

https://timeline.intel.com/1985/farewell-to-dram

As for NAND, they sold off that business to SK Hynix, just a few years ago.

https://www.tomshardware.com/pc-components/ssds/intel-and-sk-hynix-close-nand-business-deal-intel-gets-usd1-9-billion-sk-hynix-gets-ip-and-employees

And no, those nodes aren't good enough to make competitive products of either type. Micron was the last to embrace EUV for DRAM, but they're now on that bandwagon. -

TechieTwo Intel is good at manipulating public opinion. They'll end up with another $20 Billion of tax payer funds to "help" them deal with demand. They created their own problems and certainly did not deserve an $8.9 Billion tax payer bailout any more the General Motors deserved their tax payer funded free lunch.Reply

Tax payers should not be underwriting any company - especially those previously convicted on multiple continents of FTC violations of law. -

KennyRedSocks Replyhotaru251 said:man nvidia investing in em really made em follow suit and just "frick the client server pays more" mentality which is 100% correct business choice but a poor brand choise.

It's not like their hybrid architecture is great anyway.

Maybe they can throw some 14A at the client segment when Hammer Lake drops. -

bit_user Reply

One thing I'll say for Trump's approach is that it actually creates a disincentive for Intel to take any more. By demanding Intel issue stock in return for the money, it dilutes existing shareholders. If they're not convinced Intel needs more money, they might just vote against it.TechieTwo said:Intel is good at manipulating public opinion. They'll end up with another $20 Billion of tax payer funds to "help" them deal with demand.

It wasn't a free lunch - it was a loan. And General Motors paid it back. They all did.TechieTwo said:They created their own problems and certainly did not deserve an $8.9 Billion tax payer bailout any more the General Motors deserved their tax payer funded free lunch.

That's cutting off your nose to spite your face. Intel is the only truly US-controlled leading edge logic fab. Even the TSMC and Samsung fabs that are located here might not be able to operate, if cut off from their mother ships.TechieTwo said:Tax payers should not be underwriting any company - especially those previously convicted on multiple continents of FTC violations of law.

Anything else Intel does is replaceable, but their fabs are not. Right now, the fabs are operating at such huge losses, that you can't cut them loose, either. And nobody else is using them, of any significant volume. So, to keep them going, it turns out that we currently need the rest of Intel, as well.

Eventually, the fab needs to stand on its own and then it can be cut loose from the design side of the company, which is what most of the board and investors probably want, as well. -

thestryker Reply

This is false. Historically Intel wound down and eventually retired nodes when they were no longer volume competitive. 22nm has been reworked and is a somewhat specialized node they call Intel 16 now. 14nm was largely converted over to 10nm though they did use it for some chipsets. Intel is also working with UMC on a new node being referred to as Intel 12. This will likely siphon off capacity from Intel 7 as it becomes available.pug_s said:Intel has plenty of capacity for producing wafers from the 14nm and 22nm era.

The expansion of advanced DUV capacity never ended up happening and Intel replaced equipment early instead (this was part of the last big set of one time charges).

It's not until the standardized EUV nodes came about that this strategy shifted to more long term availability. Starting with Intel 3 everything after should be around as long as there's market viability. They're also creating specialized versions of 3 and 18A for TSV optimization. Doing this wouldn't have been a good strategy in the past since Intel relied on being fairly lean with regards to fab capacity. -

umeng2002_2 Replypug_s said:Intel has plenty of capacity for producing wafers from the 14nm and 22nm era. I wonder why they didn't produce memory or nand using these fabs?

You vill ownz nuzzing and be happy.