Larger Flash, Emerging Tech Will Reduce SSD Pricing In 2018

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

LAS VEGAS, NV -- In August, we said the consumer SSD market would level off but that shoppers would not see any major price drops until late 2018. Just weeks ago, reports spread across the web proclaiming an end to the NAND shortage. In some markets, that's true, but it's important to understand that the consumer market is different from the enterprise market.

Most of the new 256Gbit 64-Layer NAND available today feeds the enterprise demand, and prices are on a downward slope. On the consumer side, we see some incremental price reductions from the companies with NAND manufacturing capability, but not the free-fall we hoped for.

It's CES time, and we should be swimming in new products on display, but that's not happening this year, which seems odd on the surface. All of the conditions are right for the transition to NVMe. In a normal year, the front page of this publication would be full of new SSDs. Granted, there are some products on display, but very few are "ready for retail."

64-layer 3D NAND is shipping, but the 256Gbit die will come and go rapidly. That's what makes this NAND cycle different. Many of the companies we've spoken to do not want to invest in products with such a limited shelf life. The 512Gbit die are right around the corner from the fabs. Some estimates put a major ramp up coming before mid year. The technology offers a 2x capacity increase while taking only a little more space on the wafer. The bits per wafer doesn't double, but it gets very close. The retail products coming in the second half of 2018 with have a heavy impact on SSD pricing. Some estimates from engineers we've spoken with put retail pricing on track for a 20% to 30% reduction over similar-capacity products shipping today.

More Than Flash

Emerging technologies and form factors that reduce the material costs will also play a role. Toshiba Memory America showcased the new RC100 NVMe SSD that uses multi-chip packaging to cram the controller and flash in a single package.

“The market has never been more ready for NVMe to go mainstream, but it needs the right product,” said Alex Mei, vice president marketing, consumer SSDs and storage outbound marketing at TMA. “With the ultimate balance of value, size, power, and performance, the RC100 SSD Series makes leveraging all the benefits of NVMe a reality for more users than ever before.”

Host Memory Buffer (or "HMB" as it's commonly called) uses the system's memory (RAM) to increase performance beyond what we saw in the previous round of DRAMless products. Toshiba tells us the RC100 delivers up to 1,620 MB/s sequential read and 1,130 MB/s sequential write speeds. The random performance peaks at 160,000 read and 120,000 write IOPS.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

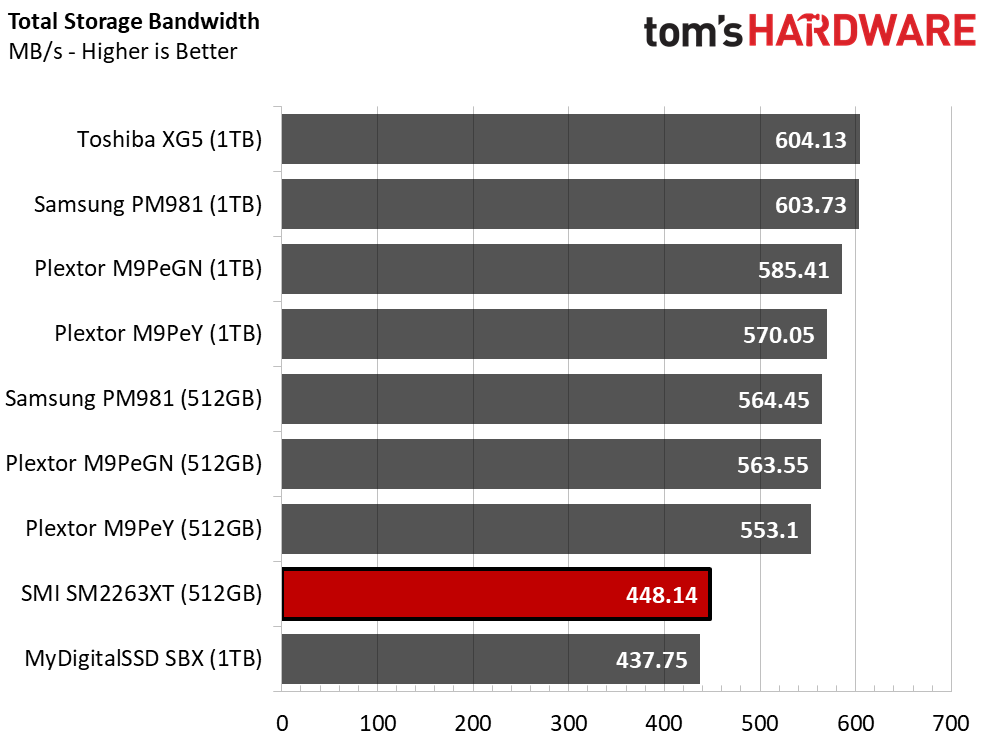

We've yet to test the Toshiba RC100 but will publish our initial findings with an early Silicon Motion, Inc. SM2263XT HMB controller in the coming weeks. In the chart above, you can see every product in our lab that has 64-layer flash. The SM2263XT NVMe DRAMless reference sample with early firmware out performs every SATA SSD shipping today in application bandwidth. When these products come to market with 256Gbit die flash, we expect to see price parity with mainstream SATA SSDs. The large price drops will come later with 512Gbit die availability, but we won't have to wait long.

Chris Ramseyer was a senior contributing editor for Tom's Hardware. He tested and reviewed consumer storage.

-

alextheblue It's about time... any idea when RAM is going to come down from Mt. Olympus? I wanted to get a decent 32GB kit for my next rig but cripes, I might start off with 16GB again.Reply