Mubadala to Keep Control Over GlobalFoundries After IPO

GlobalFoundries aims $25 billion valuation.

GlobalFoundries and its owner Mubadala are on track for an initial public offering (IPO) later this year and are targeting a $25 billion valuation for the world's No. 4 contract maker of semiconductors. But Mubadala does not want to lose control of GlobalFoundries and the two companies currently expect to raise $2.6 billion for 55 million shares that will be sold in 2021.

GlobalFoundries will sell 33 million shares at $42 per ordinary share, whereas Mubadala will sell 22 million shares at $47 per ordinary share, according to a new filing with the U.S. SEC. If the companies sell the shares at these prices, they will raise $2.6 billion. Multiple funds, such as BlackRock, Fidelity Management, and Silver Lake have already indicated interest to buy GlobalFoundries' shares, Bloomberg reports.

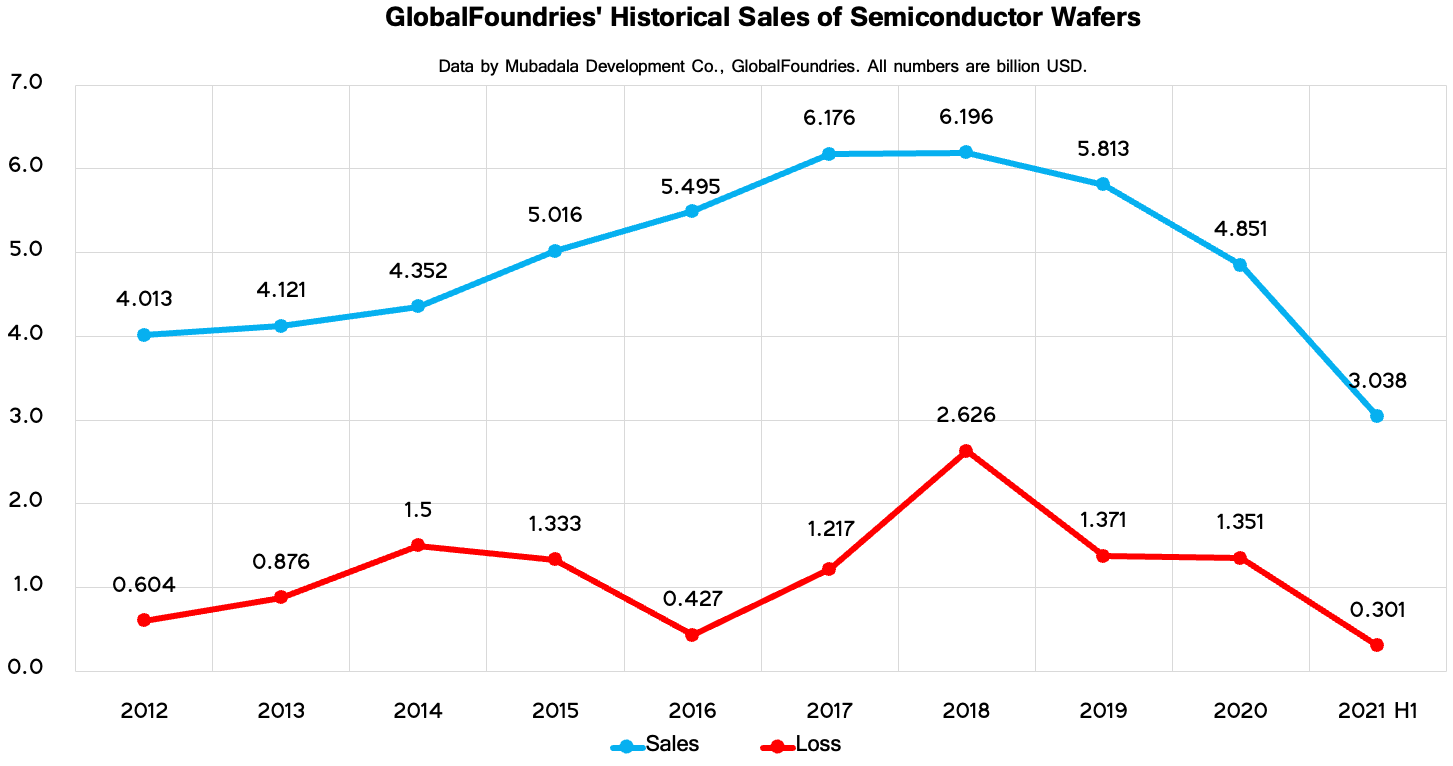

There are reasons why Mubadala may not want to sell more of GlobalFoundries stock right now. Demand for chips is stronger than ever and contract makers of semiconductors are benefiting from this. After GlobalFoundries became a specialty foundry in 2018, its sales dropped from around $6.196 billion in 2018 to $4.851 billion in 2020. But for the first half of 2021, the company's revenue totaled $3.038 billion and is likely to hit over $6 billion for the whole year due to strong demand. As a result, Mubadala has every reason to believe that GlobalFoundries' stock will get more expensive over time and therefore it makes little sense to sell a significant share of the company just now.

Mubadala has spent tens of billions of dollars on GlobalFoundries since its spinoff from AMD in early 2009. After taking over AMD's manufacturing division, Mubadala bought Chartered Semiconductor to acquire mature process technologies along with fabless customers. Nowadays GlobalFoundries serves over 200 clients and has five manufacturing sites on different continents. But GlobalFoundries has never been profitable as Mubadala had to invest in new manufacturing capacities and R&D to stay competitive with other foundries, namely TSMC and Samsung Foundry.

In 2018, the company changed its business model radically, but it remains to be seen whether it can make money. Earlier this year GlobalFoundries announced massive plans to expand its production capacities in Germany, Singapore, and the U.S., so billions of dollars will be spent and it is unlikely that with such massive spending the company will be profitable any time soon.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.