Chinese memory maker reportedly preparing for $42 billion IPO — CXMT plans to go public in early 2026

CXMT is getting ready for its initial public offering.

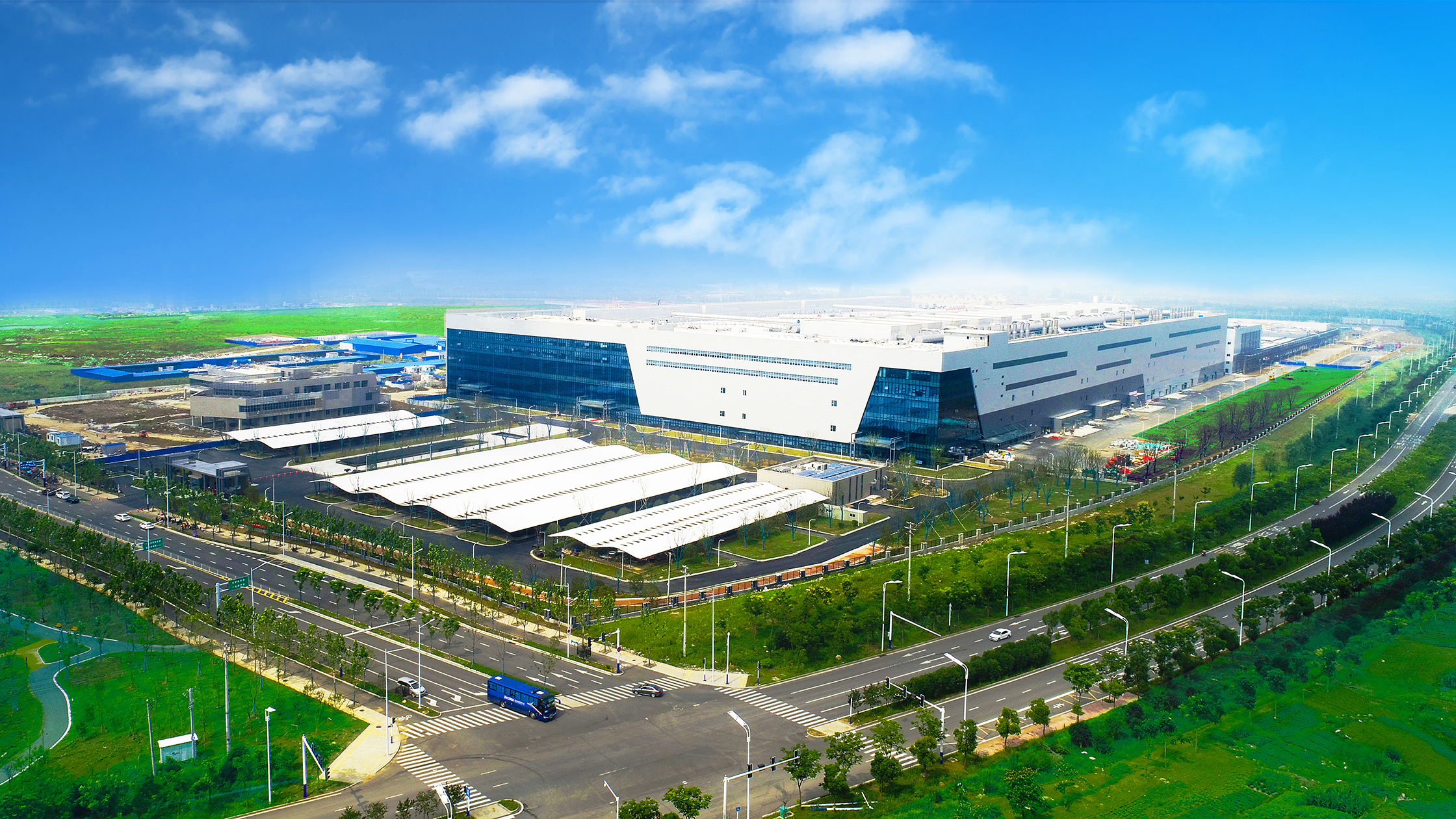

Chinese memory maker ChangXin Memory Technologies (CXMT) is reportedly preparing to go public in the first quarter of 2026, with the company signing up China International Capital Corporation and CSC Financial, two state-owned banks, back in July to start the process. According to the South China Morning Post, CXMT aims to raise 20 to 40 billion Yuan (around US$2.8 to US$5.6 billion) from the offering. However, these details are subject to change, especially as the plan hasn’t been officially announced yet.

The planned IPO is coming at a time when the AI boom is straining the global memory and storage supply chains, with shortages and price increases expected to last a decade. Aside from that, the company is well-placed to replace Micron in China, especially as the latter is reportedly leaving the Chinese market two years after it was banned from ‘critical information infrastructure’.

The news about the public offering leaks as Chinese semiconductor stock prices are soaring, with CSI’s China semiconductor index benchmark jumping 49% from January. And with the ongoing trade spat between Beijing and Washington causing companies like Nvidia to lose local market share, many local investors are keen on placing bets on chipmakers that will make it big as the country targets semiconductor self-sufficiency. The United States has also banned the exports of HBM to China in December 2024, meaning Chinese AI chip manufacturers have no choice but to rely on domestic manufacturers for their supply. At the moment, CXMT is one of just three companies building HBM chips for domestic AI chip manufacturers, making it crucial for China’s progress.

CXMT has reportedly spent $6 to $7 billion on capital expenditure during 2023 and 2024, with the company expecting to spend around 5% more in 2025. This includes an HBM back-end packaging fab in Shanghai that’s planned to start commercial operations by late 2026. But despite all these investments, the Chinese chipmaker is still a few years behind its more established competitors. Micron has already started shipping HBM4 samples to some of its clients in June of this year, while South Korean chipmaker SK hynix is said to have already completed development and is preparing for mass production of next-generation memory modules.

Analysts say that CXMT plans to begin mass production of its own HBM3 in 2026, suggesting that it’s four years behind its rivals. Despite that, this is still a big step for the Chinese semiconductor industry, especially given that CXMT was only founded in 2016 with support from the Chinese government, whereas SK hynix, Samsung, and Micron, the current biggest memory manufacturers, have been in operation for several decades already.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Jowi Morales is a tech enthusiast with years of experience working in the industry. He’s been writing with several tech publications since 2021, where he’s been interested in tech hardware and consumer electronics.