Jensen says Nvidia’s China AI GPU market share has plummeted from 95% to zero — the Chinese market previously amounted to 20% to 25% of the chipmaker's data center revenue

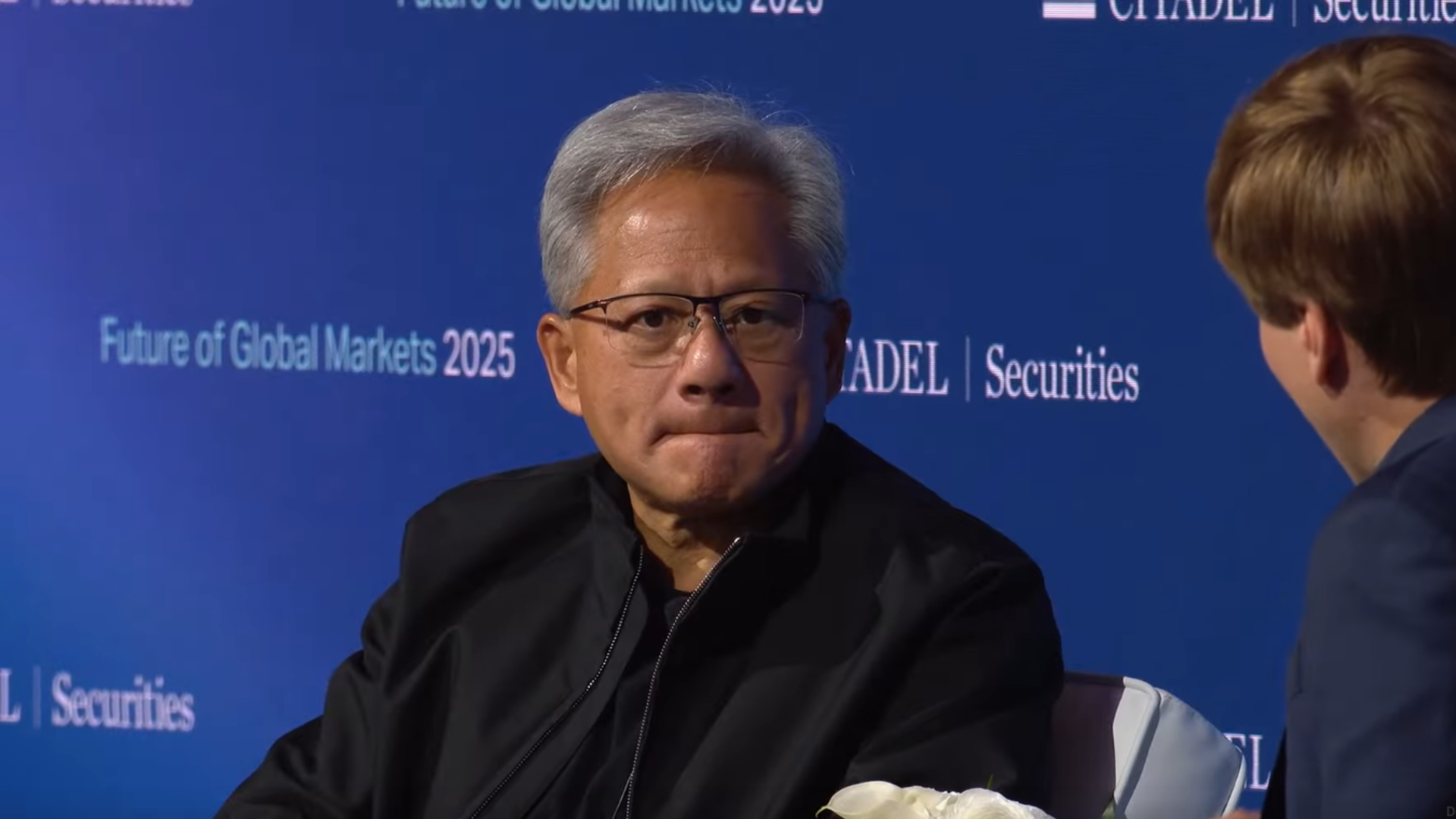

Speaking at a Citadel Securities event on October 6, the Nvidia CEO blamed U.S. export controls and said the company now assumes no revenue from China in its forecasts.

Nvidia CEO Jensen Huang said last week that the company’s share of China’s advanced AI accelerator market has collapsed from roughly 95% to zero as US export controls continue to bite. The comment came during a live interview at Citadel Securities’ Future of Global Markets 2025 event in New York on October 6, in which Huang said, “At the moment, we are 100% out of China,” adding, “We went from 95% market share to 0%.”

A full video of the interview was published on YouTube this week by Citadel Securities and marks the first time Nvidia has publicly quantified the scale of its retreat. Huang didn’t name specific products, but his remarks point squarely to Nvidia’s data center GPU line, which has faced rolling waves of export restrictions since October 2022. The company’s China-focused A800 and H800 parts were rendered noncompliant by export prohibitions in 2023, while a newer design — the H20 — has faced licensing hurdles of its own.

“I can’t imagine any policymaker thinking that’s a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%,” Huang said of the outcome.

Nvidia has previously disclosed that China represented between 20% and 25% of its data center revenue — a segment that generated more than $41 billion in its most recent financial results, representing a 56% year-over-year increase. While that figure includes cloud customers across a wide range of workloads, AI infrastructure remains the company’s growth engine. A prolonged clampdown could reshape both demand and supply chains.

The US government has tightened controls over AI accelerators sold to China as part of a broader strategy to limit Beijing’s access to cutting-edge semiconductors. But Huang’s comments highlight how quickly the dynamic has shifted on the ground. “In all of our forecasts… we’re assuming 0% for China,” he said. “If anything happens in China… it will be a bonus.”

Nvidia’s cautious guidance comes amid signs of deeper fragmentation in the AI stack. China’s hyperscalers and AI labs have increasingly turned to domestic silicon or alternative hardware in response to the export curbs, accelerating efforts to localize compute infrastructure. That’s a trend Huang flagged earlier this year, when he warned that blanket restrictions could spur the development of competitive substitutes.

While Huang said that he has hopes that Nvidia’s business can return to China in the future, the company has effectively written off the country for the moment.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.

-

erazog Nvidia was always going to lose that market anyway as the China gov pushed its own domestic designs which will only be competitive in China and lag behind Nvidia and others on size, power in the rest of the world.Reply -

crtteng Huawei will be in every belt and road nation, especially the global south where resides 75% of world population. And Nvidia will be excluded from these- if no accommodation were made with Beijing.Reply -

-Fran- You piss off a whole market dominated by a single party, then you show allegiance to the opposing faction... Pikachu face when you're told to get out.Reply

Regards. -

pf100 Does this mean they have to care about gaming again? They need to fix these effin drivers man although the new developer driver 590.26 instead of public 581.57 works better for me with a 4090. Their quality is below average for too long.Reply -

phead128 Reply

Chinese gov't put an import ban on Nvidia products now because domestic alternatives can perform as good. The need for smuggling is likely reduced.scottslayer said:Officially 0%, unofficially the GPUs are still being smuggled in. Be honest here. -

jheithaus Have fun with your 14nm+++++ GPU tied to smuggled HBM and occasional shell corporation trafficked TSMC 7nm side tiles. Huawei is hopeless in this segment. You can buy the propaganda or the math. China is clearly grey market acquiring foreign GPUs.Reply -

Thunder64 Replycrtteng said:Huawei will be in every belt and road nation, especially the global south where resides 75% of world population. And Nvidia will be excluded from these- if no accommodation were made with Beijing.

Lol what? So all developing economies (which is was "global south" is politicaly correct for apparantly) will be banned from using Nvidia? -

RedBear87 “I can’t imagine any policymaker thinking that’s a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%,”Reply

He lacks in imagination. This was always going to be the final result of America's export controls, tightening them and waging a trade war in top of that simply fastened it.