Blackwell GPU's exclusion from high-level trade talks highlights deepening AI ecosystem rift between nations — China aims to build sovereign hardware and software systems without Nvidia

The trade war takes a breather, but Blackwell is still off the table while Beijing seeks better domestic compute capabilities.

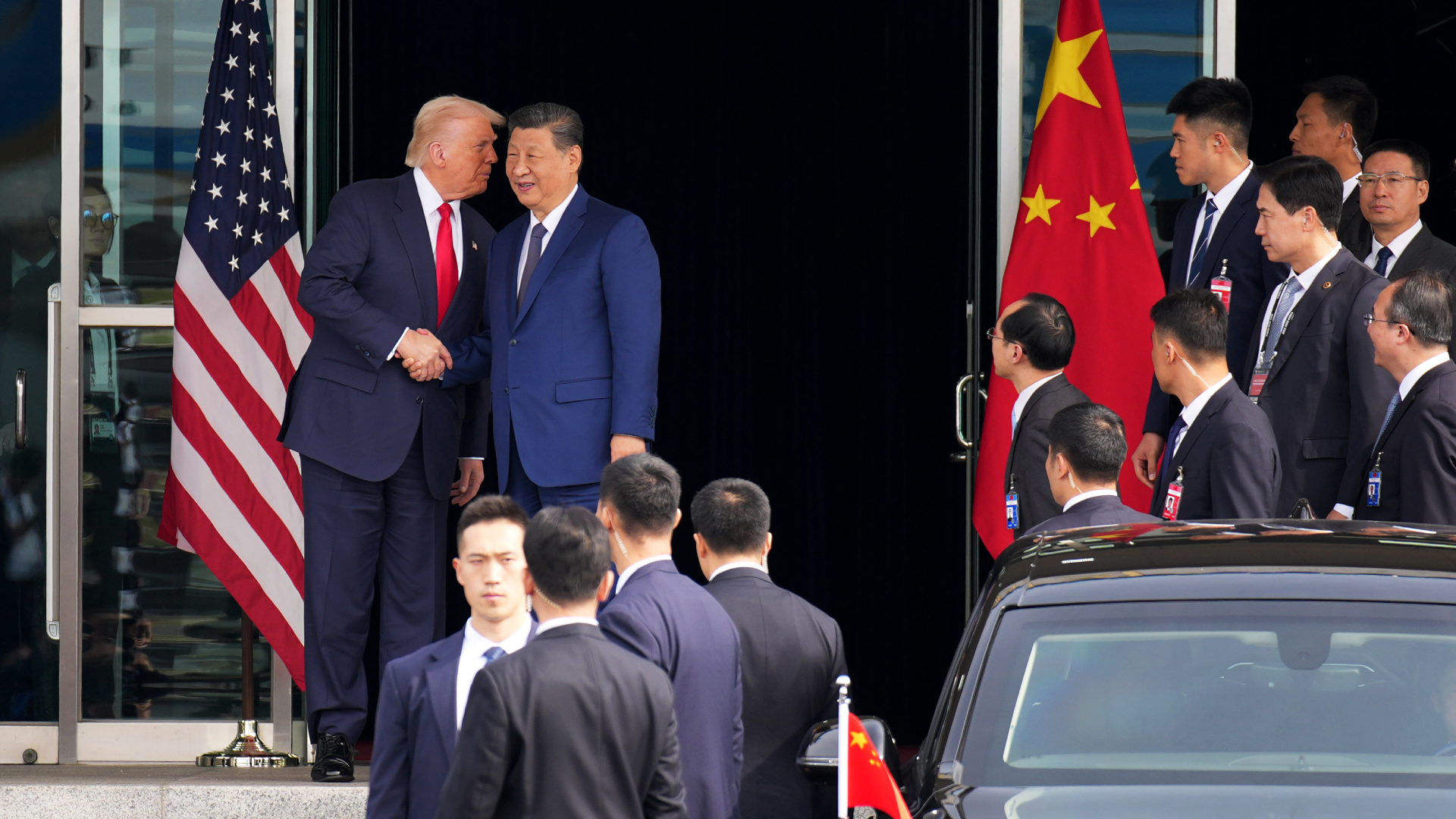

The newly announced China-U.S. trade ceasefire appears, at first glance, to be a long-overdue cooling-off period. For now, China will delay its sweeping new export controls on rare earth elements, while the U.S. holds off on tariff increases, which will remain at 10%.

This will come as a much-welcome reprieve for hardware manufacturers, who rely on China’s near-total grip over rare-earth processing. But make no mistake: this is a temporary pause, and in no way the end of the matter. For Nvidia, which finds itself increasingly encircled by export curbs, market access limits, and geopolitical brinkmanship, the bigger story is Blackwell, which wasn't on the table during negotiations.

Rare earth reprieve, with strings attached

Washington is naturally framing the deal as a win, with Beijing now temporarily backtracking on rare earth restrictions. China's new licensing regime, originally set to kick in this quarter, would have added five additional elements to the control list, tightening the screws on high-end magnets and materials used in everything from HBM modules to EUV lithography.

U.S. negotiators claim that those rules have been paused for at least a year, which gives chipmakers and industrial suppliers a lifeline, especially as reshoring projects in the U.S. scramble to reach commercial scale.

But rare earths underpin the very machinery used to fabricate, etch, and package advanced silicon, and China dominates more than 90% of rare earth processing. So, while the truce ensures continuity for now, it does nothing for control. Chinese regulators can reinstate the paused rules whenever they choose, and we already know that AI chips are a major target.

Blackwell and AI silicon

Conspicuously absent from the agreement was any discussion of AI silicon. Ahead of the meeting between the two premiers, some observers speculated that the U.S. might carve out a path for limited high-end GPU exports. That didn’t happen. Instead, Trump told reporters flatly: “We’re not talking about the [sic] Blackwell.”

To say that this is something Nvidia doesn’t want to hear would be an understatement. Blackwell is a fundamental shift in how compute power is packaged and deployed. The GB200 integrates GPU and CPU silicon with an NVLink interconnect, and is the heart of Nvidia’s DGX SuperPODs. China can’t buy it. They can’t even buy the trimmed-down versions like the H200 under current restrictions.

Meanwhile, Nvidia is rumored to be working on a China-specific chip, the B30A, a Blackwell-derived part intentionally hobbled to work around U.S. export restrictions. If it goes into production, it would slot somewhere between the H20 and GB200, giving Chinese companies a new option without technically violating the rules. Think of it as Blackwell lite: fewer NVLink lanes, reduced memory bandwidth, and firmware constraints to keep throughput in check.

Earlier this month, however, Nvidia CEO Jensen Huang said, “At the moment, we [Nvidia] are 100% out of China,” adding, “We went from 95% market share to 0%.” In essence, the political climate makes it pointless for Nvidia to even try to continue trade with China while Beijing is understood to be actively discouraging domestic companies from importing Nvidia chips as part of a broader push toward ecosystem self-reliance.

Any attempts to export Blackwell or Blackwell-derived parts to China would also be likely to face resistance from U.S. lawmakers, even if they technically don't fall afoul of export restrictions. On Wednesday, October 29, Republican Representative John Moolenaar, the House Select Committee on China Chairman, said that selling Nvidia’s AI chops to China “would be akin [to] giving Iran weapons-grade uranium,” arguing that doing so would shrink the U.S. advantage in AI.

There’s some merit to that line of thought. Recent RAND Corporation analyses have stated that while the U.S. still enjoys a large compute-capacity lead, China’s AI models are closing the gap, adding that compute access is a key bottleneck for Beijing’s long-term AI ambitions.

Ascend, PaddlePaddle, and de-Americanized AI

What makes all this so precarious is that China is building a parallel compute stack from the ground up. Huawei's Ascend 910 chips are the tip of the spear, with the company pledging annual refreshes of its full AI accelerator and ARM server portfolios. In public presentations, it now boasts a complete vertical: Ascend silicon, CANN (its CUDA-like API), MindSpore and PaddlePaddle (TensorFlow substitutes), and AI training clusters co-developed with Chinese cloud vendors.

China’s hardware, however, is still behind. Ascend lags Nvidia in both raw performance and power efficiency, but Huawei is closing the gap fast, with backing from SMIC, YMTC, and a raft of state-supported software labs. Meanwhile, Baidu, Alibaba, and startups like Iluvatar are all racing to reduce CUDA dependence and switch to domestic APIs. With Nvidia's top silicon out of reach and U.S. software tools potentially restricted, Chinese firms have little choice but to go it alone.

We’re essentially looking at a slow-motion decoupling, with one AI stack built around Nvidia, PyTorch, and Western cloud infrastructure; another built around Ascend, MindSpore, and Chinese fabs. Neither side wants to say it aloud, but we are witnessing the bifurcation of compute ecosystems. The temporary China-U.S. trade truce will do virtually nothing to stop this in the long term.

A dead market for Nvidia

All of this brings us back to Nvidia. It is still the most strategically important semiconductor firm on the planet, and it still commands eye-watering margins. But it has been cut off from what was its second-largest market. A downgraded Blackwell-derived chip, such as the B30A — if it ever comes to production and somehow makes it to China — might provide a fig leaf, but will do nothing to restore the high-end pipeline it once enjoyed with the likes of Alibaba and Tencent.

In the end, what was left out of the trade talks matters more than what was included. Blackwell is still banned, and the B30A is still hypothetical. If Nvidia has even a semblance of a China strategy left, it's putting on a strong poker face.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.