YMTC moves ahead with third chipmaking fab in Wuhan despite U.S. sanctions — blacklisted Chinese chipmaker bets big on memory

YMTC plots 2027 production start as Beijing sets its sights on memory sovereignty.

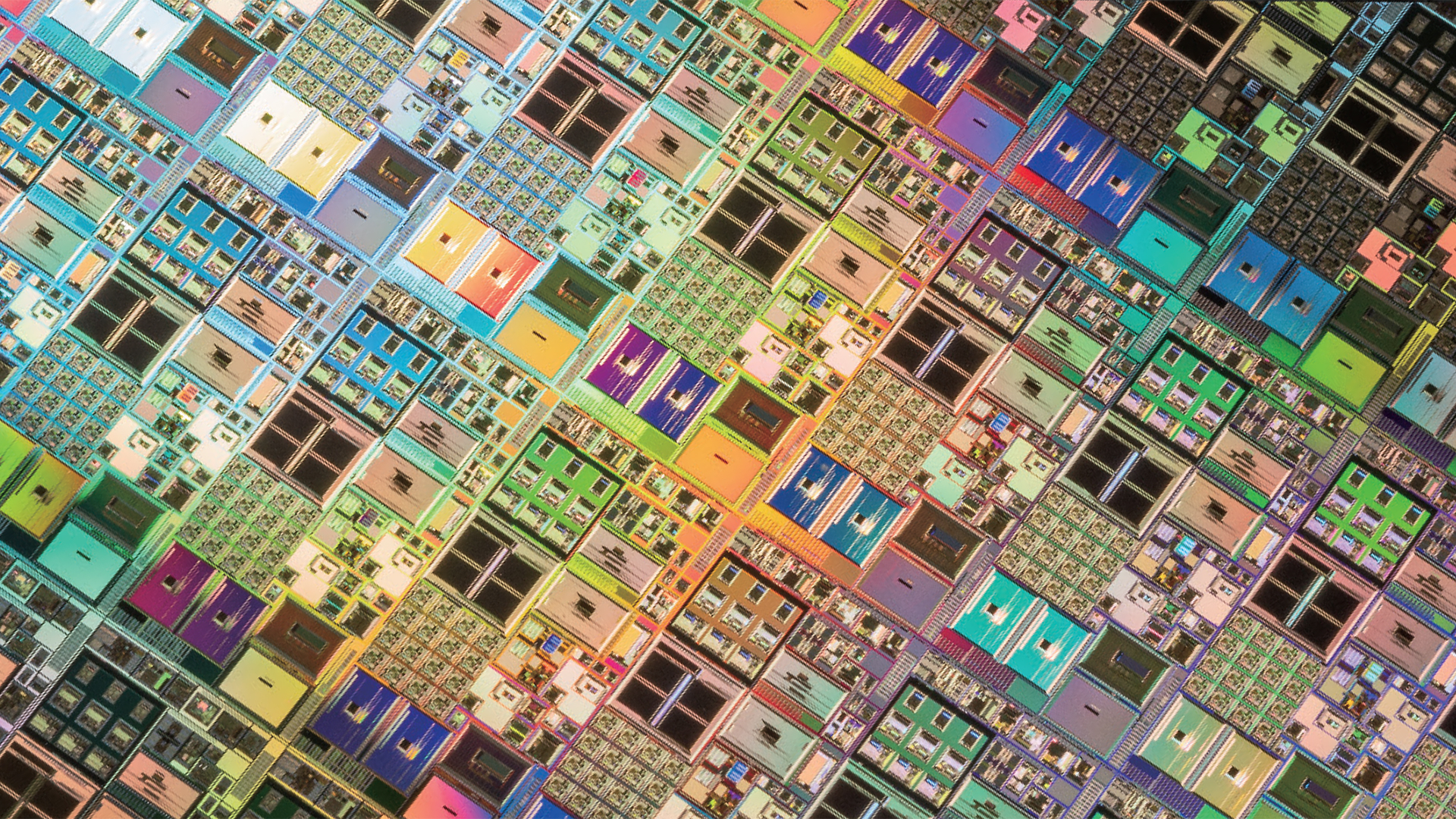

Yangtze Memory Technologies Co. (YMTC), China’s top NAND flash manufacturer and one of the most heavily scrutinized names in the chip war, is pushing ahead with plans for a third semiconductor plant in Wuhan. The facility is expected to begin mass production in 2027, in a move that underscores Beijing’s intention to double down on domestic memory capacity even as YMTC remains barred from acquiring advanced U.S. chipmaking tools.

The Wuhan expansion marks the company’s most ambitious project since being placed on the U.S. Entity List in December 2022, a designation that has crippled access to EUV and advanced DUV lithography, precision etching gear, and key U.S.-origin design IP. Yet, instead of collapsing, YMTC is adapting slowly with the full backing of China’s industrial policy apparatus.

Surviving the blacklist

YMTC’s situation is unlike that of Huawei, which was forced into a radical pivot toward software and cloud services following its sanctions. YMTC, by contrast, continues to manufacture supply-constrained NAND flash chips at scale, albeit at reduced efficiency and with aging process nodes. Its most advanced product, the 232-layer Xtacking 3.0 NAND, was benchmarked in late 2022 as competitive with Micron’s and Samsung’s offerings. But sustaining that lead has proven impossible without access to ASML’s cutting-edge tooling.

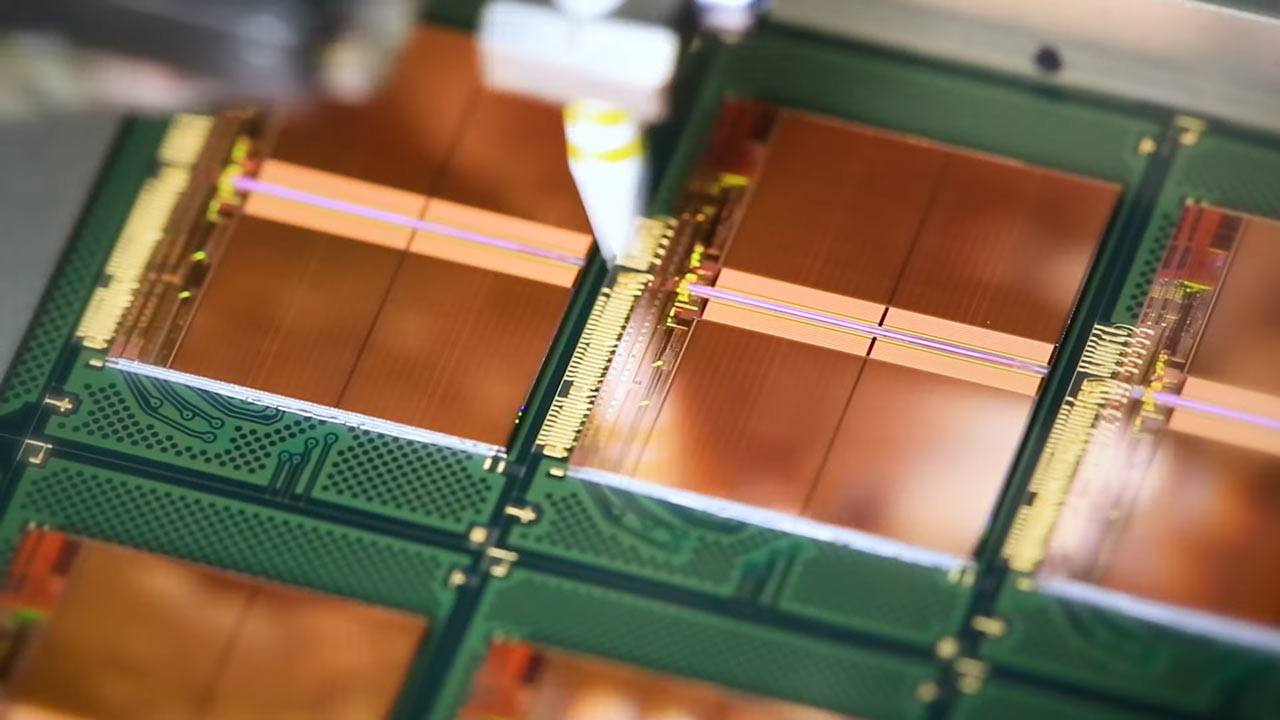

Various reports suggest that YMTC’s Fab 2 has been operating with domestic workarounds and modified legacy tools, relying in part on procurement from third-party intermediaries to secure essential chemicals and maintenance components. However, these workarounds are slow and painful.

One potential candidate is SMEE’s immersion lithography equipment, but this has yet to deliver consistent yields beyond 28nm logic equivalents, far from the sub-20nm half-pitch necessary for leading-edge NAND stacking. Still, YMTC’s new fab suggests confidence that by 2027, domestic toolchains will be capable enough to support high-volume NAND production if not at the bleeding edge, then at commercial scale.

Memory nationalism

The report by Nikkei Asia suggests that the timing of this announcement also aligns with China’s broader recalibration toward AI infrastructure resilience. With U.S. export restrictions locking out Chinese firms from Nvidia H100 and A100-class GPUs, Beijing has redirected its subsidies and engineering talent toward local accelerator design, sovereign foundation models, and the underlying memory and packaging stacks that make them viable.

In that context, NAND flash is arguably foundational. While DRAM remains the performance bottleneck in AI inference, NAND underpins persistent storage for massive model checkpoints, training data lakes, and parameter weights for retrieval-augmented generation. YMTC’s success here is thus critical not because its chips are the fastest, but because they’re Chinese.

That imperative is reflected in the composition of China’s "Little Giants" initiative, which is understood to support key industrial chains and strategic emerging industries such as semiconductors and advanced manufacturing in the upstream value chain. YMTC, though technically a commercial entity under Tsinghua Unigroup, functions effectively as a state-backed lynchpin for this ecosystem.

It’s also worth noting that YMTC’s return to expansion mirrors Beijing’s new appetite for high-risk, high-capex investment in areas where U.S. export controls bite hardest, but enforcement remains inconsistent. In that grey area, YMTC might be betting that Washington’s resolve may soften over time, or that domestic tooling will catch up just enough to justify the investment.

Sanctions or no, it’s a tough NAND world

From a business standpoint, YMTC’s decision to break ground on a third fab lands during one of the tightest NAND cycles in recent memory. According to Phison CEO K.S. Pua, the price of a 1Tb TLC NAND die has more than doubled in the past six months, climbing from $4.80 to $10.70, with virtually all 2026 production capacity already sold out. NAND flash pricing is expected to remain elevated into 2027, as AI datacenter deployments and enterprise SSD demand continue to outpace wafer output across the major suppliers.

Micron, SK Hynix, and Samsung are all riding that upturn, but their responses have been measured. Micron is prioritizing DRAM and HBM3E, while SK Hynix has pivoted to premium AI NAND. Samsung, for its part, is accelerating its transition to eighth-generation 3D V-NAND while absorbing the cost pressures that come with it. What none of them are doing is flooding the market with new capacity. YMTC, by contrast, is hoping to do exactly that, not because it sees an opening to grab global share, but because its political and economic mandate is different.

Beijing’s industrial planners are less concerned with global pricing cycles than with insulating domestic AI infrastructure from foreign dependency. If YMTC can bring its third fab online by 2027 — even at 128-layer or similar nodes — it can serve national storage demand across hyperscalers, surveillance systems, and edge compute. That volume won’t threaten Samsung’s lead, but it could give Chinese cloud providers a secure NAND supply at a time when export controls are steadily tightening and global inventories are already claimed.

There’s no denying that YMTC’s third fab is a geopolitical play as much as an economic one. On paper, its production timeline puts it three years away from volume output, which is an eternity in semiconductor terms. By 2027, however, the efficacy of U.S. sanctions will hinge on how well Chinese tooling ecosystems mature. YMTC bets that by then, it won’t need American equipment, or at least not enough to make the fab infeasible. Whether that turns out to be true is uncertain.

For the world’s top memory makers, YMTC’s continued growth even under U.S. sanctions is more than a marginal concern. With a third fab now in planning and domestic demand accelerating, the company is on track to become the fifth-largest NAND producer globally, and could climb to fourth if its expansion proceeds on schedule. According to Nikkei Asia, industry executives estimate that YMTC could capture 10% or more of global NAND production capacity by as early as next year, potentially overtaking Micron in volume terms.

Even if YMTC remains focused on serving China’s domestic market, that shift has global implications. For Samsung, SK Hynix, and Micron, it may force a recalibration of pricing strategies and long-term exposure to China, especially as Beijing continues to push for procurement of domestic components.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.