Quarterly PC Shipments Fell Below 63M Units For the First Time In 10 Years

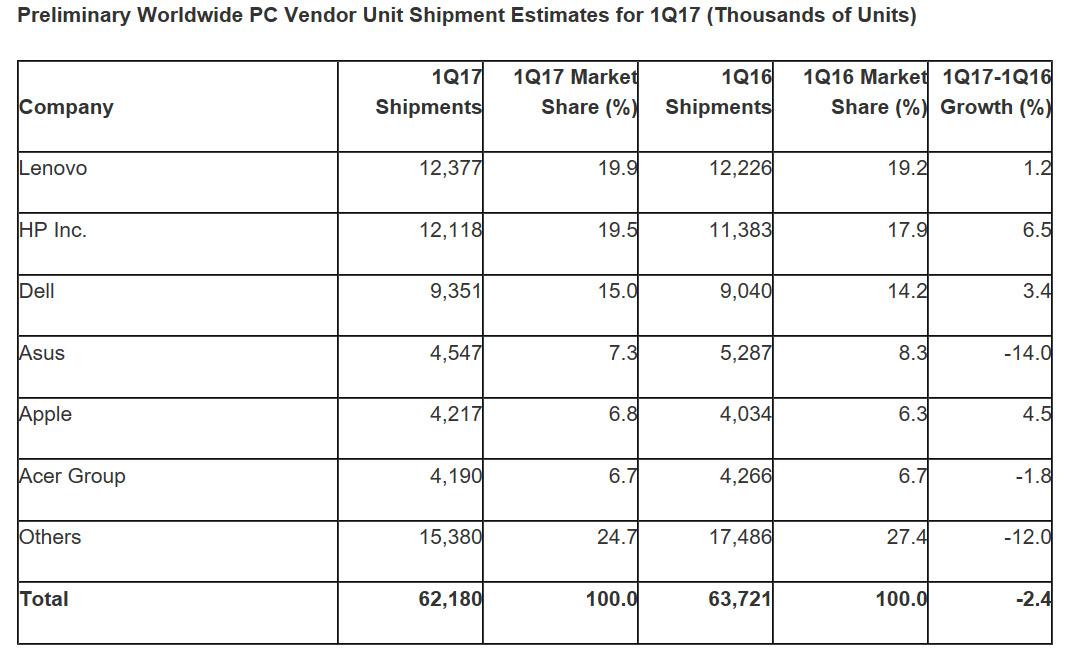

According to the latest report from Gartner, quarterly PC shipments fell 2.4% to 62.2 million units worldwide in the first quarter of 2017 over the same period last year. This is the first time since 2007 that the PC market experienced shipments below 63 million units in a quarter.

Although overall PC shipments were down again this quarter, there is a silver lining: Lenovo maintained its number one position with 19.9% market share, an increase of 1.2% over the same period in 2016. Second place HP showed a 6.5% growth with 12.1 million units shipped in Q1. Third place Dell boosted its shipments by 3.4% for a total of 9.35 million units shipped.

However, fourth place Asus shipped just over 4.5 million units for a 7.3% market share, down a whopping 14% year over year.

Rounding out the top five, Apple saw a 4.5% increase with 4.2 million units shipped and 6.8% market share.

From the report:

While the consumer market will continue to shrink, maintaining a strong position in the business market will be critical to keep sustainable growth in the PC market. Winners in the business segment will ultimately be the survivors in this shrinking market. Vendors who do not have a strong presence in the business market will encounter major problems, and they will be forced to exit the PC market in the next five years. However, there will also be specialized niche players with purpose-built PCs, such as gaming PCs and ruggedized laptops.

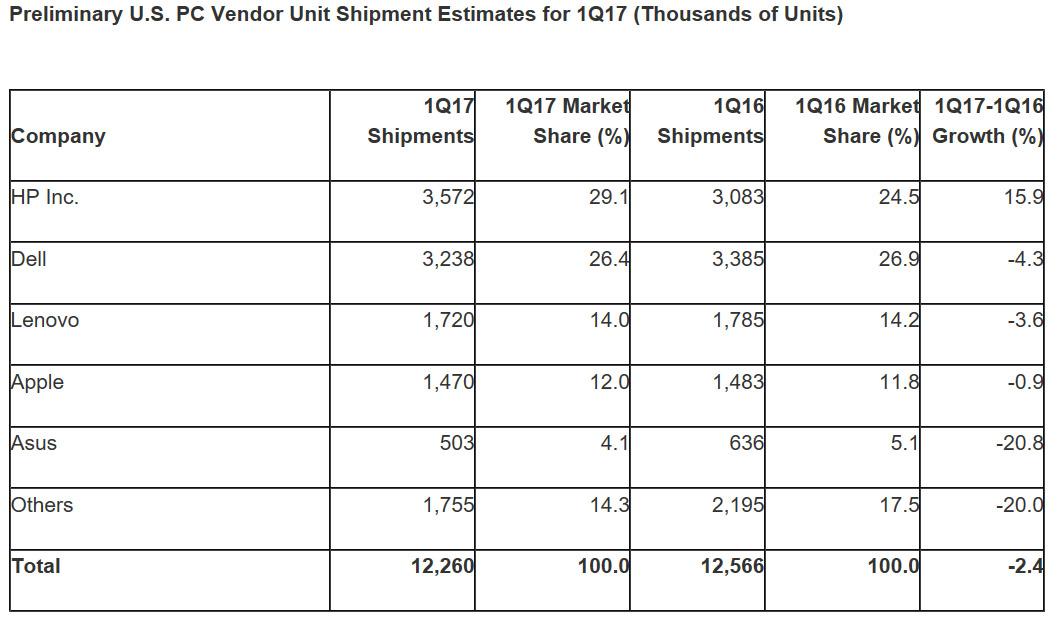

In the U.S., PC shipments totaled 12.3 million units in the first quarter of 2017, a 2.4% decline from the first quarter of 2016. PC shipments in EMEA totaled 17.9 million units, a 6.9% decline as Russia saw single-digit PC growth over the same time period. Shipments reached 22.8 million units in the Asia/Pacific region, a slight decline from the first quarter of 2016.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The report went on to state that HP and Apple showed the strongest growth among the top six vendors. The data includes desktop PCs, notebooks and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads. Gartner believes that the decline in shipments is due in part to recent increases in component prices. The firm went on to say that it believes these price hikes will suppress PC demand even further in the consumer market.

In the U.S., the numbers looked a bit different, with HP sitting in the top spot, followed by Dell, Lenovo, Apple, and Asus, in that order. In terms of U.S. shipments, HP is the only company to see year over year growth, with a 16% increase. Dell shipments were down -4.3%, Lenovo -3.6%, and Apple -0.9%. Asus once again posted the largest decline in PC shipments with an estimated -20.8% decline.

Steven Lynch is a contributor for Tom’s Hardware, primarily covering case reviews and news.

-

jtd871 So these figures seem to be for major OEM shipments. How are DIYers or boutique builders using wholesale/retail parts accounted for?Reply -

why_wolf You'd have to get numbers on shipments for parts. Either motherboards or CPUs to get a good guess for completed builds. The trend is probably fairly similar in the big picture. It's not as if millions of people stopped buy HP and just built their own. Most people are just sitting on the machine they already have for way longer than before or completely ditching them because their iPad does everything they actually need on its own.Reply -

InvalidError Between entry to mid-range PCs being more than good enough for the bulk of people's home and office use for increasingly long periods, and more people moving more of their personal computing to other devices, the traditional x86 PC market is going to continue shrinking for the foreseeable future.Reply

Next year, we'll probably get the same story telling us that PC shipments have hit a 12-13 years low. -

10tacle Reply19559342 said:So these figures seem to be for major OEM shipments. How are DIYers or boutique builders using wholesale/retail parts accounted for?

Note the "Others" in the charts. I would assume that includes the boutique builder sales. Home builder numbers with parts are not included here. It's really hard to get a bead on those numbers due to people only buying components. Are they buying for a new build or just a simple upgrade of a few components?

Would it be entirely accurate to say that someone who bought a new motherboard, CPU, and memory upgrade while keeping the other hardware was a new PC shipment? Then you have people buying upgrade components for their OEM PC purchases like memory, GPUs, and power supplies. Then you have others just replacing a single item due to an early failure in their DIY build. I don't think that can possibly be tracked with any accuracy except through surveys which themselves are prone to errors and falsehoods.

If anything, I think major component sales numbers would need to be separated and accounted for separately. Have retail box sales of motherboards, CPUs, GPUs, memory, etc. gone up, down or remained relatively flat over the past 15 years? That's the numbers I'd like to see. And I know they are out there between Etailers like NewEgg and brick & mortar stores like Fry's Electronics and MicroCenter.

-

Tech_TTT most people are assembling their pc now ...Reply

However , the Used PC market is growing , because even SandyBridge CPU are still strong enough ... -

10tacle Reply19559686 said:most people are assembling their pc now ...However , the Used PC market is growing , because even SandyBridge CPU are still strong enough ...

Uhm, no. The last figures I saw from a couple of years ago was that over 90% of PCs in use were OEM purchased, not home-built. That was overall PCs in use which included office PCs as well as home PCs. Now drill down to say gaming PCs only, and that number of OEMs goes way down.

But yeah, even my six year old Sandy Bridge i5 2500K is running solid as a good backup PC gaming rig as well as general productivity use PC (Microsoft Office, Photoshop, Blu-Ray movie watching, etc.).

-

hannibal Yep. Very few people assemble computers... They don't even know how to remove the dust from it...Reply -

InvalidError Reply

Of everyone I know, I think I might be the only one who still builds his PCs from scratch. One person I know buys pre-built, pre-tested Dell-Alienware PCs for gaming because he cannot be bothered to fit custom cooling himself and another who is knowledgeable enough to build himself has butterfingers, scrapped a CPU because of it and now has me do his building and upgrading. The rest of people I know either don't own a PC that I know of, have never opened one or use laptops.19559686 said:most people are assembling their pc now ...

-

MobiusSS In addition to owning a sign shop, I run a small PC building and repair business from home. The simple fact is that, compared to 15-20 years ago, you just don't need to get new computers very often, since the old ones still do everything you need to do at an acceptable pace. Most of my customers are local small businesses. In the past, they got new computers every 2-3 years because the new ones were that much better, and the main software they used would run poorly on their two year old hardware. I used to sell to home users and gamers as well, and their product cycles were even shorter because of the advances in games. Now the gamers all use consoles, and the businesses just keep using the computers they bought 10 years ago. Everything still runs fast, so there is no perceived need. The only time I build a new computer for them now is when they hire new people or open new offices.Reply -

why_wolf Be interesting to see the breakdown between desktop, all in ones, and laptops from these sale numbers. I imagine that most people these days are opting for laptops followed by all in ones due to their convenience over a traditional desktop.Reply

But yeah like MobiusSS said the age of Moore's law is over. It's no longer necessary to upgrade your hardware ever two years to be able to use the programs you need. At this point the hardware has more than enough headroom to run what you need across multiple version upgrades of a particular program. Unlike the 80/90s where you had to have that new Pentium if you wanted any chance of being able to run software 199X in a usable manner.