China Chip Output Declines in Wake of COVID-19 Lockdowns

The COVID "snag" keeps impacting semiconductor supply.

Even as the tech industry is scrambling to scale semiconductor manufacturing capacity through billion-dollar investments, China's IC ecosystem is further constrained in the wake of COVID-19 lockdowns. According to a report from Bloomberg, China's IC manufacturing capability over the first quarter of this year actually declined 4.2% YoY (Year-over-Year). This has put a dent in China's plans for semiconductor independence from the West - but it also impacts semiconductor availability throughout the globe.

Shanghai, one of China's key chipmaking territories, is still reeling from an ongoing, month-long lockdown instated on April 5th following a city-wide spike in COVID-19 cases. This was the first time a city-wide lockdown was issued to China's bustling tech metropolis, which contributes over 3% of China's GDP and makes up over 10% of the country's total trade since 2018. This led to factory closures and personnel reduction policies, with Semiconductor Manufacturing International Corp. (SMIC) and Hua Hong Semiconductor being especially impacted. Previously, Shanghai skirted the worst of the pandemic with localized lockdowns that could scale from apartment buildings to entire city sections.

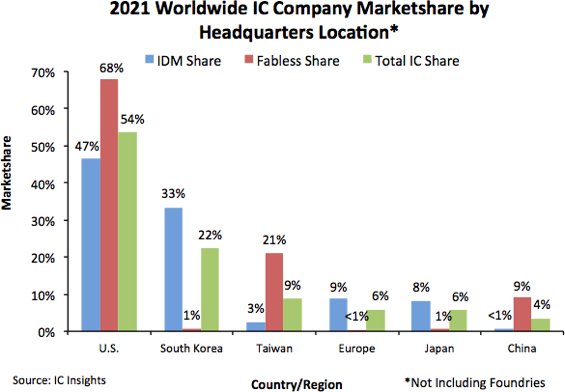

China's chip output has been experiencing double-digit growth for years, even in the face of a trade war with the United States. Yet the latest lockdown led to a 5.1% reduction in IC production for the month of March already, the second highest-recorded decline in China's IC output - only left behind by the 8.7% contraction experienced in Q1 2019. Even though Chinese IC manufacturing currently amounts to only 4% of the global production output, any reduction in chip manufacturing still piles on already tight supplies.

As is the case in such an interconnected industry, supply issues have rippling effects throughout. It's expected that both the automotive and smartphone markets will be the most affected by the production drop - industries that are still recovering from the pandemic's effects in the worldwide semiconductor market. Luckily, this should leave the best consumer GPUs and CPUs alone; but decisions on how to manage constrained IC supplies could still impact other markets, as we've seen its effects trickle into the laptop segment already.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.