SSDs Outsell HDDs in Unit Sales 3:2: 99 Million Vs. 64 Million in Q1

But HDDs maintain exabytes lead: 288.3EB vs 61.5EB.

Solid-state drives have a number of advantages when compared to hard drives, which include performance, dimensions, and reliability. Yet, for quite a while, HDDs offered a better balance between capacity, performance, and cost, which is why they outsold SSDs in terms of unit sales. Things have certainly changed for client PCs as 60% of new computers sold in Q1 2021 used SSDs instead of HDDs. That said, it's not surprising that SSDs outsold HDDs almost 3:2 in the first quarter in terms of unit sales as, in 2020, SSDs outsold hard drives (by units not GBs), by 28 perecent.

Unit Sales: SSDs Win 3:2

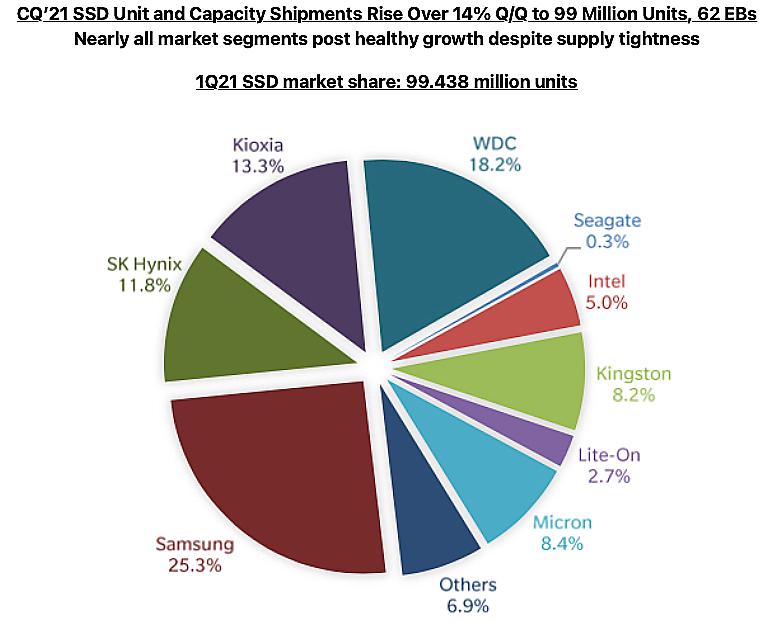

Three makers of hard drives shipped as many as 64.17 million HDDs in Q1 2021, according to Trendfocus. Meanwhile, less than a dozen SSD suppliers, including those featured in our list of best SSDs, shipped 99.438 million solid-state drives in the first quarter, the same company claims (via StorageNewsletter).

Keeping in mind that many modern notebooks cannot accommodate a hard drive (and many desktops are shipped with an SSD by default), it is not particularly surprising that sales of SSDs are high. Furthermore, nowadays users want their PCs to be very responsive and that more or less requires an SSD. All in all, the majority of new PCs use SSDs as boot drives, some are also equipped with hard drives and much fewer use HDDs as boot drives.

Exabyte Sales: HDDs Win 4.5:1

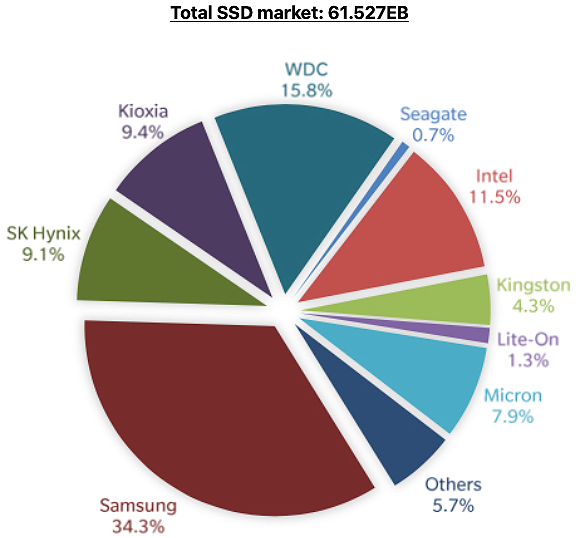

But while many modern PCs do not host a lot of data, NAS, on-prem servers, and cloud datacenters do and this is where high-capacity NAS and nearline HDDs come into play. These hard drives can store up to 18TB of data and an average capacity of a 3.5-inch enterprise/nearline HDD is about 12TB these days nowadays. Thus, HDD sales in terms of exabytes vastly exceed those of SSDs (288.3EB vs 61.5EB).

Meanwhile, it should be noted that the vast majority of datacenters use SSDs for caching and HDDs for bulk storage, so it is impossible to build a datacenter purely based on solid-state storage (3D NAND) or hard drives.

Anyhow, as far as exabytes shipments are concerned, HDDs win. Total capacity of hard drives shipped in the first quarter 2021 was 288.28 EB, whereas SSDs sold in Q1 could store 'only' 66 EB s of data.

Since adoption of SSDs both by clients and servers is increasing, dollar sales of solid-state drives are strong too. Research and Markets values SSD market in 2020 at $34.86 billion and forecasts that it will total $80.34 billion by 2026. To put the numbers into context, Gartner estimated sales of HDDs to reach $20.7 billion in 2020 and expected them to grow to $22.6 billion in 2022.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Samsung Leads the Pack

When it comes to SSD market frontrunners, Samsung is an indisputable champion both in terms of unit and exabytes shipments. Samsung sold its HDD division to Seagate in 2011, a rather surprising move then. Yet, the rationale behind the move has always been there for the company that is the No. 1 supplier of NAND flash memory. Today, the move looks obvious.

Right now, Samsung challenges other SSD makers both in terms of unit (a 25.3% market share) and exabyte (a 34.3% chunk of the market) shipments. Such results are logical to expect as the company sells loads of drives to PC OEMs, and high-capacity drives to server makers and cloud giants.

Still, not everything is rosy for the SSD market in general and Samsung in particular due to shortage of SSD controllers. The company had to shut down its chip manufacturing facility that produces its SSD and NAND controllers in Austin, Texas, earlier this year, which forced it to consider outsourcing of such components. Potentially, shortage of may affect sales of SSDs by Samsung and other companies.

"Shortages of controllers and other NAND sub-components are causing supply chain uncertainty, putting upwards pressure on ASPs," said Walt Coon, VP of NAND and Memory Research at Yole Développement. "The recent shutdown of Samsung’s manufacturing facility in Austin, Texas, USA, which manufactures NAND controllers for its SSDs, further amplifies this situation and will likely accelerate the NAND pricing recovery, particularly in the PC SSD and mobile markets, where impacts from the controller shortages are most pronounced."

Storage Bosses Still Lead the Game

Western Digital follows Samsung in terms of SSD units (18.2%) and capacity (15.8%) share to a large degree because it sells loads of drives for applications previously served by HDDs and (perhaps we are speculating here) mission-critical hard drives supplied by Western Digital, HGST (as well as Hitachi and IBM before that).

The number three SSD supplier is Kioxia (formerly Toshiba Memory) with a 13.3% unit market share and a 9.4% exabyte market share, according to TrendFocus. Kioxia has inherited many shipment contracts (particularly in the business/mission-critical space) from Toshiba. Kioxia's unit shipments (a 13.3% market share) are way lower when compared to those of its partner Western Digital (to some degree because the company is more aimed at the spot 3D NAND and retail SSD markets).

Being aimed primarily at high-capacity server and workstation applications, Intel is the number three SSD supplier in terms of capacity with an 11.5% market share, but when it comes to unit sales, Intel controls only 5% of the market. This situation is not particularly unexpected as Intel has always positioned its storage business as a part of its datacenter platform division, which is why the company has always been focused on high-capacity NAND ICs (unlike its former partner Micron) for advanced server-grade SSDs.

Speaking of Micron, its SSD unit market share is at an 8.4%, whereas its exabytes share is at 7.9%, which is an indicator that the company is balancing between the client and enterprise. SK Hynix also ships quite a lot of consumer drives (an 11.8% market share), but quite some higher-end enterprise-grade SSDs (as its exabytes share is 9.1%).

Seagate is perhaps one exception — among the historical storage bosses — that controls a 0.7% of the exabyte SSD market and only 0.3% of unit shipments. The company serves its loyal clientele and has yet to gain significant share in the SSD market.

Branded Client SSDs

One interesting thing about the SSD market is that while there are loads of consumer-oriented brands that sell flash-powered drives, they do not control a significant part of the market either in terms of units nor in terms of exabytes, according to Trendfocus.

Companies like Kingston, Lite-On, and a number of others make it to the headlines, yet in terms of volume, they control about 18% of the market, a significant, but not a definitive chunk. In terms of exabytes, their share is about 11.3%, which is quite high considering the fact that most of their drives are aimed at client PCs.

Summary

Client storage is going solid state in terms of unit shipments due to performance, dimensions, and power reasons. Datacenters continue to adopt SSDs for caching as well as business and mission-critical applications.

Being the largest supplier of 3D NAND (V-NAND in Samsung's nomenclature), Samsung continues to be the leading supplier of SSDs both in terms of volumes and in terms of capacity shipments. Meanwhile, shortage of SSD controllers may have an impact on the company's SSD sales.

Based on current trends, SSDs are set to continue taking unit market share from HDDs. Yet hard drives are not set to give up bulk storage.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

lvt I can relate to this, last year I bough 5 drives, 3 are SSD.Reply

But I believe that HDDs still win in combined capacities sold. -

samopa Bought 10 unit Seagate FireCuda 2TB SSD, 2 of them fail less than a year, warannty still covers both of them, but the loss of data make a lot of damage to the project I'm working on, never again I will bought SSD from Seagate.Reply -

InvalidError Reply

More or less the same story for me: In recent years, the only new HDD I have purchased is a 4TB Baracuda for offline backups vs 500GB+1TB in new SSDs, so SSDs outnumber HDDs 2:1 by drive count while my new HDD out-stores my new SSDs 2.6:1.lvt said:I can relate to this, last year I bough 5 drives, 3 are SSD.

But I believe that HDDs still win in combined capacities sold. -

waltc3 I can actually remember buying a couple of Samsung platter drives years ago for a small RAID 0 array in a home system at the time. Had no problems that I recall--I only recalled that pair of drives because of this article's mention of Samsung's platter-drive manufacturing days.Reply

I didn't quite understand the statement that Samsung "had" to close its Austin facility--that would have been an interesting angle for a writer to investigate as short of bankruptcy, factory closures are most often due to broader planning strategies of some kind within the larger company. The entire "SSD shortage" situation the article discusses would seem to support Samsung's keeping the Austin factory open, imo--unless Samsung is taking a different approach to the same problems--new factory plans, upgrading of existing plant hardware, securing a guaranteed source for the components its SSDs need that is thought superior to what Austin can make, etc. Seems like some dots in need of connection are missing--but it was an interesting comment to make, certainly!

SSDs are great and a really nice advance in general drive technology for the masses (us...;)). But in terms of sheer storage capacities, platter drives have no peer as there are no SSDs that even get close to replacing them. But, as with all technical issues, the either-or market situations advanced by imaginative article authors do not actually exist ("If you use widget A, you cannot use widget B, as you must use one or the other because the two widgets are locked in a death struggle and only one shall rise --It's A-li-i-i-i-i-i-ive!--in the end!"..;) ) Both technologies have clear and undeniable strengths and weaknesses, and each has advantages the other lacks. That's why I use both...;)

Three disadvantages I see for NVMe SSDs contrasted with platter drives:

*operating temps (even 7200 rpm platters can be much cooler in use)

*price per GB

*Maximum storage capacities

Clear advantages for (NVMe) SSDs:

*spacial and electrical requirements much less/simpler than what platter drives require

*Solid state design sans moving parts

*performance, performance, performance...yes the sheer performance of near ram-disk speeds in a single stick (well--much closer to the ideal than a platter drive, certainly...)

So I use both and will continue to use both for the foreseeable future. Using both--if you have needs that speak to the advantages of platter drives as enumerated above--would seem to be much better configuration advice than the either-or scenario, imo.

Nice article--always nice to take a peek at these general, atm trends! -

USAFRet My house is pretty evenly split between numbers of SSD vs HDD.Reply

However...

All the desktops and laptops are SSD only.

The spinning drives live in or are attached to the NAS.