TSMC Q1 Revenue Record: 35.5% Increase Year-Over-Year

TSMC earns nearly $17 billion in Q1 2022.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

In our rapidly changing world demand for various chips is high. So high that foundries can increase their quotes without fearing to lose customers. But TSMC (Taiwan Semiconductor Manufacturing Co.) stands apart from its rivals. TSMC has more capacity than any other foundry, and it has leading-edge technologies not available from its rivals. Increased prices, extraordinary capacities, and leading-edge nodes drove TSMC's Q1 results to a record high.

TSMC reported revenue of NT$491.08 billion ($16.965 billion) for the first quarter of 2022, up a whopping 35.5% year-over-year. TSMC's results beat analyst estimates, but did not beat TSMC's own guidance of $16.6 – $17.2 billion revenue for Q1 2022. TSMC has yet to report its gross margin next week during its earnings call, but it guided a range between 53% and 55%, which is also higher than the company's historical margins.

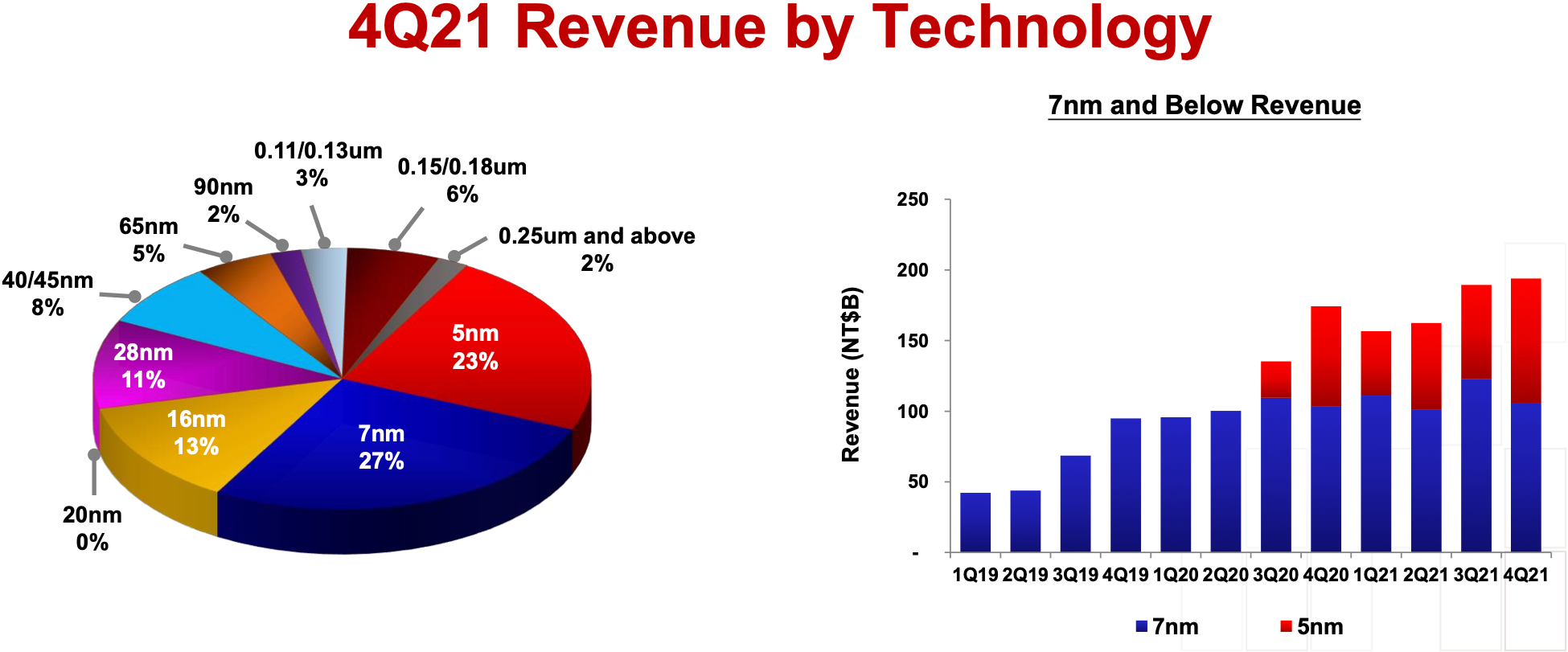

Another uncommon thing with TSMC's first quarter results is that the company's Q1 2022 revenue exceeded its earnings in Q4 2021 and Q3 2021. Typically, fabless chip designers tend to start ramping up production of their ICs in late Q1 – early Q2, then TSMC delivers those chips in the second half of the year and its revenues increase in Q3 and Q4.

We do not know what volumes TSMC delivered in Q1, but we know that the contract maker of semiconductors increased its quotes in late August by 10% on N5 and N7 nodes and by 20% on its N16 and thicker nodes for orders set to be fulfilled starting December. To that end, it is not surprising that TSMC's results for Q1 2022 are particularly strong and exceed those in Q1 2021 by more than a third.

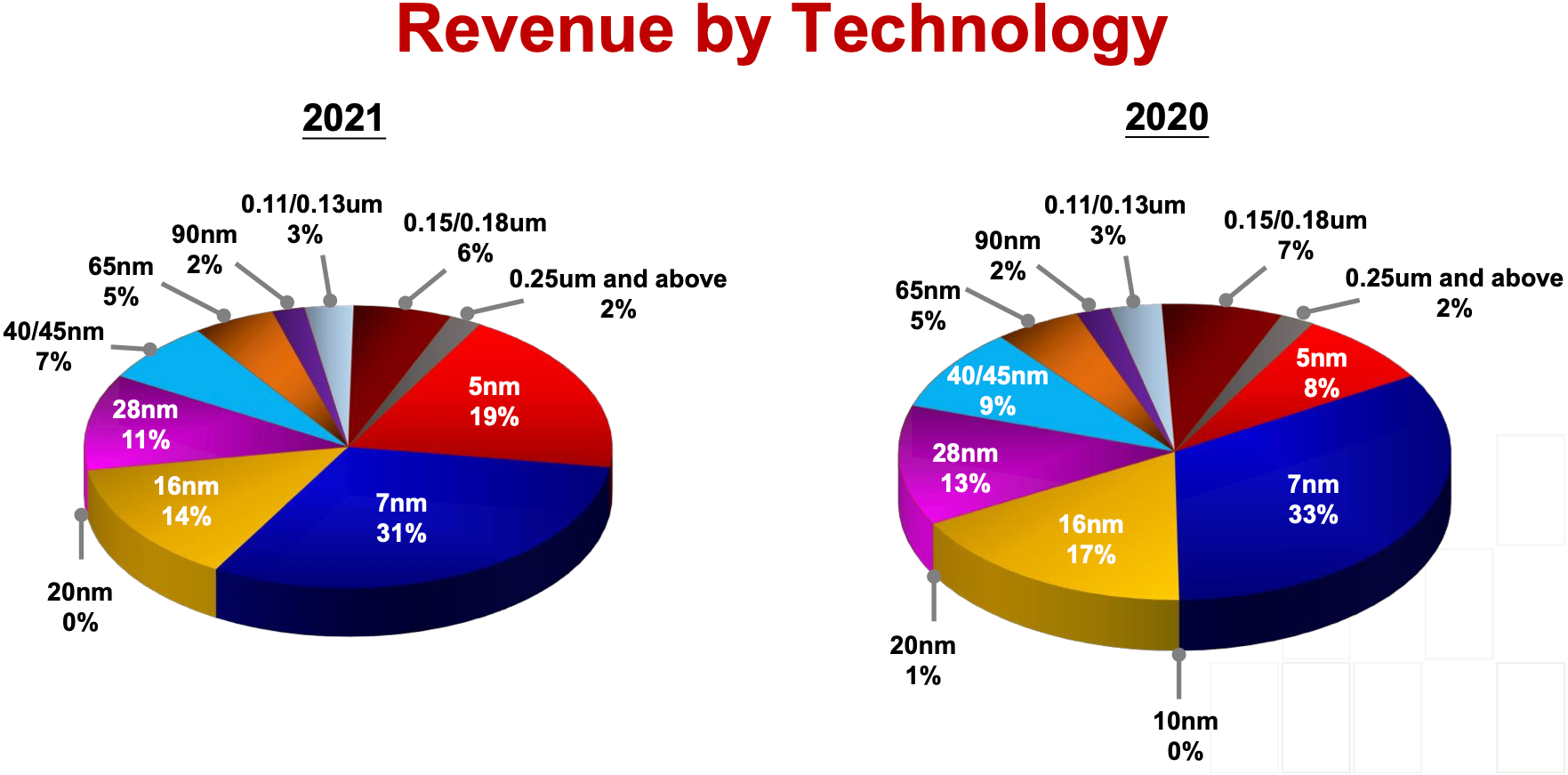

Hiked prices are not the only reason why TSMC is thriving. Leading-edge N5 and N7 fabrication technologies account for about a half of TSMC's earnings. TSMC's N5 have been used by Apple almost exclusively for nearly two years now, but this node is now gaining traction with other high-volume customers of the foundry, so as TSMC ramped up delivery of N5/N4 silicon to customers like AMD and MediaTek in Q1 2022, its revenues grow significantly.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.