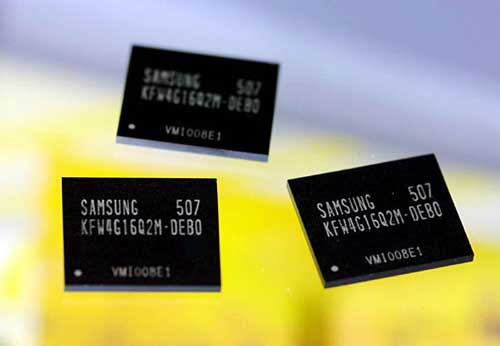

Flash Likely to Get More Expensive; Samsung Builds 10nm Fab

If you are looking to buy Flash memory, you may want to purchase rather sooner than later.

There are more signs of supply constraints in the flash memory market, which could lead to price increases. Following Toshiba's announcement that it would cut flash memory production by 30 percent, we have seen companies that rely on these chips warn of demand exceeding supply.

For chip makers such as Toshiba, that may be good news, but the product chain is likely to see higher prices. Among the companies that warned of revenue shortfall due to supply constraints are OCZ as well as Sandisk. OCZ said that it had record orders, but was not able to meet the demand because of flash shortage, according to Seeking Alpha. The publication noted that Samsung, the world's largest flash chip maker "indicated its intention to convert to the production of logic products from memory chips at its Austin, Texas facility."

Add to that the fact that Apple has largely secured first dibs on flash memory from all major manufacturers, and a greater than expected success of the iPhone 5 could make the current constraint situation even more serious.

On the brighter side, Samsung is reportedly preparing the construction of a fab in Xi'an, China, which will be dedicated to 10 nm flash chips initially. At a cost of $7 billion, the factory will be built in two phases and have floor space of 10.8 million square feet - the equivalent of about 187 football fields. The factory is scheduled to go online in 2014 with an initial floor space area of almost 5 million square feet. The Xi'an is home to a total of 37 universities and more than 3,000 IT R&D facilities.

Contact Us for News Tips, Corrections and Feedback

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Wolfgang Gruener is an experienced professional in digital strategy and content, specializing in web strategy, content architecture, user experience, and applying AI in content operations within the insurtech industry. His previous roles include Director, Digital Strategy and Content Experience at American Eagle, Managing Editor at TG Daily, and contributing to publications like Tom's Guide and Tom's Hardware.

-

mikenygmail Even if this is true, in the long run Flash memory will definitely get cheaper! :)Reply -

alyoshka Why does all this production manipulation feel like big scams... first it was HDDs due to the Thai floods.... now it's the Flash chips...... the big guys really aren't offering us much for the price rise..... as always.Reply -

rikimaru55 alyoshkaWhy does all this production manipulation feel like big scams... first it was HDDs due to the Thai floods.... now it's the Flash chips...... the big guys really aren't offering us much for the price rise..... as always.Reply

Exactly. -

alidan 10nm flash, that will cut current prices of ssd (that use 20-25nm)Reply

by 4 to 6.5 times

basically 100gb now costs 100$

when the 10nm evens out 100gb will cost between 16-25$ -

drwho1 I wonder how much Tom's get paid for all of this "run and buy now"... "articles".Reply

*cough*Advertisements*cough* -

tomfreak I am not sure what kind of flash memory u are talking about, SSD? or USB drive. If it is USB drive, I got more than enough for daily use for now. So there is no need for me buy a new one for years.Reply -

saturnus 10nm flash. That sounds very interesting indeed when coupled with the time line of production start in 2014 as that indicate 2 die shrinks from the current 20nm process in under 2 years.Reply

What it also indicate is that Samsung might be able to make processors on 10nm by 2015, a full year before Intel. -

Memory manufactures keep stating that prices will go up for the past 5 months, yet prices are even or lower than before.Reply

-

deadlockedworld How many suicides per day will there be at a 10.8 million square foot factory? Another elevation in the Apple - Samsung competition!?Reply