Intel Announces Bitcoin Mining Initiative, Bonanza Mine Chips Ship This Year

Intel has officially entered the cryptomining business.

Intel's Raja Koduri penned a blog post that officially announces the company's plans to enter the cryptomining/blockchain market with a roadmap of specialized energy-efficient accelerators. Intel will begin delivering the new chips, comprised of the Bonanza Mine ASICs that we recently unearthed, this year to several large customers as it enters the Bitcoin mining market that it expects to grow by $2.8 billion from 2021-2025. Intel's first customers include BLOCK (formerly known as Square and helmed by CEO Jack Dorsey of Twitter fame), Argo Blockchain, and GRIID Infrastructure. We'll provide a bit more detail on those relationships below.

Intel also announced that it had created a new Custom Compute Group, folded under Koduri's Accelerated Computing and Graphics (AXG) Business Unit, to design and build its blockchain hardware. The group will also build other unspecified custom accelerated supercomputing hardware based on Intel's existing IP blocks. It's unclear if those products could address other types of cryptocurrency mining, or if the unit will also serve as an adjunct to Intel Foundry Services (IFS).

Intel shared an image of its new blockchain accelerator, but Koduri's missive is light on technical details. However, we already know quite a bit about the company's upcoming Bitcoin-mining hardware. We first discovered Intel's Bonanza Mine chips in a listing for a presentation at the upcoming ISSCC conference, but the company has already moved on to its second-gen 'Bonanza Mine' ASIC, known as BZM2. This chip has a specialized architecture designed specifically to accelerate SHA-256 (a cryptographic algorithm) processing for Bitcoin mining at ultra-low voltage. These energy-efficient chips produce what Intel characterizes as "over 1000x better performance per watt than mainstream GPUs for SHA-256-based mining."

However, GPUs aren't often used for SHA-256 / Bitcoin mining, so that isn't the best comparison. Instead, Bitcoin is typically mined on ASICs, which are specialized processors specifically designed to execute one type of workload. ASICs afford efficiency and performance advantages over more complex types of chips, like CPUs and GPUs, that can perform the same task.

Intel's Bonanza Mine will compete with other ASIC-based devices from companies like Bitmain (which has a quasi-monopoly on high-end miners) and MicroBT. These companies suffer from long lead times and charge prohibitively high pricing (often based on Bitcoin's valuation) for their chips. They also have to rely on third-party design houses and foundries for manufacturing. Foundries like TSMC don't tend to give these companies preferential status in their fabs due to the uncertainty of the demand and sporadic nature of cryptomining; instead, they prioritize longer-term steady business from bigger chip designers.

Intel has tremendous production capacity of its own, but it isn't clear if it will fab the BZM2 ASICs in its own internal fabs or outsource production to TSMC (BZM2 is rumored to use TSMC's 5nm). However, Intel has traditionally outsourced roughly 25% of its silicon production and will drastically increase that amount over the next few years as it moves its GPU and some CPU production to TSMC, meaning it has more purchasing power than competing mining hardware firms. Additionally, Intel has tight control over its supply chain and has its own production, including packaging and test (OSAT) capacity, a critical step in the manufacturing process that has proven to be one of the major contributors behind the ongoing semiconductor shortages.

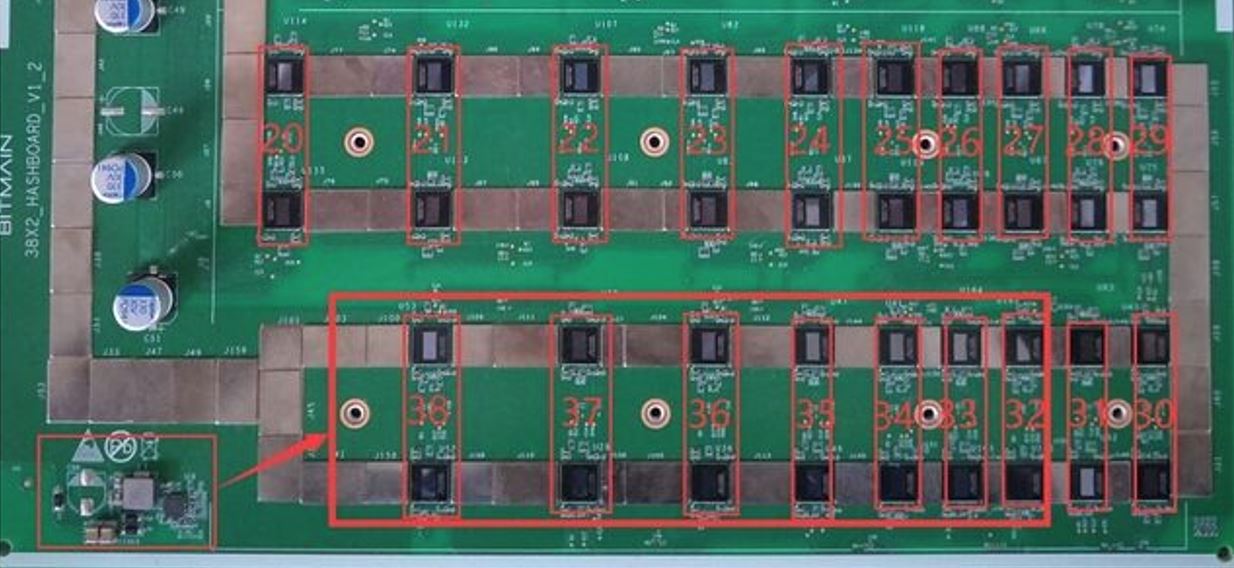

Intel says that its mining hardware consists of tiny pieces of silicon (the first-gen BZM1 chip measures a mere 14.2mm^2), so this new foray shouldn't impact its supply of current products. However, much like you can see in the image of half of a Bitmain S19's hashboard above, mining ASICs are deployed en masse. We expect Intel's solution will have a similar arrangement, so it will consume a non-trivial amount of silicon in aggregate. However, the smaller die size boosts yield and maximizes wafer area usage (up to 4,000 die per wafer), thus helping maximize production capacity (though it does require more wafer dicing/packaging capacity).

Intel's First Bitcoin Mining Customers

Intel has announced three of its first customers, BLOCK (formerly known as Square), Argo Blockchain, and GRIID Infrastructure, but it's possible that the company has other large customers that wish to remain unnamed. The Bitcoin mining industry has been plagued by hardware shortages and excessive pricing for the last few years. Considering that analysts predict 1.5 to 2 million Bitcoin miners will ship this year, that will likely continue. As such, Intel could prove to be a disruptive force in this market segment given its scale, more predictable pricing, and likely more predictable supply.

We can see some of those aspects come into play with Intel's deal with its first publicly known customer, GRIID computing, which will soon go public at an estimated $3.3 billion valuation. Intel has guaranteed GRIID that it will sell it a minimum of 25% of its overall mining ASIC supply through 2025 at fixed pricing (until 2023), which is far more desirable than the fluctuating pricing from competing firms like Bitmain that assign pricing based on Bitcoin valuation. GRIID considers Intel's pricing assurance to be a considerable competitive advantage over other mining firms, noting that hardware costs are the largest expenditure for any mining deployment.

GRIID's supply agreement with Intel has plenty of redactions to protect sensitive information, but it also heavily references Intel's Reference Design Materials, which are a series of documents that customers use as guidance when they integrate the Bonanza Mine chips into their own custom systems.

This implies that Intel will supply the silicon to some of its customers, who will then create their own systems. This also meshes well with Jack Dorsey's plans for BLOCK, which he says will create a “bitcoin mining system based on custom silicon and open source for individuals and businesses worldwide.” Intel could also manufacture complete mining systems and bring them to market through partners, but we'll have to wait to learn more details about its go-to-market strategy.

Intel's listing for the upcoming ISSCC conference notes that Bitcoin mining is currently estimated to consume 91TW-hour of power annually, which is greater than the country of Finland, but points out that customized accelerators can optimize energy efficiency. Koduri acknowledges that blockchains require tremendous amounts of energy, but says that Intel aims to provide scalable and energy-efficient solutions to "promote an open and secure blockchain ecosystem and advance this technology in a responsible and sustainable way."

Intel's publicly-acknowledged customers all say they focus on sustainable energy sources. Notably, GRIID claims that approximately 74% of its power consumption is carbon-free, with a goal of being 90% carbon-free by the end of 2023 — all without carbon offsets or credits. GRIID hasn't released firm projections of the number of machines it plans to deploy, but it intends to operate three industrial-scale facilities totaling 734 megawatts of power by 2023.

The publicly-traded Argo Blockchain, which recently purchased 20,000 Bitmain Antimer machines for its West Texas data center, says it is climate-positive and focuses on hydropower for most of its facilities, though it will use a combination of wind and solar for its Texas plants.

Finally, BLOCK (formerly known as Square), also has a heavy focus on renewable energy sources. The company recently partnered with Blockstream Mining to build an open-source solar-powered Bitcoin mining farm in the United States.

More To Come

Intel's Bonanza Mine chips could give it a solid beachhead in the lucrative Bitcoin mining market where its new competitors, like Bitmain and MicroBT, have long dominated. Intel will also not limit the mining performance of its standard Arc Alchemist GPUs that will come to market soon, allowing it to compete with its old rivals AMD and Nvidia in other types of cryptocurrency mining (like Ethereum).

This provides Intel with a dual-pronged strategy of ASICs and GPUs for the rapidly-growing blockchain/cryptomining market that it hasn't participated in before (at least not publicly). Plugging those products into Intel's global production and supply chains could help the company grow quickly and sidestep some of the production shortfalls we've seen with other mining hardware providers.

Intel will present its first-gen Bonanza Mine chips at an industry event later this month, and its claimed 137 GH/s performance and 18.2 W/TH efficiency rivals the best mining ASICs on the market. That sets a promising tone for the company's second-gen Bonanza Mine chips. However, there are still plenty of unknowns about the technical details, like performance, efficiency, pricing, power consumption, the process node, foundry used, and so on. We also don't know the company's plans for its future roadmap.

One thing is clear, though: If Intel can deliver enough silicon with competitive efficiency, performance, and pricing, its entrance into the Bitcoin hardware market could disrupt the status quo and touch off a new performance/efficiency arms race. We're sure to learn more during the company's investor event next week and the ISCC presentation at the end of the month. Stay tuned.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

-Fran- This reminds me of that Southpark episode where the kids were brainwashed by Pokemon and when the dads got into it, they lost interest.Reply

Too little too late, perhaps? Not sure.

Regards. -

jkflipflop98 I don't know why we're even selling these in the first place. Put them in the basement in a mega-server and mine crypto like crazy. Make way more money.Reply -

rixik91683 Hardware enthusiasts don't have conceptual thinking to recognize the next revolution in tech. Every single billion dollar corporation is investing it because if they don't innovate, they'll die. Look at how Facebook is struggling against ByteDance. They had to push into Metaverse to survive.Reply -

husker If you have a secret key to get all the answers to tests in school, you might get away with it. But it doesn't scale well: If everyone has the key it will all fall apart. Crypto also cannot scale in an unlimited way. One cannot assume that pricing and markets won't adjust to a new influx of wealth created out of whole cloth. Will a cryptocurrency get mined out to the point it cannot be mined profitably? If no then "hurray, we all have a money tree in our yard". If yes, new currencies are created in an endless cycle and "hurray, we all have a money tree in our yard". That won't end well and probably will lead to a global economy and bank system crash like we have never seen.Reply -

TJ Hooker Intel's talk of addressing crypto mining power draw through efficient miners is so disingenuous. If you develop a miner that's more efficient (and therefore more profitable), that just means miners will buy more of them. Eventually, difficulty will increase point where profitability is roughly what it was previously. All that you've done is consumed a bunch of resources to produce the new ASIC miners, and resulted in a bunch of old ASIC miners becoming e-waste.Reply -

Blitz Hacker Reply

It's for a more sustainable blockchain, which not only nets them a bunch of money, but it also reduces the energy load on the grid, both are wins in intel's case. Old asic's will run until/if the cost of energy exceeds the revenue they can produce. Even 10 cents usd a day, is ten cents (over power costs), same argument could be made for electric cars aswell.. well all the gasoline ones will become waste, yes but progress must be had :)TJ Hooker said:Intel's talk of addressing crypto mining power draw through efficient miners is so disingenuous. If you develop a miner that's more efficient (and therefore more profitable), that just means miners will buy more of them. Eventually, difficulty will increase point where profitability is roughly what it was previously. All that you've done is consumed a bunch of resources to produce the new ASIC miners, and resulted in a bunch of old ASIC miners becoming e-waste. -

Blitz Hacker Reply

Obviously you don't understand blockchains. You can't mine more coins than is given at a rated time. If you increase the hashrate on a network, the network difficulty spikes to compensate for it. Meaning the same amount of crypto is earned over time no matter what the hashrate on the network is, with more people it's distributed more is all and the network becomes more secure. The more decentralized the network is, the more secure it is (and less likely anyone can get a solo 51% of the hashrate on a network to 'change the governance rules) As time goes on and future halvings (the rewards given out are halved) the amount of crypto mined decreases (by half) and presumably the value of each coin increases, as supply/demand/scarcity. Will it get to a point of where it's not profitable? Yes probably. That's why the push for more efficient ways of doing it are an ever increasing need. The only thing that can 'crash' in crypto is the traded value of it, and over time crypto valuates really really well. As more gets 'lost' 'forgotten' or just being held by everyone, the value of a coin will almost always go up. It's why people are using crypto as a store of value. As time goes on the value increases. Where as with fiat and this BBRRRRRR money printing going on, the value of saved money is going down.husker said:If you have a secret key to get all the answers to tests in school, you might get away with it. But it doesn't scale well: If everyone has the key it will all fall apart. Crypto also cannot scale in an unlimited way. One cannot assume that pricing and markets won't adjust to a new influx of wealth created out of whole cloth. Will a cryptocurrency get mined out to the point it cannot be mined profitably? If no then "hurray, we all have a money tree in our yard". If yes, new currencies are created in an endless cycle and "hurray, we all have a money tree in our yard". That won't end well and probably will lead to a global economy and bank system crash like we have never seen. -

Matt_ogu812 Does this mean that the rumors of Bitcoin mining death is all BS?Reply

Surely Intel would not be making this investment if Bitcoin mining doesn't have a future, like MSM has been reporting. -

TJ Hooker Reply

I think you missed the point. Making miners more efficient just means people will run more miners. In the end, there is no reduction in power draw.Blitz Hacker said:It's for a more sustainable blockchain, which not only nets them a bunch of money, but it also reduces the energy load on the grid, both are wins in intel's case. Old asic's will run until/if the cost of energy exceeds the revenue they can produce. Even 10 cents usd a day, is ten cents (over power costs), same argument could be made for electric cars aswell.. well all the gasoline ones will become waste, yes but progress must be had :)

How would load on the grid decrease by adding more miners? Consider that hashing efficiency has improved by orders of magnitude since bitcoin mining started, but network power draw just keeps increasing. -

TJ Hooker Reply

Where have you seen people saying that? Or are you confusion bitcoin mining with ethereum mining? Ethereum mining will eventually die when it moves from Proof of Work to Proof of Stake (which has been coming 'soon' for like 3 years). This does not apply to bitcoin though.Matt_ogu812 said:Does this mean that the rumors of Bitcoin mining death is all BS?

Surely Intel would not be making this investment if Bitcoin mining doesn't have a future, like MSM has been reporting.