TSMC is on track to have more employees than Intel for the first time in history — TSMC's explosive growth stands in contrast to Intel's rapid contraction

Does not spend that much on semiconductor R&D as well.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Among semiconductor companies, Intel has always been the biggest one both in terms of revenue and in terms of headcount. However, following massive layoffs at Intel in recent years, TSMC is now on track to outpace Intel as the world's biggest semiconductor employer. While Intel is still an exceptionally huge semiconductor company that employs more people than AMD, Nvidia, and Arm combined, the moment when TSMC becomes bigger than Intel from a headcount point of view will be an epic one.

85,100 employees after years of cuts

Intel employed 85,100 people as of December 27, 2025, following substantial job cuts at Intel in 2024 and colossal job cuts in 2025. TSMC had 83,825 full-time employees serving in various capacities as of December 31, 2024, following years of aggressive hiring amid expansions overseas as well as building out new production capacity in Taiwan. As a result, it is more than likely that when TSMC publishes its Annual Report in mid-April, it will report well over 83,825 full-time employees, therefore surpassing Intel as the biggest employer in the semiconductor industry.

To put the numbers into context, AMD had approximately 31,000 of full-time employees (FTE) in the end of 2025, Nvidia employed around 36,000 people full time at the end of its fiscal 2025 (i.e., calendar 2024), Qualcomm had about 52,000 employees on its payroll as of September, 2025, Apple exited its fiscal year 2025 with 166,000 full-time equivalent employees, whereas Arm had roughly 8,330 FTEs as of March 31, 2025. All of these companies have been hiring aggressively in recent years as they have benefited greatly from the increased demand for semiconductors amid the AI and cloud data centers expansions. This makes Intel one of a few semiconductor companies that have been aggressively reducing their headcount in 2024 – 2025.

It should be noted that comparing Intel to other companies in the industry is not exactly an apples-to-apples comparison. Intel is among a few remaining integrated design manufacturers (IDMs) and is the only IDM that still produces chips on a leading-edge process technology in-house. By contrast, TSMC is the world's largest contract chipmaker that certainly runs more fabs and packaging facilities than Intel at this point, so the number of its employees shows how vast its manufacturing operations are. Yet, TSMC does not develop its own products. AMD, Apple, Nvidia, and Qualcomm develop very competitive products, but they do not conduct any in-house manufacturing, so they do not have appropriate personnel.

One may argue that Intel employs way too many people in terms of such metrics as revenue per employee. That being said, Intel maintains and operates multiple fabs and packaging facilities across the world (something none of its direct rivals do these days, except TSMC); it has vast R&D operation as it develops process technologies (again, only TSMC does it among its rivals), it designs multiple products, and it also happens to develop technologies that become industry standards. Although Nvidia designs vertically integrated data center platforms, whereas AMD tends to adhere to industry standards, Intel does plenty of fundamental work behind things like DDR, PCIe, USB, and Thunderbolt, just to mention a few technologies.

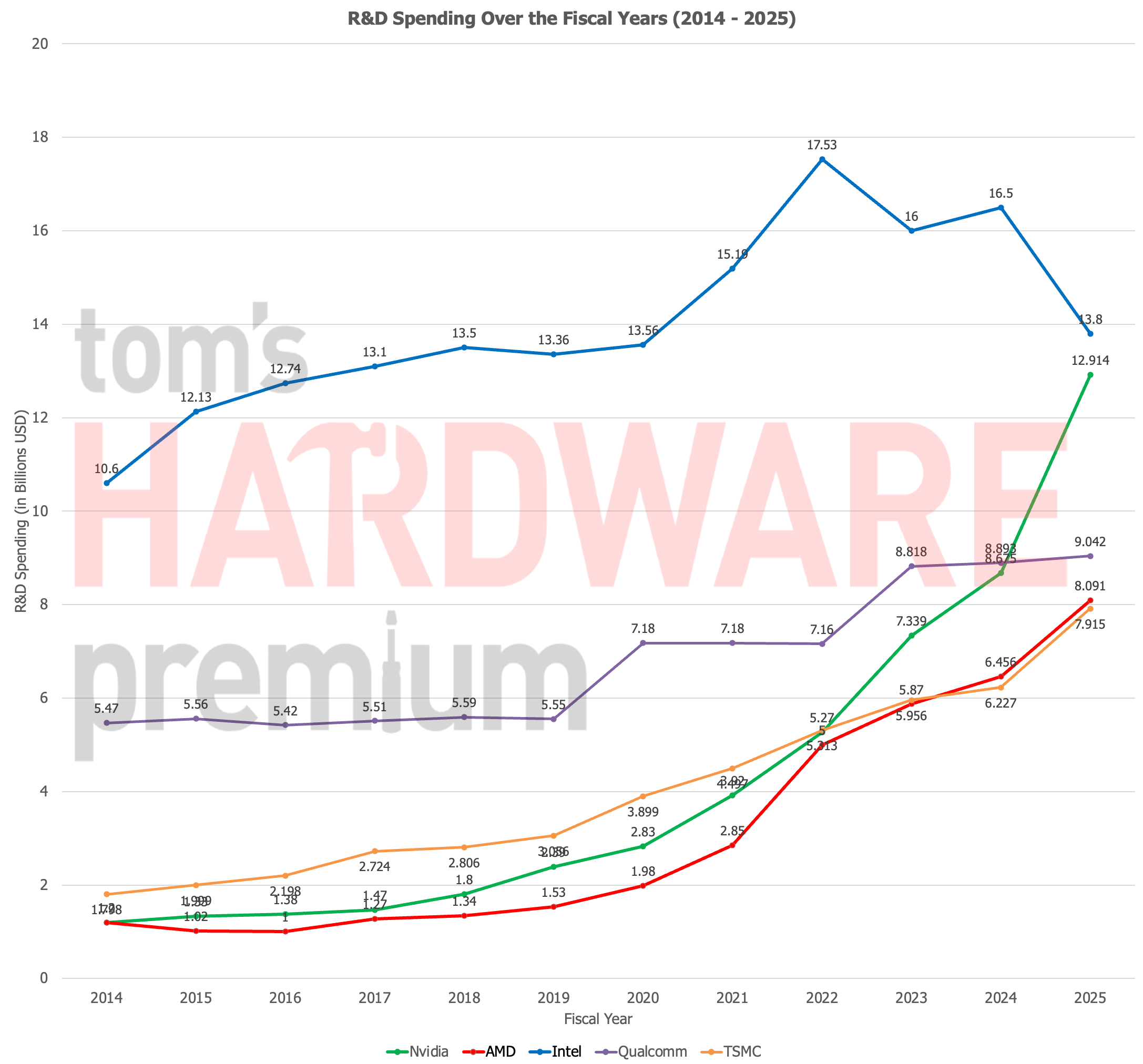

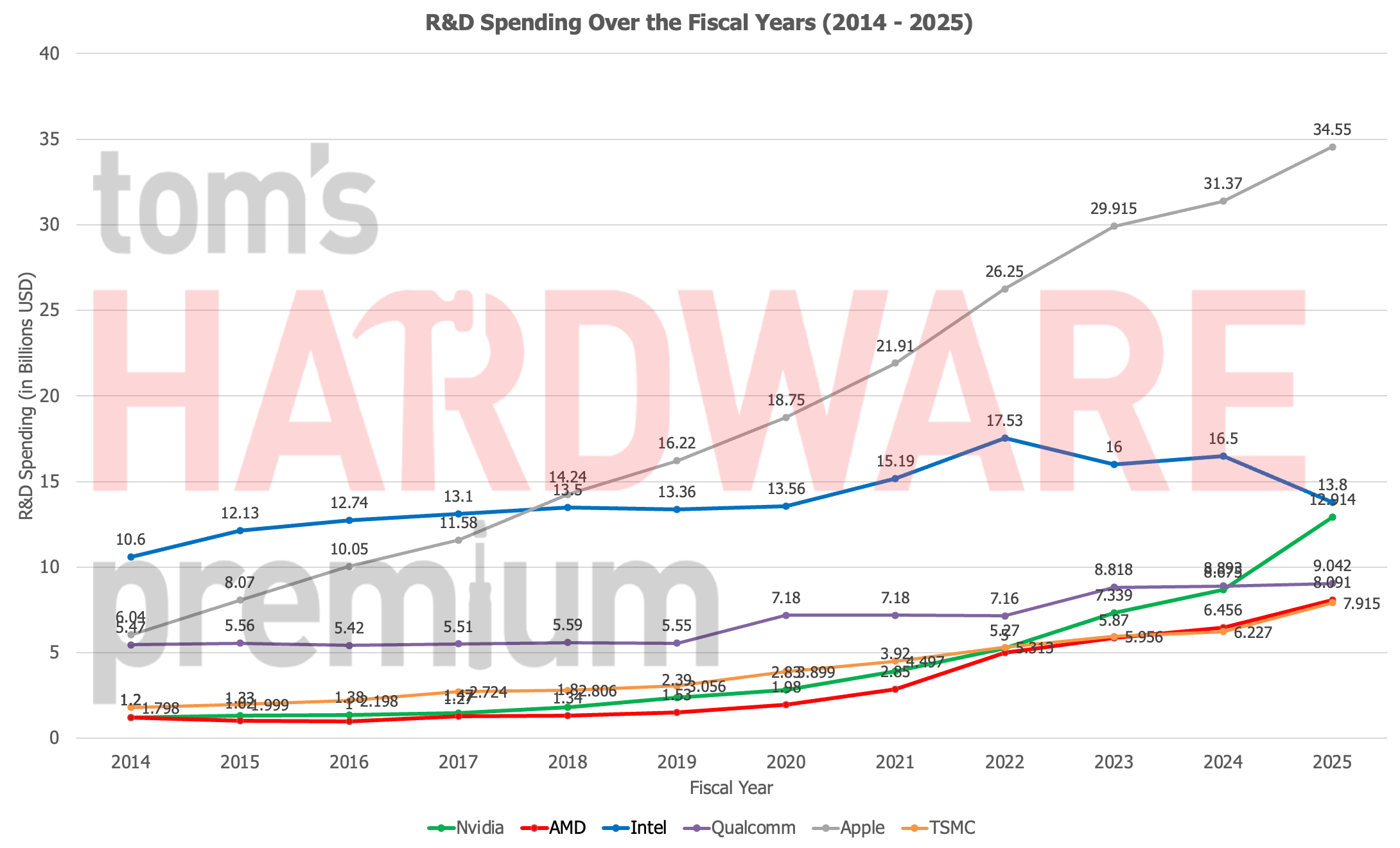

Intel still spends more than AMD and TSMC on R&D

Intel's spending on research and development (R&D) illustrates how many projects the company handles at once, both on the foundry and on the products side. Even after a sharp cut of R&D expenses in fiscal 2025, Intel spent $13.8 billion on R&D, which is more than AMD, TSMC, Qualcomm, or TSMC did. Nvidia yet has to report its FY2026 results — which roughly correspond to calendar 2025 — and while it will likely leave Intel behind, this will be the first time ever. Of course, the company has been outspent by Apple since 2018, but Apple spends a lot on development of actual products, so this is again not an apples-to-apples comparison.

For obvious reasons, after cutting approximately 40 thousand positions in two years, it is hard to expect Intel to keep R&D investments at its 2025 level. Along with people, dozens of projects have either been shut down or merged with others, so the company's R&D expenses will be reduced further in 2026. At this point, we can only wonder whether Intel's R&D budget for this year will match that of AMD and TSMC, or will still remain ahead of both companies.

To some degree, R&D spending is a good benchmark that shows the financial health of the company. However, it also gives an idea of where the company is going in the next three to five years. In Intel's case, it must spend on the development of products that will be competitive with those from AMD, Nvidia, and Qualcomm in the latter half of the decade and early next decade. It must also spend on next-generation process technologies to stay competitive with TSMC.

Therefore, in the best-case scenario, Intel must spend more than AMD, Nvidia, Qualcomm, and TSMC combined — like it used to do in 2014 – 2019 — to stay ahead of everyone. However, given the current situation (after Intel exited 5G, modem, 3D NAND, Optane, servers, and many other businesses), the company's R&D budget must be comparable to the combined R&D spending by AMD and TSMC, its two key rivals in the products and foundry realms. If Intel cannot properly fund R&D for its products and semiconductor production operations, it only remains to be seen whether the company retains its relevancy in the late 2020s and the early 2030s.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.