AMD vs. Intel CPU Market Share Q4 2019: EPYC and Desktop CPU Growth Decelerates, Mobile Ryzen Roars

Chip, Chip, Chippin' away

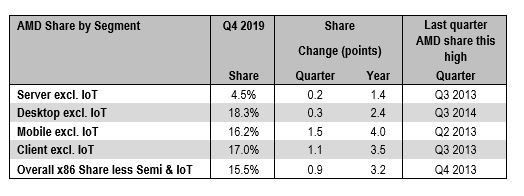

Mercury Research, the premiere CPU market share analyst firm used by the likes of AMD and Intel, released its fourth quarter 2019 market share numbers today, highlighting the ninth consecutive quarter of share gains for AMD across the desktop, mobile, and data center lineups.

However, quarterly unit share gains were surprisingly muted for both the desktop and the data center segments. Meanwhile, the company made strong progress in the mobility market, which is an encouraging sign given that laptops comprise roughly two-thirds of the consumer silicon market, and has reached its highest quarterly desktop PC unit share level since 2014. It also set high watermarks for the other segments that it hasn't seen since 2013.

Let's take a closer look at the numbers for each segment, and we'll include AMD's statements in the relevant areas. We also added analysis from Dean McCarron of Mercury Research.

AMD Desktop Market Unit Share

| Row 0 - Cell 0 | 3Q16 | 4Q16 | 1Q17 | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | 3Q18 | 4Q18 | 1Q2019 | 2Q19 | 3Q19 | 4Q19 |

| AMD Desktop Unit Share | 9.1% | 9.9% | 11.4% | 11.1% | 10.9% | 12.0% | 12.2% | 12.3% | 13% | 15.8% | 17.1% | 17.1% | 18% | 18.3% |

| Quarter over Quarter (QoQ) pp | Row 2 - Cell 1 | +0.8 | +1.5 | -0.3 | -0.2 | +1.1 | +0.2 | +0.1 | +0.7 | +2.8 | +1.3 | Flat | +0.9 | +0.3 |

| Year over Year (YoY) pp | Row 3 - Cell 1 | Row 3 - Cell 2 | Row 3 - Cell 3 | Row 3 - Cell 4 | +1.8 | +2.1 | +0.8 | +1.2 | +2.1 | +3.8 | +4.9 | +4.8 | +5 | +2.4 |

Notably, all of the following numbers exclude the IoT and semi-custom segments.

"Desktop CPUs were up due to strong high-end gaming CPU demand, and also because Intel improved entry-level CPU supply during the quarter. AMD had very strong growth in the "Matisse" core Ryzen 3000 series, and in addition to the improved entry-level supply Intel had strong growth in i9. Much of the growth for both AMD and Intel happened at the very very top of the market for CPUs with the highest core counts," said Dean McCarron of Mercury Research.

AMD now has 18.3% unit share of the desktop CPU market. The company gained 0.3 percentage points compared to last quarter, which is softer than expected given that the company launched its 3000-series products for both the mainstream and HEDT segments in time for the holiday shopping season. Notably, the fourth quarter has comprised AMD's strongest growth during each of the prior three years, but wasn't as robust in 2019 as the third quarter.

AMD dominated Intel in Amazon's most popular CPU rankings during Black Friday and Cyber Monday, often occupying the top ten spots. However, this reminds us that the retail market is much smaller than the OEM/SI segment where Intel has historically ruled the roost. Volume sales to this segment are comparatively much larger than retail, and according to our conversations with several motherboard vendors at CES 2020, Intel still maintains its leadership in the OEM/SI segment. According to those vendors, Intel's sales are particularly dominant with office and government buyers that remain 'spec'd in" for Intel systems, meaning purchasing Intel systems helps them avoid paying for expensive re-validation programs. The ongoing Windows 7 refresh also likely plays in to Intel's advantage in the quarter.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

It's also hard to tell if AMD's sporadic shortages came into play during this period, and we've also seen large price cuts at retailers for the mid-range high-volume Ryzen models over the last month.

AMD is still making progress: The company's desktop unit share jumped 2.4 percentage points on the year. AMD also had a flat quarter last year, but growth resumed soon thereafter, meaning there could be some seasonality involved. However, in the past, AMD's jumps in the holiday season have traditionally been much higher.

AMD's revenue on the Computing and Graphics side of the business, which encompasses both Ryzen and Radeon products, grew 69% on the year to $4.7 billion, and 30% over the prior quarter to $1.66 billion. That means the muted gain in unit share is blunted somewhat by higher average selling prices as AMD transitions to more profitable 7nm products. Comparatively, Intel generated $10 billion in revenue for its consumer CPUs last quarter.

Here is AMD's comment on the matter, but we have followed up for further details:

"Thanks to the strength of powerful new processors launched in Q4, like the Ryzen 9 3950X and the 3rd generation Threadripper family, desktop, excluding IoT, also increased, with AMD share moving up 0.3 share points quarter over quarter, and 2.4 share points year over year, hitting 18.3%."

AMD Server Unit Market Share

AMD bases its server share projections on IDC's forecasts but only accounts for the single- and dual-socket market, which eliminates four-socket (and beyond) servers, networking infrastructure and Xeon D's (edge). As such, Mercury's numbers differ from the numbers cited by AMD, which predict a higher market share. Here is AMD's comment on the matter: "Mercury Research captures all x86 server class processors in their server unit estimate, regardless of device (server, network or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] provided by IDC only includes traditional servers."

| Row 0 - Cell 0 | 4Q17 | 2Q18 | 3Q18 | 4Q18 | 1Q2019 | 2Q19 | 3Q19 | 4Q19 |

| AMD Server Unit Share | 0.8% | 1.4% | 1.6% | 3.2% | 2.9% | 3.4% | 4.3% | 4.5% |

| Quarter over Quarter / Year over Year (pp) | Row 2 - Cell 1 | Row 2 - Cell 2 | +0.2 / - | +1.6 / 2.4 | -0.3 / - | +0.5 / +2.0 | +0.9 / +2.7 | +0.2 / +1.4 |

AMD's gains in the server market amount to 0.2 percentage points quarter-over-quarter and 1.4 percentage points year-over-year. That gain in share amounts to 4.5% of the server unit share.

These growth numbers are also somewhat below our expectations, particularly given AMD's projections for double-digit server market share in the third quarter of 2020. AMD's recent financials foretold less-than-explosive growth for the data center as the company reported soft performance in the Enterprise, Embedded and Semi-Custom (EESC) business that produces both EPYC processors and chips for consoles.

Citing weak console sales partially offset by increased EPYC sales, the EESC group generated $465 million for the quarter (down 11% quarter-over-quarter). The group generated $2 billion during 2019, down 14%. Comparatively, Intel's data center group generated $7.2 billion during the fourth quarter alone, underlining the size of the addressable market.

AMD chalked up the lowered revenue to depressed console volume as Microsoft and Sony ramp up for next-gen consoles, but AMD's unified reporting of both the semi-custom and data center segments makes it hard to gain clear visibility into the company's data center business without these types of third-party reports.

In either case, AMD CEO Lisa Su said that server revenue grew by "double-digit" percentages during the last quarter due to increased EPYC Rome demand and higher ASPs. Given that Intel's data center revenue was also up during the quarter, the expanding market may benefit both companies in terms of revenue, so AMD's forward progress could be muted by Intel's strong sales.

Here's AMD's comment on the market share report, but we have followed up for further detail:

"The ramp of 2nd generation EPYC processors, launched mid-2019, has been significantly faster than 1st generation, thanks to performance and TCO advantages over the competition. This in turn has helped drive share gains for AMD server, excluding IoT, of 0.2 share points quarter over quarter, and 1.4 share points year over year, hitting 4.5%."

AMD Mobile Unit Share

| Row 0 - Cell 0 | 2Q18 | 3Q18 | 4Q18 | 1Q2019 | 2Q19 | 3Q19 | Q419 |

| AMD Mobile Unit Share | 8.8% | 10.9% | 12.2% | 13.1% | 14.1% | 14.7% | 16.2% |

| Quarter over Quarter / Year over Year (pp) | Row 2 - Cell 1 | Row 2 - Cell 2 | Row 2 - Cell 3 | +0.9 / ? | +1.0 / +5.3 | +0.7 / +3.8 | +1.5 / +4.0 |

Although supply is improving, Intel continues to be plagued by shortages on the low end. It's important to remember that mobile comprises roughly 2/3 of the client market, so success here is key.

AMD is making solid progress in this segment with a gain of 1.5 percentage points for the quarter, its highest quarterly jump of 2019. The 16.2% of unit share also represents a healthy 4 pp gain year-over-year.

These gains are impressive given that AMD's Ryzen 4000 Mobile processors are still working their way to market, and the increased performance and power efficiency granted by the combination of the 7nm process and Zen 2 execution cores could touch off a faster rate of growth for AMD in this segment.

Early indications are that the 4000-Series Mobile chips address some of the relatively poor battery performance results with AMD-powered laptops, like the recent Microsoft Surface Laptop 3. That should help the company increase its share in the upper echelons of the laptop market. Intel is bringing its Tiger Lake platform to bear soon and ties the chips into a platform play with its forthcoming Xe graphics, so we expect increased competition throughout 2020.

"The mobile market was weaker, but saw growth at the top like desktop CPUs. Gaming was big for notebooks as well," said McCarron.

AMD Total Unit Market Share

| Row 0 - Cell 0 | 3Q19 | 3Q PP Change QoQ / YoY | 4Q19 | 4Q PP Change QoQ / YoY |

| AMD Client | 15.8% | +0.8 / +4.2 | 17.0% | +1.1 / +3.5 |

| AMD Overall x86 | 14.6% | +0.7 / +4 | 15.5% | +0.9 / +3.2 |

AMD now has 17.0% of the x86 client market, and 15.5% of the overall x86 market. That's a year-over-year increase of 3.5 and 3.2 percentage points, respectively, and represents a strong overall trend for the company. In the past, AMD has cited increased profitability (~50%) from its 7nm-based products, so the company will excel on the revenue front as its 7nm mix increases.

| Row 0 - Cell 0 | 2Q18 | 3Q18 | 1Q2019 | 2Q19 | 3Q19 | 4Q19 |

| AMD Total Unit Share | 15.6% | 15.7% | 15.6% | 17.1% | 16% | 14.2% |

| Quarter over Quarter / Year over Year (pp) | Row 2 - Cell 1 | Row 2 - Cell 2 | Row 2 - Cell 3 | +1.5 / + 1.5 | -1.7% / +0.3% | -0.9 / +0.9 |

"AMD gained share in server and client segments. In the non-reported IoT/Semicustom segment, declines in AMD's console business resulted in AMD's overall units going down. This resulted in Intel gaining share in the total CPU market for the quarter. This also explains why AMD's annual share gain is smaller than the on-year gains in the segments," said McCarron.

AMD now holds 14.2% of the entire x86 market share, a quarterly decline of 0.9 percentage points, but a year-on-year gain of 0.9 pp.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

digitalgriffin If you think about it, desktop saturation is almost a given. I think the rough estimates say that AMD's production capabilities are only 1/5th that of Intels. And 1/5th of Intels is ~20%...Guess where they are sitting? Yes, they are pretty darn close to that.Reply

AMD doesn't get huge revenue growth (50%) by sitting on unsold product. They are selling out most of what they have.

For AMD's long term growth however, laptop & server markets become crucial. I'm happy to see the laptop market take off because business laptop lease renewals for new laptops is a steady income.

However, I'm worried about the lack luster server growth. This is where the big money is. I know validation takes a long time, but EPYC Rome should be selling like hotcakes given the low entry point / core and TCO. -

twotwotwo So AMD's opportunities this year seem like 1) better mobile parts to take advantage of the shortages there (and maybe steal a little market share), 2) maybe muscling into the mid-to-high-end GPU market a bit more, and 3) semi-custom, though that's lower-margin.Reply

The most plausible extreme possibilities seem to mostly depend on Intel. If Intel can't make 10nm server parts in large quantities or at high core counts, for example, maybe AMD sees good server growth. If things start clicking for Intel product-wise, and Intel chooses to cut prices a ton rather than continue to bet on their (amazing) inertia, that's harsher.

Longer term it seems like AMD CPUs stay competitive for at least the next couple gens (Zen 4 this year, 5nm shrink after that); to be seen if that actually wears away Intel's ecosystem advantage much.

Also: software seems like a real advantage for their competitors (CUDA, MKL, ICC). Dunno what the software analogue is of hiring Jim Keller for a few years, but I'd love to see it. Given AMD's position they could benefit from making their GPUs' compute units, and the cores and vector capabilities on their CPUs, usable for mere mortal programmers, as huge an effort as it is. -

JayNor Intel didn't make any 10nm server parts in q4, yet their server revenues were up 19%.Reply

Some leaks about Cascade Lake refresh coming. Cooper Lake is also coming in 1H. Both are 14nm. Cooper Lake will have Barlow Pass Optane support, more memory channels, faster memory, bfloat16 support in avx512.

Intel also talking about Snow Ridge 5G infrastructure chips coming in 1H. Those are 10nm. Also, the 10nm Agilex FPGAs are shipping. 10nm Tiger Lake laptop chips are shipping to OEMs in the summer.

I don't think they have fab capacity to start any kind of huge 10nm Ice Lake Server shipments, but Intel says those chips are coming in q4. Maybe that's when the capacity expansion kicks in. -

donner ReplyJayNor said:Intel didn't make any 10nm server parts in q4, yet their server revenues were up 19%.

When the patches for Intel security flaws reduce performance and it takes many months to qualify new servers. The only option a data center has is to buy more of the same Intel servers to get back up to full compute capacity. -

GoatGuy Replydigitalgriffin said:If you think about it, desktop saturation is almost a given. I think the rough estimates say that AMD's production capabilities are only ⅕th that of Intels. And ⅕th of Intels is about 20%…Guess where they are sitting? Yes, they are pretty darn close to that.

Hmmm… if AMD's output is ⅕ Intel's, then Intel's is ⁵⁄₅. Which means AMD's potential market share is ⅕ / ( ⅕ ⊕ ⁵⁄₅ ) → (⅕ ÷ ⁶⁄₅) → ⅙ → ≈ 17%

Even closer to actual figures!

⋅-⋅-⋅ Just saying, ⋅-⋅-⋅<br>⋅-=≡ <b>Goat</b>Guy ✓ ≡=-⋅<br> -

800Volts Replydigitalgriffin said:However, I'm worried about the lack luster server growth. This is where the big money is. I know validation takes a long time, but EPYC Rome should be selling like hotcakes given the low entry point / core and TCO.

The problem is, AMD combines server with customer silicon (read Xbox / Play Station).

The consoles crashed harder than anyone imagined, and EPYC saved the day is my hypothesis. Hopefully, they seperate out the business lines for reporting.. until then.... -

800Volts Replytwotwotwo said:Also: software seems like a real advantage for their competitors (CUDA, MKL, ICC). Dunno what the software analogue is of hiring Jim Keller for a few years, but I'd love to see it. Given AMD's position they could benefit from making their GPUs' compute units, and the cores and vector capabilities on their CPUs, usable for mere mortal programmers, as huge an effort as it is.

Chicken or Egg, my guess is Intel has more software engineers than AMD employees. It's what market leadership margins buy you, same with NVIDIA. -

Rdslw Reply

I know that servers ARE very very high inertia systems. If it works, no touching. And unless it solves other problem it will stay as it is. only netflix did instantly catch the wind of the gains because they had constant problems of bandwith and epic did magically almost tripled it for them.digitalgriffin said:However, I'm worried about the lack luster server growth. This is where the big money is. I know validation takes a long time, but EPYC Rome should be selling like hotcakes given the low entry point / core and TCO.

but for now half of the companies have EPIC in backlog for "review", few execute tests if their crapware wont explode.... it takes a while. -

Olle P Reply

Epyc CPUs are essentially "flying off the shelves" which is the reason Threadripper is so hard to find in stock.digitalgriffin said:AMD doesn't get huge revenue growth (50%) by sitting on unsold product. They are selling out most of what they have. ...

... However, I'm worried about the lack luster server growth.

AMD sell all Epyc they can produce, and the demand is going up.

The (server market) situation is actually perfect for AMD, with huge deliveries going to a few (new) facilities at for example Amazon and Google while AMD build up the broader support organisation required to handle a larger amount of customers a few years from now.

Yup. The transition process has begun and demand for CPUs will come.Rdslw said:... half of the companies have EPIC in backlog for "review", ... it takes a while. -

cryoburner Reply

Nvidia and AMD have a roughly similar number of employees, though with AMD covering a wider range of products, they undoubtedly have fewer working in their graphics division. Intel, of course, has somewhere around 10 times the employees of either company.800Volts said:Chicken or Egg, my guess is Intel has more software engineers than AMD employees. It's what market leadership margins buy you, same with NVIDIA.