Intel says it has two prospective customers for 14A — expects to hear about commitments in second half of 2026

Intel still has zero committed external customers for 14A.

Two potential customers are currently exploring their test chips made on Intel's 14A fabrication process, Intel disclosed as part of its earnings call this week. The company said that there will be different variants of 14A, but Intel had to admit that it does not have any external customers that have committed to using the new manufacturing technology. Yet, the good news is that so far, the response from potential customers to its 14A process development kit (PDK) has been positive.

14A test chips at customers' hands, commitments in H2

"A couple of customers we are already engaging about the PDK version 0.5, they are [also] looking at the test chip [and] more importantly, a specific product they are going to run [at] our foundry and that one we are working with them," said Lip-Bu Tan, chief executive of Intel. "Engagements with potential external customers on Intel 14A are active, and we believe customers will begin to make firm supplier decisions starting in the second half of this year, and extending into the first half of 2027."

For now, Intel has no commitments from external customers to use 14A, which is why it is not investing in 14A capacity for third-party clients as part of its broad policy of keeping costs at a minimum. But the company's CEO seems optimistic as he expects some of the potential external customers to commit to using the fabrication process in the second half of the year. Once they do, they will be able to ramp up production of their designs sometime in 2028.

"We think that in the second half of this year, they are going to indicate to us what kind of capacity, firm commitment, so that we can deploy the capacity, CapEx, to really build that [capacity they need]," said Lip-Bu Tan. "I think it is a service business. We already give the trust and the consistency we are able to deliver."

14A PDK 0.5 on track for Q1

While alpha customers tend to build test chips using very early versions of PDK (which seems to be the case with 14A), typically in the foundry industry, chip designers start to develop test chips using PDK version 0.5, so it is crucial for contract chipmakers to release this one rather sooner than later. Intel revealed that it is on track to offer 14A PDK version 0.5 later this quarter and that so far the response to prior versions of the kit have been positive.

"Intel 14A development remains on track and we have taken meaningful steps to simplify our process flow and improve our rate of performance and yield improvement," Tan added. "We are developing a comprehensive IP portfolio on Intel 14A, and we continue to improve our design enablement approach. Importantly, our PDKs are now viewed by customers as industry standard."

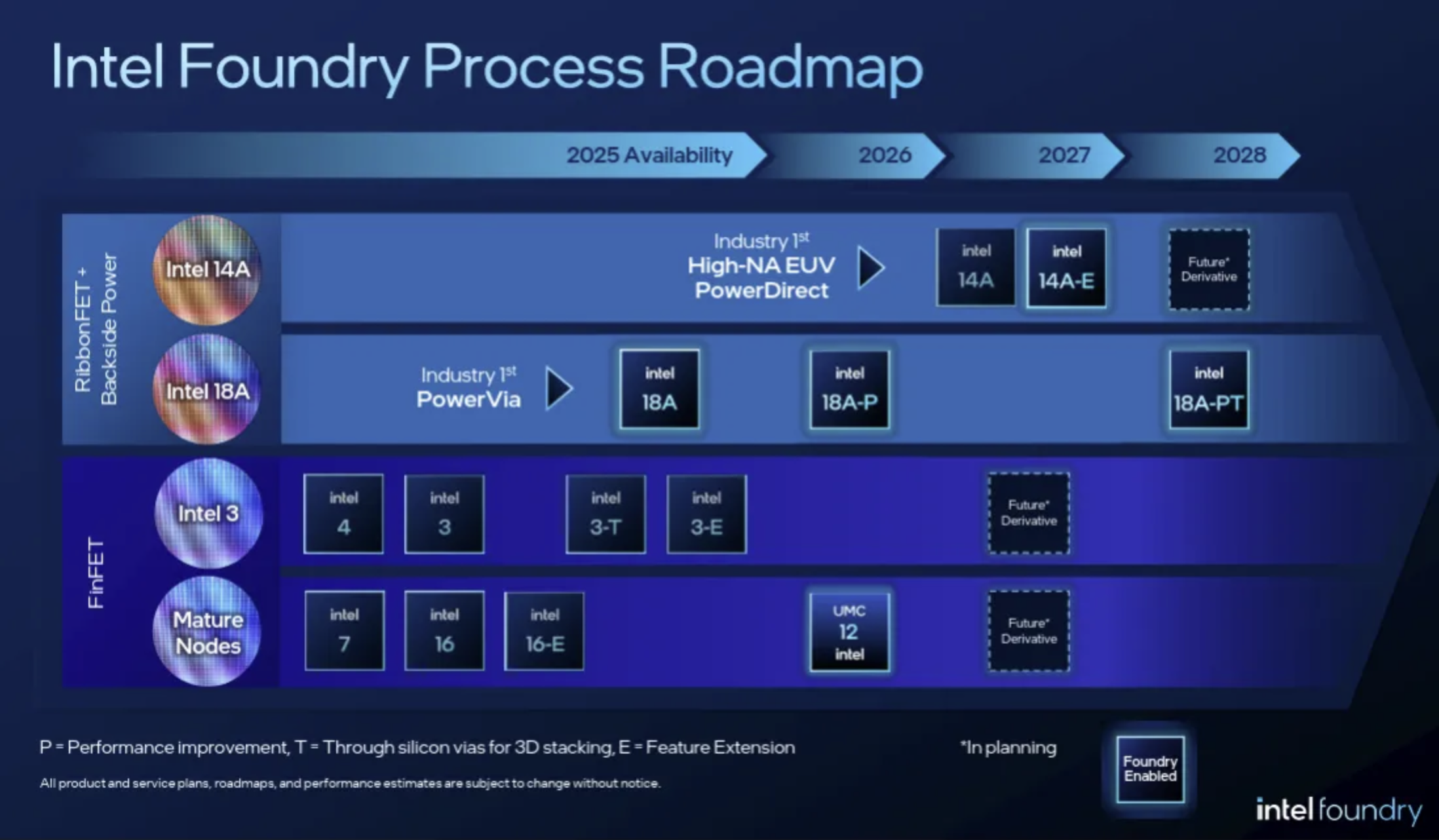

Different versions of 14A

In addition to offering early versions of its PDK to its own product design groups and to select potential external customers, Intel seems to be developing different variants of 14A for different applications, which proves that the company is developing the fabrication process with different customers in mind.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"Of course, there will be different variants of 14A, but High-NA is targeted [for insertion into] 14A [flow]," said David Zinsner, chief financial officer of Intel, when asked whether the company plans to use ASML's Twinscan EXE High-NA lithography tools for making chips on 14A.

Zinsner did not elaborate on the difference between different versions of 14A process technology and whether he meant 14A-E (a feature extended intra-node update) as a version of 14A, or if he meant something else, possibly aimed at different applications than the original 14A. For example, a version of 14A aimed at smartphones could come without a backside power delivery network, which would cut costs. Also, for applications that do not need the maximum transistor density, Intel could skip the usage of ASML's ultra-expensive Twinscan EXE High-NA lithography scanner, which costs around $400 million, to cut costs further. However, this is speculation.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Gururu It's all coming down to price I am sure. Doing stuff in the U.S.A is almost not feasible.Reply