PC hobbyist charged $684 in tariffs on $355 shipment of parts due to classification defaults as low-value import exemptions vanish - de minimis exemption expiration poses big problems for the holiday season

After U.S. customs rules were tightened, hardware buyers are seeing inflated bills.

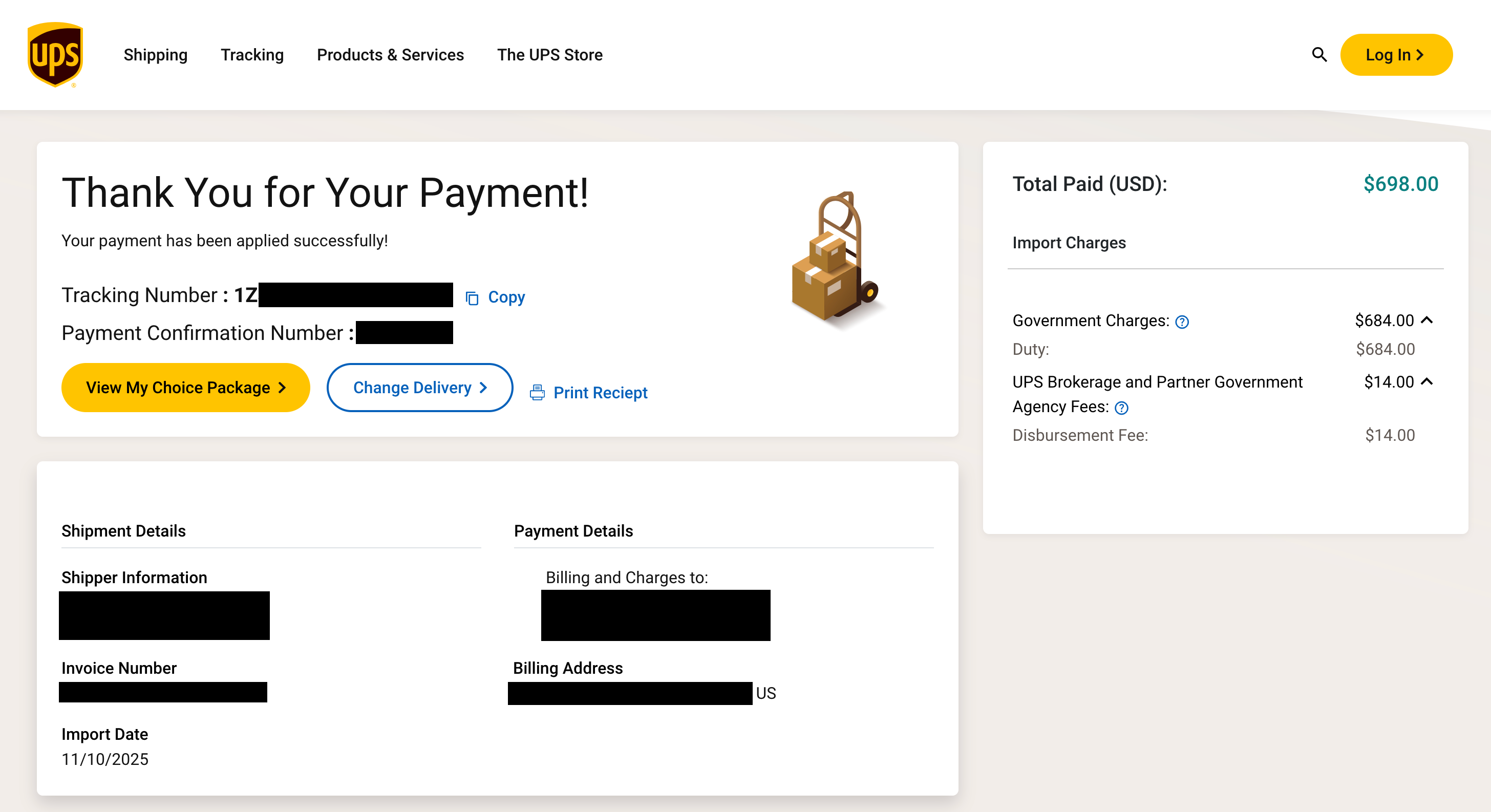

A PC hobbyist says he was hit with a $684 tariff bill on a $355 shipment of retro computing parts, in what appears to be a growing pattern tied to changes in federal import rules. The case, described in a blog post published November 15 by the writer behind OldVCR, involved a vintage parts order from Germany. UPS, the courier, later reduced the charge after the recipient disputed the tariff classification.

The incident is one of a growing number surfacing online as couriers and customs authorities apply tighter scrutiny to low-value imports. Under rules implemented earlier this year and finalized in late August, the United States has begun phasing out the so-called de minimis exemption that allowed shipments valued under $800 to enter duty-free, even when tariffs otherwise applied. The change was designed to close loopholes used by bulk e-commerce sellers and now affects one-off tech imports from small retailers as well.

According to the U.S. Customs and Border Protection website, duty-free treatment no longer applies to many low-value imports beginning August 29, 2025, and express carriers are now required to provide full 10-digit Harmonized System (HS) codes and origin data. When that information is missing or incorrect, classification defaults can trigger disproportionately high duties.

In the OldVCR case, UPS reportedly invoiced based on a misclassification. The customer claims UPS assessed tariffs as if the order contained unrelated goods, resulting in a bill almost double the declared value. The charges were lowered after he escalated the issue, but only after receiving automated late notices and payment demands.

This isn’t the first time hobbyists have been stung by tariff changes. A Business Insider investigation in October detailed cases where hobbyists received duty invoices after delivery, in some cases accompanied by late fees or threats from collections agencies. One buyer told the publication he received a $1,400 tariff bill on a $550 computer kit shipped from overseas.

UPS documentation confirms that duties and clearance-related fees are not included in quoted shipping costs. Instead, these charges are added post-delivery based on customs filings, which are often generated using the shipper’s provided data. If that data is incomplete or vague — a feasibly common scenario with shipments of vintage components — misclassification becomes more likely.

Buyers importing retro parts or niche hardware are encouraged to request specific HS codes and verify origin declarations with the seller in advance. Once a shipment has cleared under the wrong category, correction becomes more difficult and expensive.

Edit 11/17/2025 2:35pm PT: Clarified title.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.

-

George³ I didn't even know that second-hand devices are taxed. Especially retro ones. They don't harm the market for new computers made in the US in any way.Reply -

gamerk316 Reply

Do you think the people who implemented the tariffs care? They want revenue, they got revenue.George³ said:I didn't even know that second-hand devices are taxed. Especially retro ones. They don't harm the market for new computers made in the US in any way. -

shady28 Correct title: Hobbyist fails to fill out paperwork correctly for electronics items shipped from overseas, gets hit with default tariff.Reply

...express carriers are now required to provide full 10-digit Harmonized System (HS) codes and origin data. When that information is missing or incorrect, classification defaults can trigger disproportionately high duties.

-

A Young Trick Named Jim Reply

THANK YOU. I came here to say this. I didn't vote for the dude but these blatant click bait titles putting lies into people's heads are out of control. I didn't know Tom's Hardware had an agenda but apparently they've been corrupted as well.Admin said:A PC hobbyist says he was hit with a $684 tariff bill on a $355 shipment of retro computing parts, in what appears to be a growing pattern tied to changes in federal import rules.

PC hobbyist charged $684 in tariffs on $355 shipment of parts as low-value import exemptions vanish - de minimis exemption expiration poses big pro... : Read more -

A Young Trick Named Jim Reply

Did you even read the article here? The guy importing the vintage parts incorrectly labeled them so he got charged with tariffs that didn't apply to his purchase.gamerk316 said:Do you think the people who implemented the tariffs care? They want revenue, they got revenue. -

ravewulf Replyshady28 said:Correct title: Hobbyist fails to fill out paperwork correctly for electronics items shipped from overseas, gets hit with default tariff.

The title is already accurate and doesn't need correcting. They wouldn't have had to pay any tariff prior to the changes because it was a low-value import. -

ravewulf ReplyA Young Trick Named Jim said:Did you even read the article here? The guy importing the vintage parts incorrectly labeled them so he got charged with tariffs that didn't apply to his purchase.

You missed the part where, prior to the changes, tariffs wouldn't have applied at all, regardless of how it was labeled, because it was a low-value item. -

booberry Reply

The guy importing the parts did not incorrectly label the contents, the seller did, and the tariff charge was not shown during checkout.A Young Trick Named Jim said:Did you even read the article here? The guy importing the vintage parts incorrectly labeled them so he got charged with tariffs that didn't apply to his purchase.

I doubt anybody would be very rosy if they bought a $300 computer part from Germany and received a sudden $600 collections bill later on.

Who even know about these tariff codes beforehand? This is new. Did you know about the codes beforehand and how to read them?

Now you have to ask the seller what the code is, make sure it's correct, and figure out how to estimate the tariffs because apparently those e-commerce sites don't do that for you even before you checkout.

It's added complexity thanks to tariffs. It's no wonder that some lawyers make their entire career about helping businesses understand complex tariff costs, ensure accurate charges, and process tariffs refunds should the tariffs be struck down or to fix an error.

If the trump tariffs are struck down, small business and large ones alike are entitled to a refund on the customs charges, but small businesses may not even be able to afford a lawyer to process the complex financial data and paperwork necessary to receive a refund. It's all about passing laws that ultimately hurt the individual or small business. The bigvbusinesses benefit because they can afford the lawyers and trouble and make it harder to afford replacement parts for an individual person.

Now hardware enthusiasts buying a used part for their hobby have to familiarize themselves with a complex new tax system. That's good 😊 -

pmendes Now he’s had a tiny taste of what it’s like living in Brazil, where almost nothing remotely sophisticated is made locally and the government greets every imported item as if it were a luxury yacht made of gold. Here, you pay 30–60% on everything — income, jobs, medicine, profit, you name it. The government is your permanent business partner, the kind that never takes losses, never lifts a finger, and still demands a cut of every single transaction.Reply -

SirStephenH The de minimis exemption never should have been ended. Like usual with this administration, they took a sledgehammer to a problem that requires a scalpel and everyone's caught up in the fallout.Reply