Washington's ambition for a 50/50 semiconductor deal with Taiwan is missing a key component — lack of a mature homegrown supply chain could be the missing link

Is Lutnick's plan just political hogwash?

Last week, U.S. Commerce Secretary Howard Lutnick attempted to urge Taiwan to agree to a 50% - 50% arrangement, under which chips used in devices for the American market would be produced equally in both countries. The ultimate plan of the current administration is to boost domestic semiconductor production to more than 40% by the end of President Donald Trump's current term.

As observed by officials in Taiwan and analysts, the proposal lacks a workable definition, overstates Taiwan's influence on supply constraints, overlooks the current state of the U.S. semiconductor industry, and ignores peculiarities of the global supply chain.

The proposal

Lutnick said in an interview that the U.S. government has held preliminary talks with Taipei about rebalancing chip output to ensure that half of America's consumption comes from domestic facilities. Even if successful, he acknowledged, the country would remain reliant on Taiwan but would gain the ability to act independently if a crisis arises. Lutnick links his proposal to Taiwan's security, suggesting that a stronger U.S. production base would enable America to safeguard the island more easily, as it would have the means to do so, and would not be dependent on chip supply from the country.

He rejects the idea that Taiwan's (or rather TSMC's) advanced logic dominance — the so-called Silicon Shield — inherently deters conflict. To a large degree, his remarks echo Trump's past claims that Taipei benefits from U.S. protection without adequate compensation.

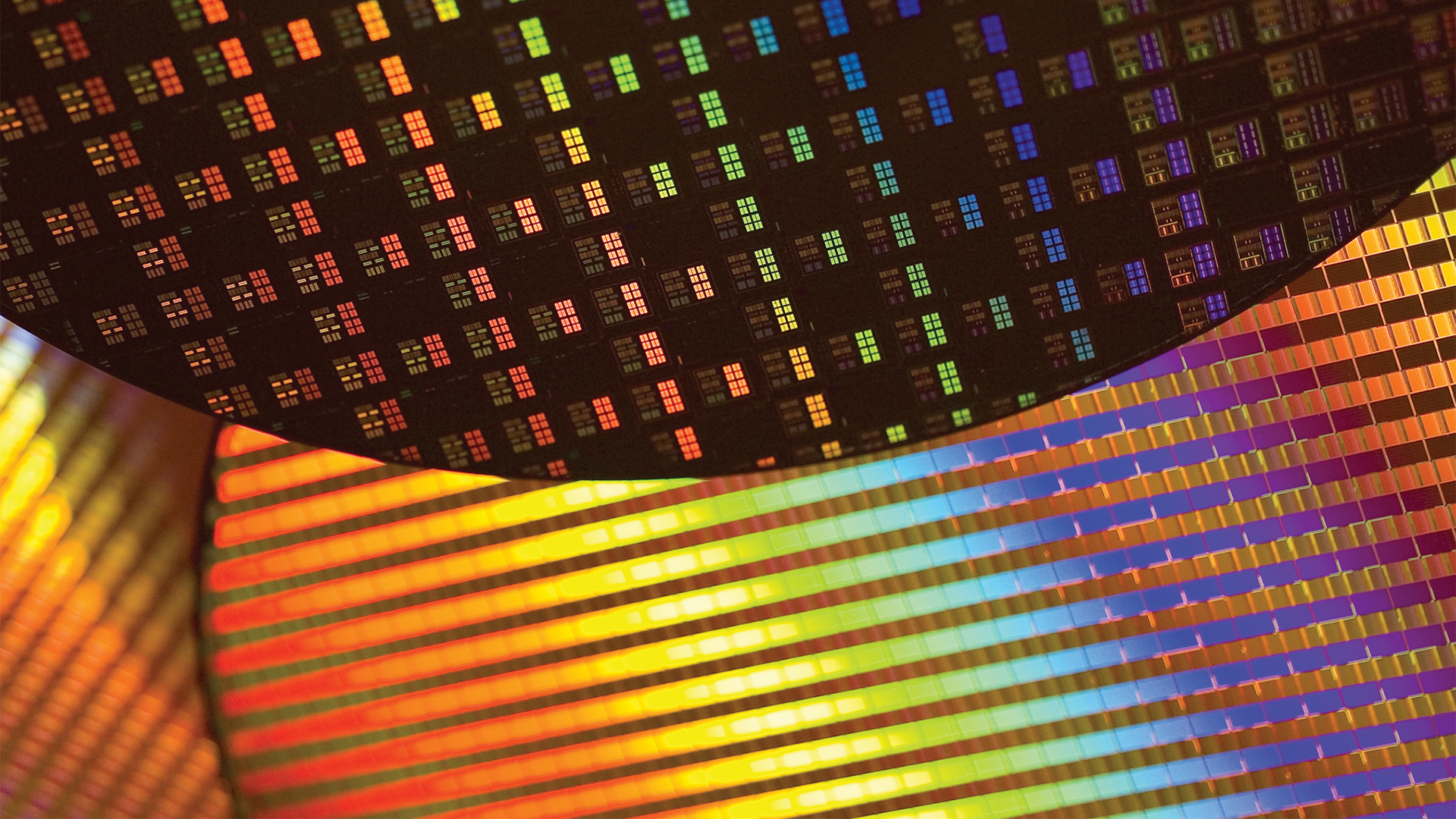

The Trump administration's stance stems from a long-standing concern: Taiwan manufactures more than 90% of the world's most advanced logic chips, which all happen to be developed in the U.S., which is a vulnerability for American companies like Apple, AMD, Broadcom, Intel, or Nvidia, given the island's proximity to China.

The current U.S. government believes that if the U.S. shares the manufacturing load, it can better defend Taiwan because critical components would not be trapped offshore. In addition, the U.S. Government also tied the cooperation to continued defense commitments. Furthermore, the administration has also paired this message with economic pressure. It proposed 100% tariffs on imported semiconductors but offered exemptions to companies investing in U.S. fabs, such as TSMC and Samsung, to encourage them to build capacities in the U.S. In all likelihood, the proposed 100% tariff would hurt smaller manufacturers.

American semiconductor industry today

Lutnick's '50% – 50%' idea focuses on geography instead of capacity. The real issue is not that too many chips are made in Taiwan: it is that the U.S. does not have enough advanced-node capacity or packaging infrastructure to meet its own demand, particularly to make chips equipped for techologies like 5G or AI.

The United States already manufactures a large number of chips domestically — Analog Devices, GlobalFoundries, Texas Instruments, SkyWater, and onsemi produce vast quantities of mature-node semiconductors used in cars, power systems, and industrial gear. These often represent the majority of chips in terms of unit count and revenue. Meanwhile, Intel produces plenty of advanced logic chips in the USA, whereas Samsung Foundry and TSMC aim to significantly expand their advanced fabs in America.

So, the U.S. already makes millions of chips, but lags in cutting-edge logic used in AI accelerators, CPUs, smartphones, and servers. Rebalancing the total chip production 50% – 50% is meaningless if the categories are mixed or not defined: the bottleneck lies in EUV-era logic and advanced packaging, not in chips produced on trailing nodes, which represent the lion's share of all chip supply.

"The '50% – 50%' lacks a workable definition, hindering substantive discussion," wrote Ming-Chi Kuo, an analyst with TF International Securities. "For example, does it refer only to advanced nodes, or also include mature nodes or advanced packaging? Does it apply to chips used domestically within the U.S., or those required by the U.S. government and companies? Without a clear definition, meaningful discussions cannot proceed. This also helps explain why Cheng Li-Chun, Taiwan’s Vice Premier of the Executive Yuan, said there have been no '50% – 50%' discussions with the U.S."

Taiwan views its cooperation with the United States as mutually beneficial, rather than delivering on a fixed quota. TSMC's management has expressed commitment to its U.S. sites but remains cautious about overextending resources abroad, highlighting that complex production chains cannot be duplicated overnight.

For years, the United States has been attempting to reclaim lost ground in leading-edge microelectronics. While Intel continues to produce its latest products on its most advanced nodes in America, its arch-rival AMD has long become a fabless semiconductor designer, and Nvidia has always been one. However, GlobalFoundries has ceased to develop leading-edge process technologies. As a result, Taiwan-based TSMC and UMC have gradually absorbed production of advanced chips, which were developed in the U.S., due to costs and logistical reasons. Since the majority of PCs and smartphones are assembled in Asia, it makes sense to make chips there as well.

Is 50% - 50% possible at all?

Lutnick's 50% - 50% proposal looks bold, but it remains aspirational because the gap between American and Taiwanese capabilities is vast. TSMC alone produces more advanced chips than the rest of the world combined. Catching up would require multiple new fabs, tens of thousands of advanced tools from Europe and the U.S., in addition to tens of thousands of skilled workers that the United States currently lacks.

Industry leaders have repeatedly warned that the U.S. labor pipeline for advanced manufacturing remains limited, which makes constructing news fabs longer and running them difficult.

TSMC's ongoing expansion in the United States already represents the largest foreign semiconductor investment in history. The plan includes six fabs for advanced nodes, two advanced packaging facilities, and one research center. The first facility in Arizona — Fab 21 phase 1 — started mass production in late 2024, while the second — Fab 21 phase 2 — was initially expected to use the N3 process by 2028, but has been accelerated to the second half of 2027 and upgraded to include N2 (and possibly A16) technology at the request of the U.S. government, according to Kuo.

The analyst expects the first three fabs to reach full utilization between 2028 and 2030. TSMC itself says that 30% of its N2/16 capacity will be located in the USA, whereas Kuo suggests that its U.S. output will account for roughly 10% to 15% of the foundry's global capacity by 2030, and once all six phases of Fab 21 are operational around 2032, the share could reach 25% to 30%. By some definitions, this level would already fulfil the intent of producing half of America's advanced-node demand domestically at TSMC's Fab 21 in Arizona alone, not to mention Intel's fabs in Arizona and Ohio as well as Samsung's fab in Texas.

Kuo argues that the real constraint on American self-reliance is not the willingness or unwillingness of chipmakers to invest in U.S. capacities, but the actual semiconductor industry ecosystem that supports chip manufacturing.

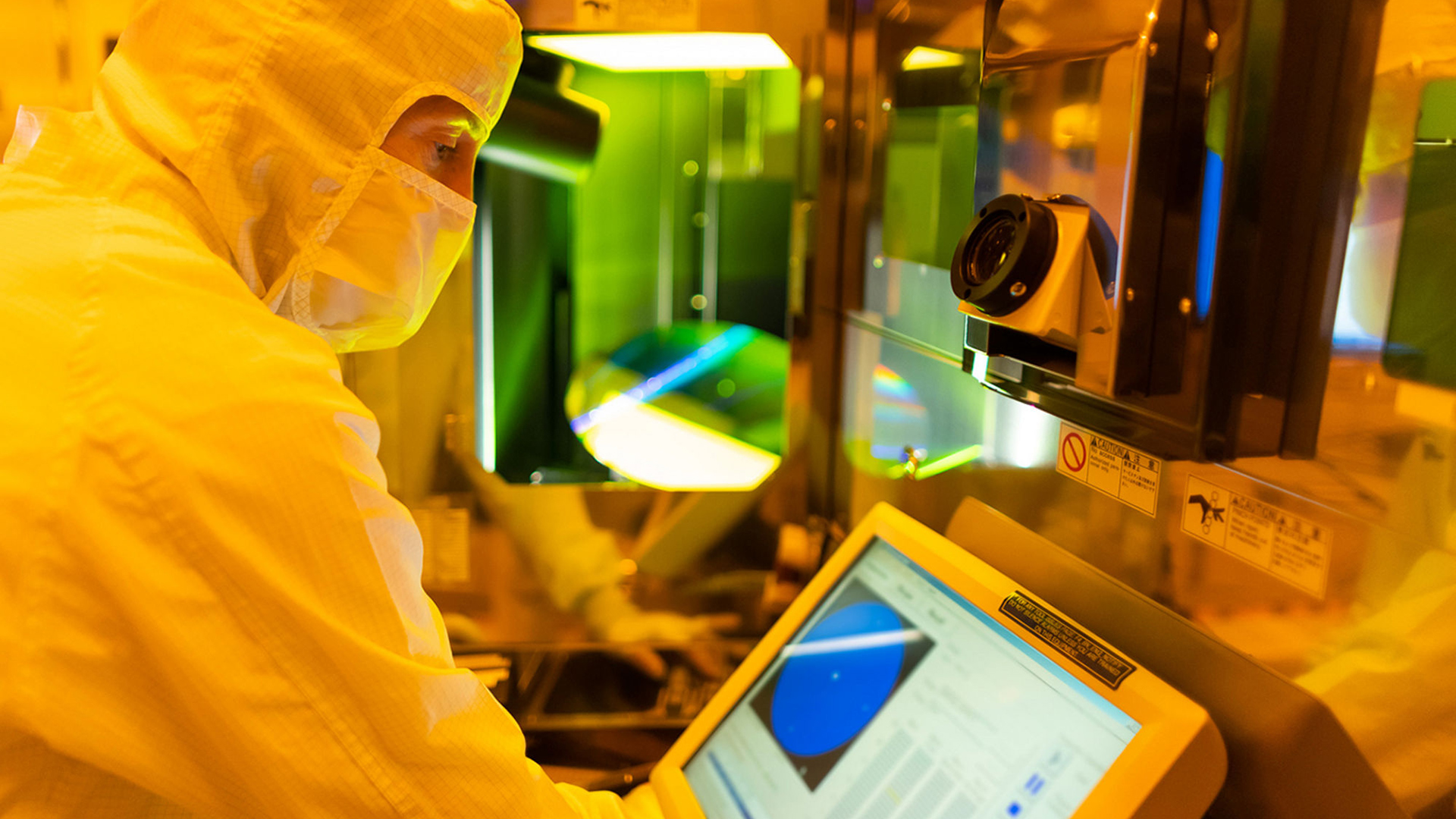

The upstream network supplying materials such as ultra-pure photoresists, underfills, and liquid monomer coatings is heavily concentrated in Japan. Companies like JSR, Namics, and Nagase currently ship to Arizona to support TSMC's Fab 21 phase 1, but as capacity grows, they would need to establish local production or logistics centers in America to avoid tariffs and add flexibility. Building such infrastructure will take years and may not be commercially attractive straight away, given the relatively small demand outside Asia as of today.

Neither Intel, nor TSMC, nor Samsung has been able to persuade JSR to build a photoresist or CMP factory outside of Japan, South Korea, Taiwan, or the U.S., where it serves plenty of customers.

However, if GlobalFoundries, Intel, Micron, Samsung, and TSMC build the necessary EUV-based capacity in the U.S., JSR may be more inclined to build its own plant on American soil. At the end of the day, the global photoresist market is expected to grow to $5.3 billion by 2028, and the U.S. may stand to represent a significant share.

This dependence on Japanese materials undercuts the assumption that relocating fabs automatically guarantees security. If geopolitical tensions were to disrupt East Asian trade routes, it is unclear whether Japanese firms could continue supplying chemicals to American customers. Thus, moving chip fabrication to the United States without parallel supply-chain localization would just shift vulnerabilities from one region to another.

The same applies to equipment vendors from Europe and the Netherlands, whose lithography tools remain irreplaceable. Semiconductor resilience depends on the entire global ecosystem: from raw materials to chipmaking equipment and packaging facilities, not just the geographical placement of wafer fabs.

Does it make financial sense?

Perhaps a fundamental question is whether it even makes sense to produce half of chips for the U.S. in America, considering the fact that they are more expensive than chips made in Asia.

From a cost standpoint, producing half of the chips used in the U.S. on domestic soil is inefficient. Even chips made on TSMC's proven N4/N4P/N5/N5P technologies in the U.S. are said to carry a 30% higher markup than the same chips produced in Taiwan, and while companies like AMD, Apple, and Nvidia can absorb that extra cost, not all companies are that rich.

Furthermore, Asian hubs benefit from dense industrial ecosystems that span from raw materials to fab tool suppliers, enabling fast maintenance and low logistics costs. New U.S. fabs must recreate that web from scratch, and their output will take years to match that of long-established facilities abroad.

Overall, end-users in America will have to pay more for chips produced in the U.S. The difference might seem small per component, but it scales significantly across industries. Everything that relies on silicon — cars, medical devices, PCs, smartphones — absorbs a fraction of the added cost, and becomes more expensive. The price inflation is something that remains to be seen, but ultimately, Americans will have to pay for the onshoring of semiconductor production.

Of course, the logic changes when viewed through the lens of security and resilience. The United States consumes roughly 25% - 33% of the world's semiconductor supply. But it manufactures only about 10% - 12%, and its leading-edge capacity is limited. Meanwhile, Taiwan alone accounts for approximately 90% of leading-edge logic output. Any disruption — whether from conflict, blockade, or earthquake — would affect everything from cloud infrastructure of AWS and Microsoft Azure, to defense electronics.

Truth be told, not many sensitive microelectronics are produced outside the U.S., but the economic harm caused by disruptions may be comparable to actual military harm. Therefore, the proposed '50% to 50%' plan may be considered an insurance policy that guarantees the U.S. and its allies' economic and military continuity, if Asian production faltered.

As a bonus, each fab attracts satellite suppliers, boosts local innovation, and rebuilds technical skills that generate far greater downstream value. However, though the immediate financial return looks weak, the long-term industrial payoff may be substantial. Making half of America's chips domestically may be inefficient, but strategically important.

Political symbolism

The implications of Lutnick's proposal extend beyond economics, defense, and supply chains. For the Trump administration, the political symbolism of semiconductor self-reliance is a big deal. Expanding domestic chip production aligns with his economic nationalism and industrial revival, and big announcements by Intel, Samsung, and TSMC enable the government to talk about tangible progress toward that goal.

The proposed total commitment of $165 billion from TSMC, and substantial plans from other chipmakers reinforce that narrative, even if many commitments were made when Joe Biden was in the White House, and full capacity remains years away.

Meanwhile, trade talks between Washington and Taipei continue, and future tariff structures for companies getting chips in Taiwan and supplying them to the U.S. will depend on those negotiations.

Achieving a balance in semiconductor supply will depend on tackling bottlenecks that span across regulators, workforce development, and supplier localization. TSMC's U.S. build-out is already advancing faster than expected, and by the early 2030s, American fabs could meet a significant portion of local demand.

However, transforming the global semiconductor supply chain into a model, equipped with multiple major vertically-integrated semiconductor manufacturing hubs, led by America and Taiwan, would require changes that are outside the U.S. government's control.

What's next?

True strategic autonomy for the U.S. will require more than just advanced logic fabs. For now, lithography systems are made in Europe, while sophisticated raw materials are supplied by Japanese companies, which have never disclosed plans to make them in Korea, Taiwan, or the U.S.

All advanced processors need memory, and only Micron plans to produce DRAM in the U.S. Even SK hynix, which plans to assemble HBM memory stacks in America, has no plans to build actual HBM DRAM dies in the country.

Without a vertically integrated semiconductor supply chain, which will take years to build, the strategic autonomy vision will remain a political talking point, rather than a practical path to semiconductor independence.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.