EPYC Pressure: Intel Discontinues Some Cascade Lake Xeon Models, Slashes Pricing on Others

In a sign of the increasing pressure on Intel's product stack from AMD's capable EPYC Rome processors, and perhaps slow uptake for Intel's Optane DC Persistent Memory DIMMs, today Intel issued a Product Change Notice (PCN) announcing that it has discontinued its "M" series Cascade Lake Xeon models.

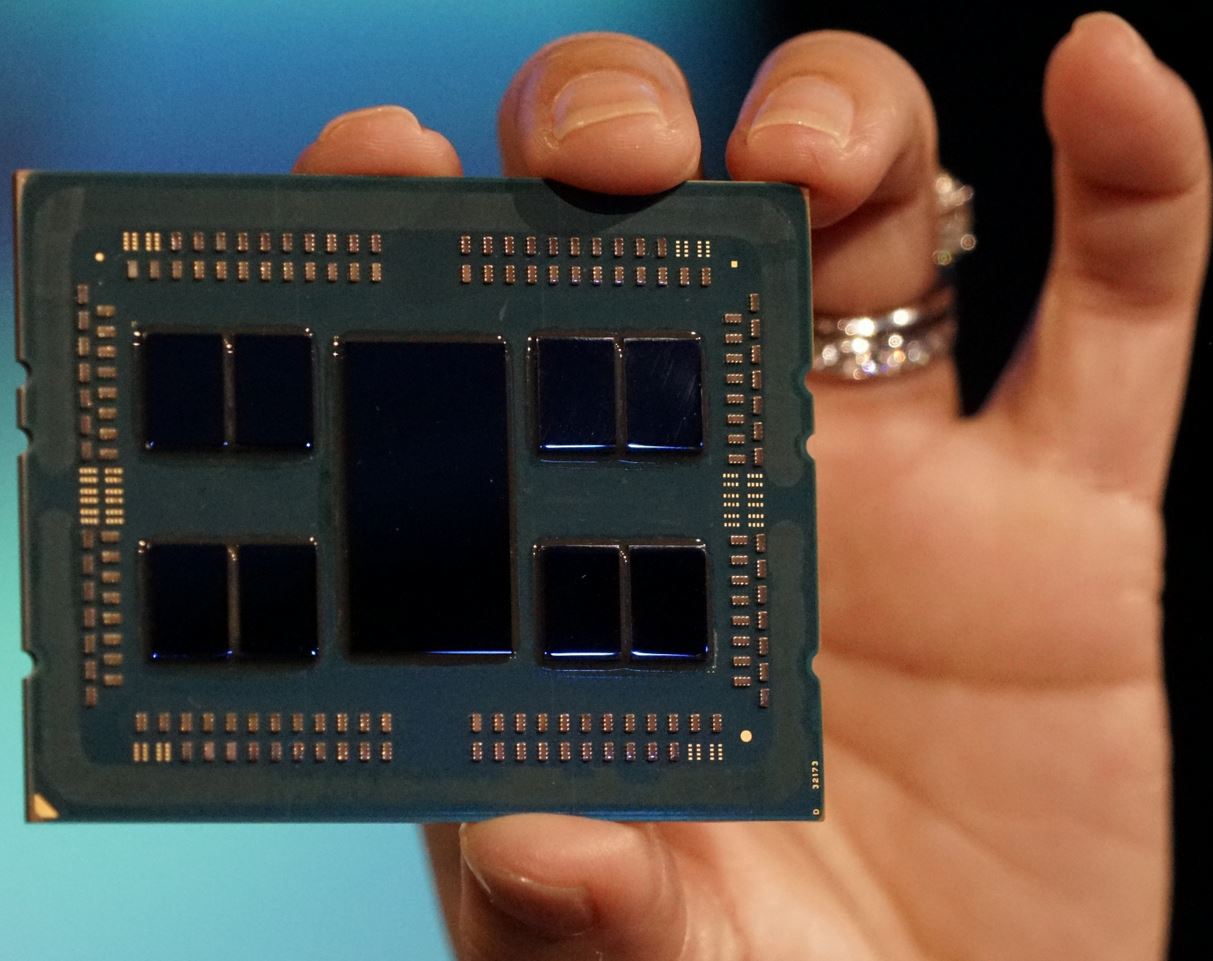

Intel built the M-series models from the same silicon as the standard Xeon processors, but they came with a hefty markup of $3,003 over the standard chips. In exchange, customers gained support for up to 2TB of memory capacity per chip, which is a sizeable increase over the 1TB of memory support on standard models. That still didn't match the maximum 4TB capacity of AMD's EPYC Rome processors, which comes free of charge.

An Intel representative told Tom's Hardware that these price cuts come as a result of customer feedback, and now the company will offer its L-series models, which support a beefy 4.5TB of capacity, at the same price points as the discontinued M models.

| Row 0 - Cell 0 | Memory Support | Markup Before Cuts | Markup After Cuts |

| Standard Cascade Lake Xeon SKUs | 1 TB | - | - |

| M-Series (Medium Memory Support) | 2 TB | $3,003 | Discontinued |

| L-Series (Large Memory Support) | 4.5 TB | $7,897 | $3,003 |

That equates to a big price cut for Xeon customers that require more memory capacity or are considering adopting high-capacity Optane DIMMs. Again, L-series models are built from the same silicon as the standard Xeon models, but before the change, customers had to pay $7,897 more to step up to the L-series models that support up to 4.5TB of memory capacity (given that you use Optane DIMMS).

Now they'll only have to plunk down an extra $3,003 per chip.

AMD EPYC Rome Impact

Intel's Cascade Lake Xeon lineup has one of the most complex product stacks we've ever seen, carved up by core count, base frequencies, PCIe connectivity, memory capacity/data rates, AVX-512 functionality, Hyper-Threading, UPI connections, and FMA units per core. Intel also excises Optane Persistent DIMM support on some of its Bronze models.

This strict segmentation policy assures that customers pay every penny for every single feature, but AMD's EPYC Rome processors proved to be a fly in Intel's high-margin ointment. That's largely because of AMD's standard value proposition of offering unrestricted feature sets on all of its processors.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Every Rome processor supports up to 4TB of memory per socket (two DIMMs per channel) without any additional fees. That certainly makes it hard to swallow a $3,003 premium over Intel's already-higher-than-AMD pricing and still fall short of matching EPYC's memory capacity, and even harder for Intel to charge a $7,897 premium to beat its competitor's available memory capacity. Perhaps Intel hopes that offering a higher memory capacity, albeit with some help from Optane and a lower $3,003 premium, helps the situation.

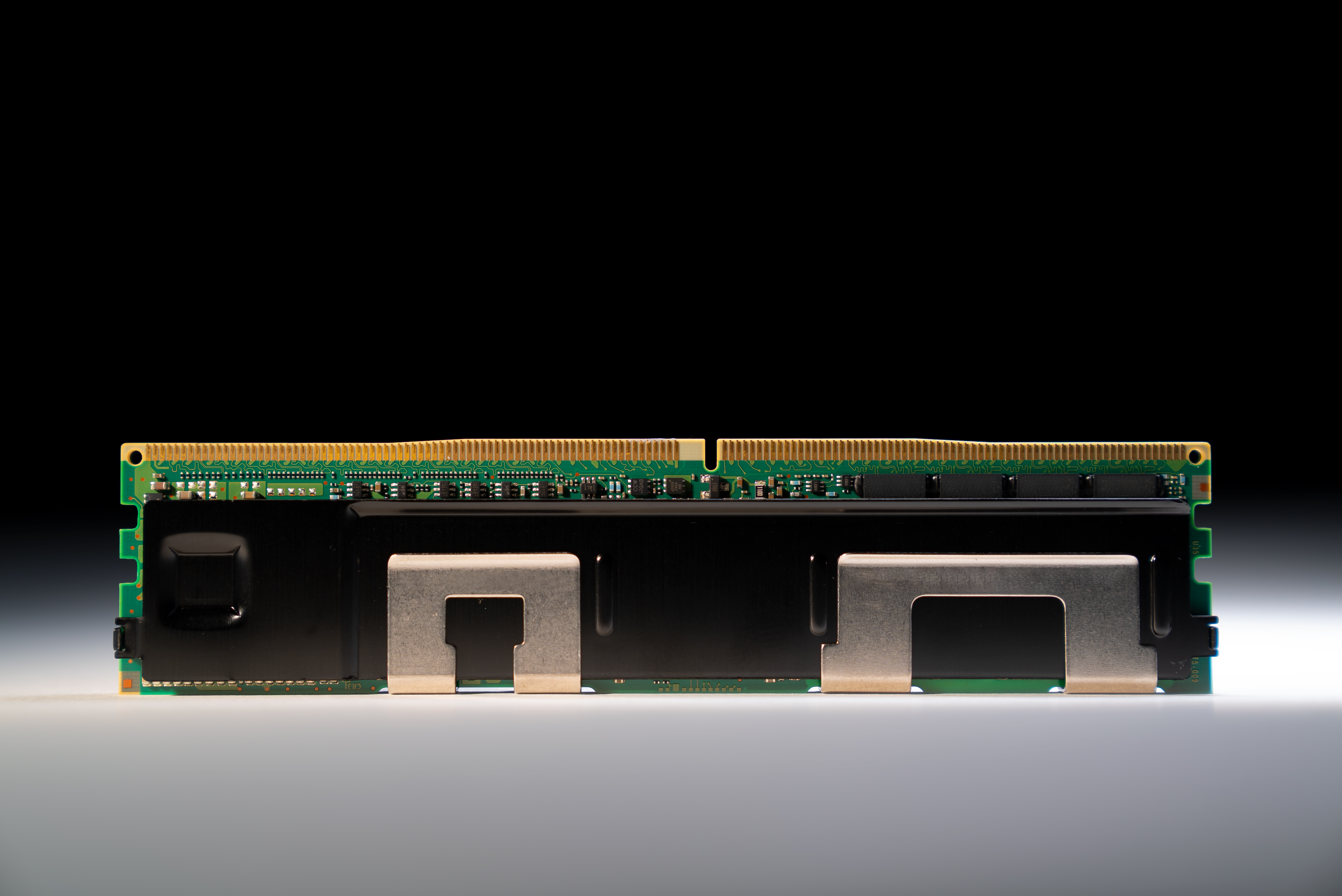

Factoring in Optane DC Persistent Memory DIMMs

Intel's Optane DC Persistent Memory DIMMs also come into the picture. Uptake of these modules is generally thought to be slow, largely because not all workloads benefit from the new technology that uses a persistent storage memory instead of DRAM. For the workloads that do benefit, it requires significant re-coding to optimize applications to extract the utmost capabilities of the new tech, not to mention validation costs. That equates to a steep up-front investment that serves as a major cost adder to the DIMMs themselves, not to mention the extra cash required for the chips that support the beefiest capacities.

And you'll need Optane DIMMs, which stretch up to 512GB per module, to fully use the L-series' 4.5TB of memory capacity. That's because the Xeon processors have six channels for DRAM, so if the processor runs with two DIMMs per channel, you'll only have 3TB of memory capacity. You'll need capacious Optane DIMMs to fully utilize your $7,897 investment and gain access to 4.5TB of memory.

To be clear, customers still have the option of using Optane DIMMs with most regular SKUs and had the same option with M-series models, but it's safe to assume that customers willing to spend the cash to accommodate the new tech are interested in fully utilizing the capacity advantages, which means they would have to pay the extra $7,897 tax.

Thoughts

It looks like Intel is killing two birds with one stone here: Eliminating the M-series while simultaneously slashing pricing on the L-series allows the company to both become more competitive with EPYC Rome processors on the pricing front, while also lowering the bar for entry to the most capacious Optane DC Persistent Memory DIMM deployments.

The price cut marks yet another benefit of the renewed competition in the server market, but also might indicate that Intel's sales of Optane DIMMs aren't going to plan. Intel and Micron recently split, so now Intel doesn't have its own captive Optane production, and it's noteworthy that Micron cited underutilization of its 3D XPoint fabs in the months before the split, and continued underutilization at its recent financial earnings call. That's telling because Micron doesn't have its own end devices based on 3D XPoint on the market, instead selling its portion of production off to Intel. But apparently, Intel isn't buying the projected amount of production capacity. That means sales were lower than projected then, and given the relative silence on the Optane DIMM front lately, they may continue to struggle.

To stave off the obvious value advantage of AMD's 7nm Zen 2-based chips, Intel also recently slashed gen-on-gen pricing in the client market with its Cascade Lake-X chips. Given Intel's remarks shortly thereafter, the company is ready to suffer lowered margins as a result of lowered ASPs until the 2023 time frame.

Make no mistake; the lowered margins are a direct result of what is now a price war between Intel and AMD. That means we could see drastic gen-on-gen price cuts when Intel's next data center lineup, Cooper Lake, lands this year.

Intel is already paying a steep price for its ~60% price reductions in the HEDT market, and we're sure volume discounts on the Cascade Lake Xeon chips are at record levels, but it's anyone's guess how much pain Intel plans to endure in its high-margin enterprise segment as it seeks to prevent AMD from gaining a meaningful foothold in the market.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

TerryLaze Intel has a 50% sale on the base game to lure people in and make more sales on the DLC(optane dimms,nervana on m.2 and on pcie)Reply -

Olle P I think Optane is the only reason to set up an Intel server today (and in the foreseeable future), and then only if you can make good use of it.Reply -

passivecool Customer feedback: "There's no F*cking way i'm paying that anymore"Reply

Intel: "ummm." -

urbanman2004 Intel had this coming while resting on its laurels so I def don't feel sorry for them.Reply -

JamesSneed Well when you look at the AMD's EPYC 7742 which is 64 cores, supports 4TB of max memory and supports 2P(two processors) is selling for under $7K. Intel can't match the cores or memory sizes which is a big deal in server consolidation.Reply -

xvegan The old adage "No one gets fired for going with Intel" still persists among corporate types.Reply -

Jennifer W Reply

What is nervana?TerryLaze said:Intel has a 50% sale on the base game to lure people in and make more sales on the DLC(optane dimms,nervana on m.2 and on pcie) -

spongiemaster ReplyTerryLaze said:Intel has a 50% sale on the base game to lure people in and make more sales on the DLC(optane dimms,nervana on m.2 and on pcie)

Whatever it takes to stop losing major money on optane. That's not why Intel dropped prices and cancelled a CPU. -

TerryLaze Reply

Intel is making as much money from non-volatile alone as AMD is making from all of their desktop CPU and GPU sales put together,I hardly think that they are hurting.spongiemaster said:Whatever it takes to stop losing major money on optane. That's not why Intel dropped prices and cancelled a CPU.

"as did Non-Volatile Storage which was up 19% to $1.3 billion. "

https://www.anandtech.com/show/15030/intel-announces-q3-fy-2019-earnings-record-results

"Computing and Graphics segment revenue was $1.28 billion, up 36 percent year-over-year and sequentially. Higher revenue was primarily driven by increased Ryzen client processor sales."

https://seekingalpha.com/pr/17679175-amd-reports-third-quarter-2019-financial-results