2020 GPU Sales Failed to Impress, Despite Record Demand

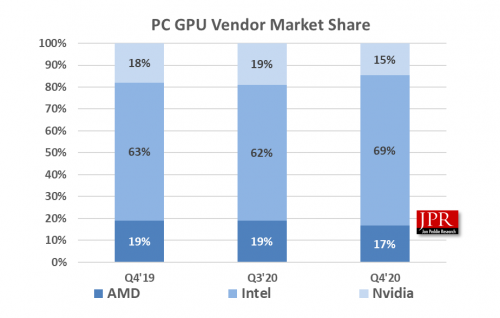

Intel gains GPU market share at expense of AMD and Nvidia.

Sales of PCs increased sharply in 2020 as people needed new desktops and notebooks to work and learn from home. As a result, shipments of GPUs (graphics processing units) also increased compared to 2019, mostly because the majority of today's CPUs (central processing units) come with integrated GPUs. But while many people were hoping to pick up one of the best graphics cards or best CPUs, availability was severely limited, particularly in the second half of the year. The surprising result is that, despite record demand for gaming PCs and hardware, sales of dedicated GPUs were not exactly exceptional in 2020. Data from Jon Peddie Research (JPR) confirms what we experienced, but let's look at the details.

As PC Sales Increase, Intel's GPUs Eat AMD's and Nvidia's Lunch

According to Gartner, PC shipments increased 10.7% year-over-year to 79.392 million units in Q4 2020. Quarter-over-quarter, PC sales increased by 11.2%. For the year, they totaled 274.147 million units, up 4.8% from 2019. JPR says that shipments of both integrated and discrete GPUs in the fourth quarter were up 20.5% quarter-over-quarter, as some chips are sold well before actual systems become available. That sounds good, but the actual GPU sales aren't quite as impressive.

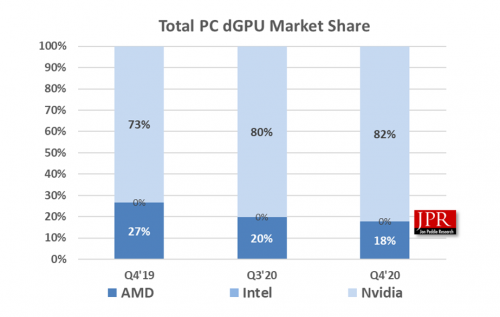

Since Intel remains the leading supplier of CPUs, it's also the No. 1 supplier of GPUs. In Q4 2020, Intel actually managed to solidify its lead by increasing its market share to 69%. Meanwhile, the three GPU vendors posted mixed results in the fourth quarter compared to the previous quarter: AMD's shipments were up 6.4% and Intel's sales increased 33.2%, while Nvidia's unit shipments decreased by a rather significant 7.3%.

As far as market share goes, Intel controlled 69% of the PC GPU market in Q4 2020, Nvidia's share dropped to 17%, and AMD's share fell to 15%. We've been talking about graphics card shortages since the Ampere launch back in September, but it's good to have hard numbers.

Both Intel and AMD sell loads of CPUs with integrated graphics, and last year the companies released quite successful 11th-Gen Core 'Tiger Lake' chips as well as Ryzen 4000-series 'Renoir' processors for laptops and compact desktops. To that end, it isn't surprising that the two companies increased GPU sales as shipments of notebooks boomed. Meanwhile, note that when counting CPU shipments, some of these devices may be sold to fill in backlog, or to sit in the inventory of PC makers.

Unlike AMD and Intel, Nvidia supplies only discrete GPUs and its unit shipments decreased because it suffered severe shortages of its desktop products in Q4. Despite the drop in unit sales and the deficit, Nvidia's position as the leading discrete GPU supplier didn't suffer. More on that later.

Sales of Desktop Graphics Cards Hit by Shortages, but ASPs Set Records

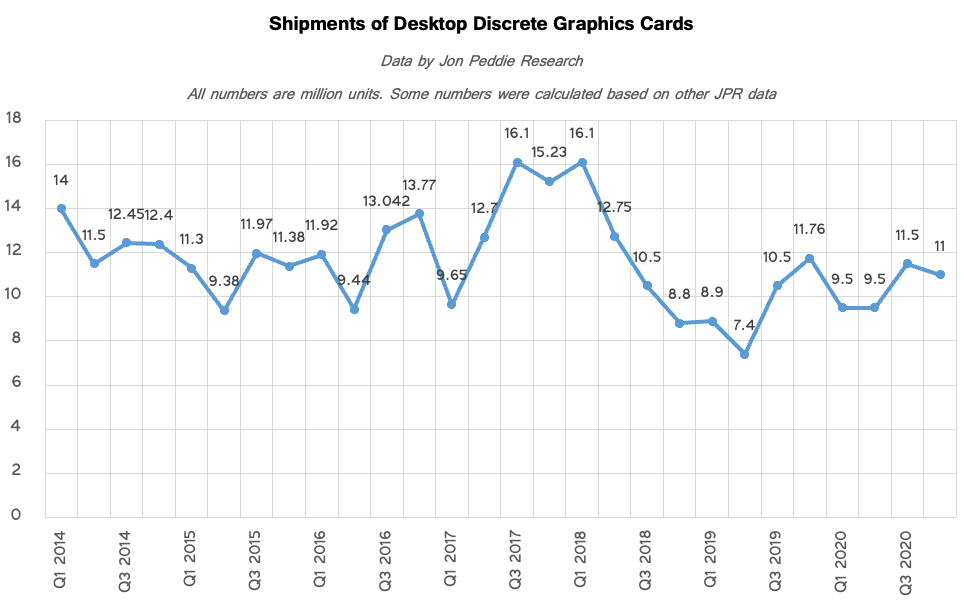

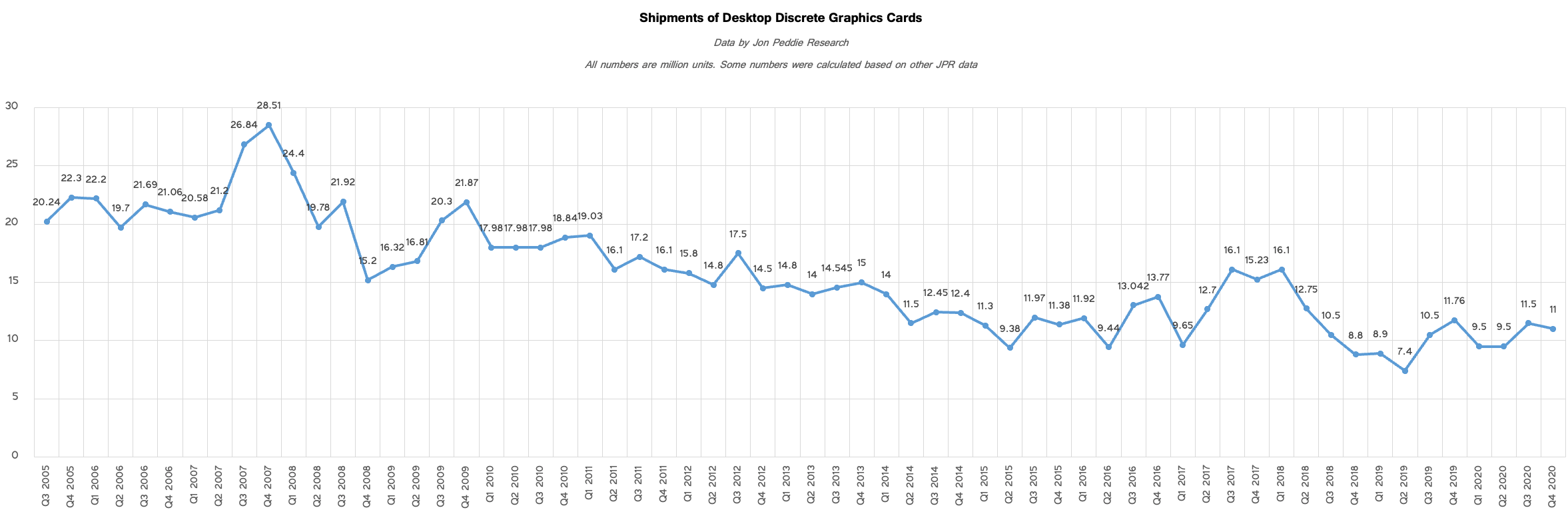

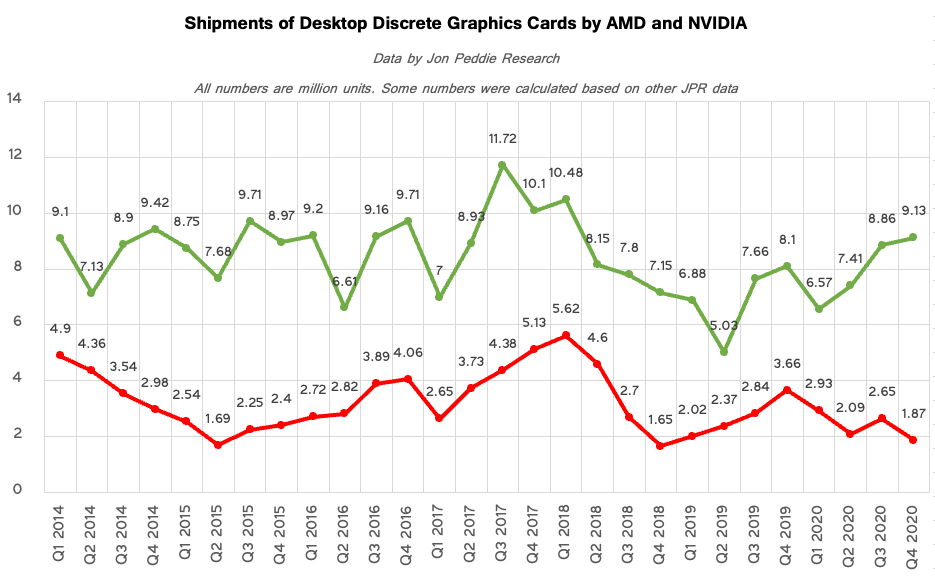

Unit sales of desktop discrete graphics cards were down 3.9% sequentially in Q4 2020. Jon Peddie Research reports that around 11 million add-in-boards (AIBs) were sold during the quarter.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Generally, approximately 11 million graphics cards sold in the fourth quarter looks like a rather modest result (it's below Q4 2019, Q4 2017, Q4 2016, and Q4 2015), but keeping in mind how significantly average selling prices of AIBs increased recently, 11 million GPUs mean a lot of money for AMD, Nvidia, and their AIB partners. Meanwhile, since it's extremely hard to get a new graphics board these days, it becomes rather evident that there is a great undersupply.

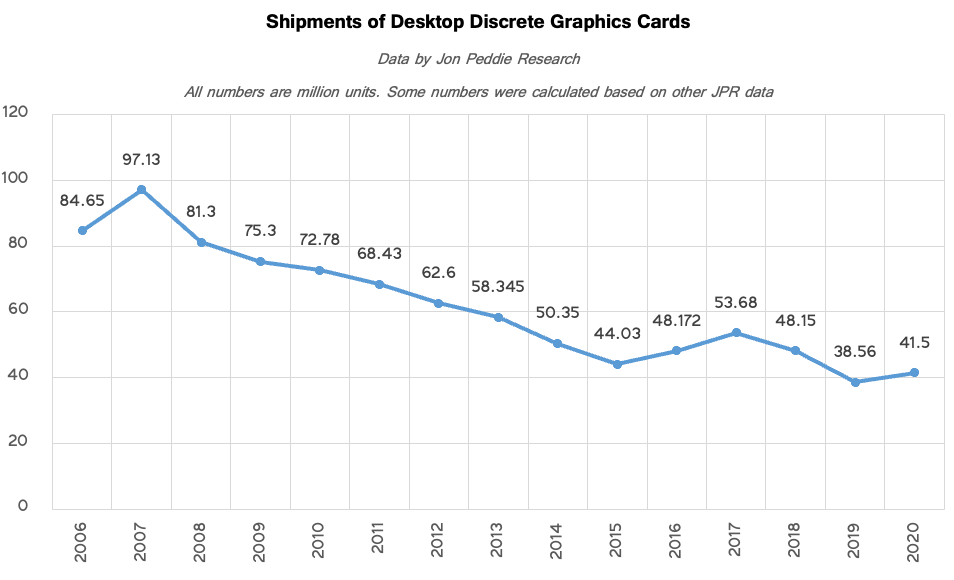

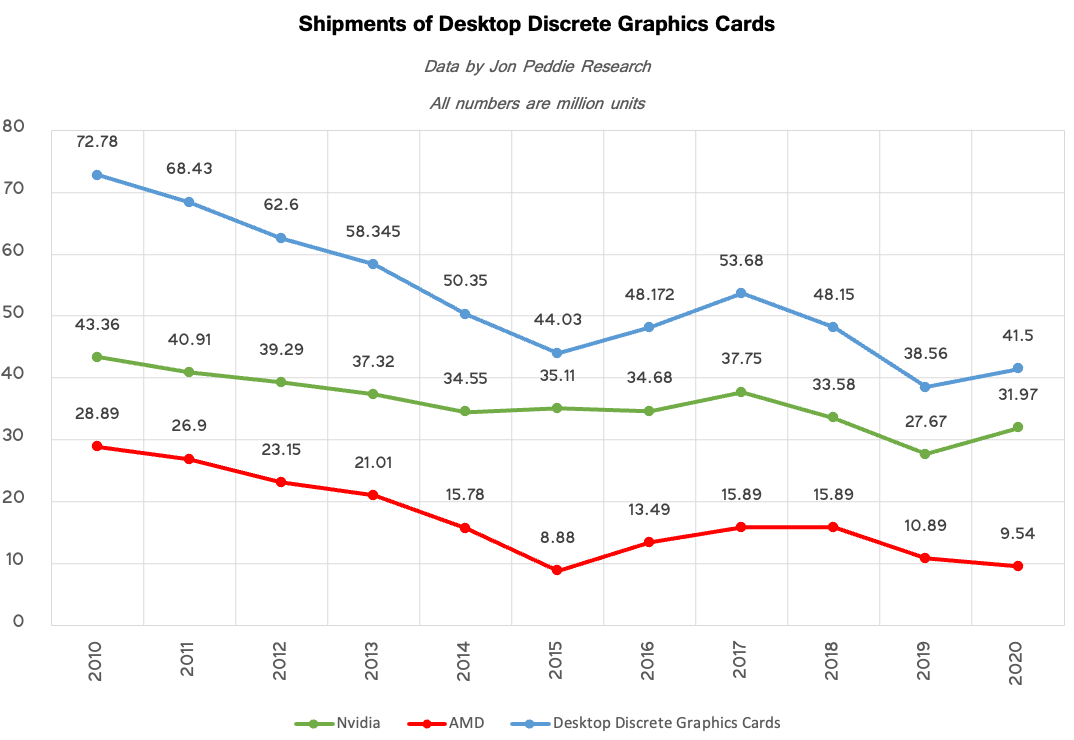

Overall, the market shipped around 41.5 million discrete graphics cards for desktop PCs in 2020, which is about 3 million more than 2019 but still below sales in prior years. Jon Peddie Research reports that the AIB market reached $14.8 billion last year, which means that an average graphics card cost $360 last year.

In recent months we saw numerous reports and videos about cryptocurrency mining farms using hundreds or thousands of graphics AIBs to mine Ethereum. While there certainly are mining farms using loads of GPUs, it doesn't appear that they somehow substantially increased the total available market of video cards. Most probably, they have had added to the deficit of graphics cards on the market, but neither miners nor scalpers are the key reasons for the shortages.

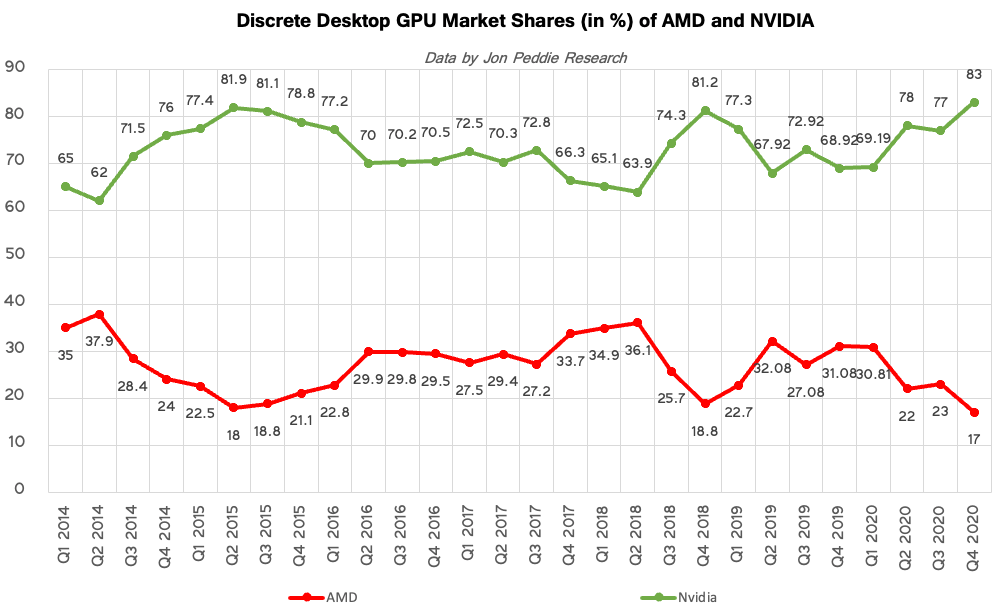

Desktop Discrete GPUs: Nvidia Continues to Lead, AMD's Share Hits Historical Low

Nvidia has been leading the desktop discrete GPU market since the early 2000s, and in Q4 2020 it actually captured its highest unit market share ever. Last quarter the company controlled 83% of the shipments. By contrast, AMD's share hit an all-time low of just 17%.

Throughout the fourth quarter, Nvidia complained about shortages of GPUs and other components. However, it still managed to ship over 9 million standalone graphics processors for desktops throughout the quarter, which is its best result in two years. We do not know the share of Nvidia's Ampere GPUs in its shipments in Q4 2020, but previously the company indicated that it was draining its Turing inventory for a couple of quarters, so the GeForce RTX 30-series was probably sold in noticeable quantities in Q4.

AMD's desktop discrete AIB market share in the fourth quarter 2020 dropped sharply by 6% sequentially. The company commanded 17% of shipments and sold about 1.87 million standalone GPUs for desktops in Q4 2020, 780 thousand less than in Q3 2020, according to Jon Peddie Research. For AMD, this is the worst result in two years.

During the last quarter, AMD launched its latest Radeon RX 6800/6900-series graphics cards based on the Navi 21 GPU that were sold out as soon as they reached store shelves. The company also complained about shortages of components. In addition to its desktop discrete GPUs, AMD also had to ramp up production of its Ryzen 5000-series processors as well as system-on-chips (SoCs) for the latest game consoles in Q4, which naturally decreased the number of pre-allocated wafers it could use for the Radeon products.

Nvidia Solidifies Positions as Leading dGPU Supplier

Although Nvidia's unit sales dropped by 7.3% quarter-over-quarter in Q4 2020, the company still managed to post massive gaming revenue gains and actually increased its discrete GPU market share (which includes graphics processors for both desktops and laptops) to 82%, based on data from Jon Peddie Research.

In recent years, Nvidia has outsold AMD 7:3 or 4:1 in the discreet GPU market, which is a significant lead. Nvidia has also long dominated the standalone GPUs market for laptops with gaming GPUs for laptops. Historically, this market was small, but it grew by 7X in seven years, according to Nvidia. So far, the company has sold 50 million mobile GeForce graphics processors for gaming, which is a lot.

"Laptops right now, gaming laptops, is probably the fastest-growing gaming platform that is out there," said Colette Kress, CFO of Nvidia, at the Morgan Stanley Technology, Media and Telecom Broker Conference (via SeekingAlpha). "It is up 7 times in just 7 years. Q4, for example, was our 12th consecutive quarter of double-digit year-over-year growth in our overall laptops. Our GeForce RTX 30 series laptops launch was one of our largest launches ever with more than 70-plus different devices. […] We have got 50 million GeForce laptop gamers at this time."

Summary

Demand for PCs is booming, which helps AMD and Intel sell tens of millions of CPUs every quarter. Over 274 million systems were sold in 2020, which means these two companies supplied over 274 million client processors throughout the year, and most of these CPUs featured an integrated GPU. In contrast, the situation looks different when it comes to discrete GPU sales.

Traditionally, GPU sales increase when new GPUs and new games arrive, or at least stay at high levels. Both AMD and Nvidia started shipments of their new AIBs based on the latest RDNA2 and Ampere architectures in Q4 2020. Several new AAA games were released during the quarter as well, including Cyberpunk 2077, Assassin's Creed Valhalla, Marvel's Avengers, and Microsoft Flight Simulator. However, despite new hardware and game launches, actual discrete GPU shipments dropped in Q4 vs Q3, which was almost certainly caused by component shortages.

Nvidia sold over 9.13 million of desktop discrete GPUs in Q4 2020, which was a bit up from the prior quarter, but the shipments were constrained. With its Radeon RX 6800/6900-series graphics cards based on the Navi 21 GPU, AMD's Radeon products turned out to be competitive against Nvidia's in the lucrative enthusiast segment for the first time in years. Unfortunately, the company's market share and unit shipments declined sequentially because of the shortages and because the company had to ramp up production of other products, which lowered its ability to produce enough Radeons for the market.

In general, discrete desktop GPU shipments in 2020 totaled approximately 41.5 million units and exceeded shipments of graphics cards in 2019. That's likely due to AMD and Nvidia both selling out of previous generation cards, rather than significant numbers of the latest generation GPUs. Shortages constrained and continue to limit AIB sales, and it's difficult to estimate just how high the actual demand for standalone desktop GPUs was in 2020. Looking forward, there's still unmet demand, and the GPU and graphics card makers would need to produce plenty of products to keep up in 2021. Unfortunately, that's likely not possible, as the shortages continue to plague the industry.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Phaaze88 Intel's doing well.Reply

AMD appears to be in a grey area, of sorts.

Nvidia looks like a, 'yes, but actually no' scenario. -

InvalidError Reply

AMD is bottlenecked by its TSMC situation and most work-from-home systems don't need a dGPU, perfect time for Intel to claw some desktop and laptop market share back.Phaaze88 said:Intel's doing well. -

escksu ReplyPhaaze88 said:Intel's doing well.

AMD appears to be in a grey area, of sorts.

Nvidia looks like a, 'yes, but actually no' scenario.

This chart is not accurate. Intel is doing very well because vast majority of its CPUs comes with integrated GPU.

Nvidia is actually having their best performance ever. They are having a record quarter. The only thing stopping them from doing even better is not making enough GPUs to sell to their AIB partners. They are also increasing their pricing due to demand.

AMD sales is very good but not as good as nvidia due to 2 reasons:

Not enough GPUs to sell. Their stocks are even worse than nvidia.

Not attractive to miners. Nvidia cards are way better in mining this time. 3060ti/3070 are just as fast but lower power. 3080/3090 are way faster.

AMD's 5700 was actually the best mining card prior to 3060ti/3070 but AMD decide to phase it out totally. The reference 5700 can be tweaked to provide around 52MH/s while keeping power at just 100W or even a little lower. 2 of these will produce over 100MH/s @ 200W......6800 series pales in comparison. -

CaptainMorgan2006 It's also misleading because a significant number of the "AMD GPUs" and "Intel GPUs" are never utilized as such. My Omen desktop came with a 9600k (not kf), and I upgraded to a 9900k (cheaper than the kf at the time), and the Intel Graphics 630 on those chips can't be utilized on my motherboard. However, for accounting purposes, that goes down as two "Intel GPU" sales.Reply -

TerryLaze Reply

Impossibruh, plug a monitor into the mobo and the igpu will be detected by bios/windows if it's enabled.CaptainMorgan2006 said:and the Intel Graphics 630 on those chips can't be utilized on my motherboard.

On win 8 you could make a virtual connection to enable the iGPU,

https://linustechtips.com/topic/351206-super-easy-quicksync/Apparently it's still there in windows 10 but it doesn't show up for me personally so I don't know.

Windows10/comments/5p5qgzView: https://www.reddit.com/r/Windows10/comments/5p5qgz/try_to_connect_anyway_on_vga_option_missing/

-

CaptainMorgan2006 Reply

There is no video output on the motherboard. This is pretty standard on gaming desktops.TerryLaze said:Impossibruh, plug a monitor into the mobo and the igpu will be detected by bios/windows if it's enabled.

On win 8 you could make a virtual connection to enable the iGPU,

https://linustechtips.com/topic/351206-super-easy-quicksync/Apparently it's still there in windows 10 but it doesn't show up for me personally so I don't know.

Windows10/comments/5p5qgzView: https://www.reddit.com/r/Windows10/comments/5p5qgz/try_to_connect_anyway_on_vga_option_missing/

-

Phaaze88 Reply

That is not standard at all. That is HP being an anti-consumer dick.CaptainMorgan2006 said:There is no video output on the motherboard. This is pretty standard on gaming desktops.

Like, really, why was there a need to remove those?

Most buyers of prebuilt towers aren't buying an HP Omen, Alienware, Lenovo Legion, or whatever other gaming moniker, due to cost.

They're going a step below that, or going to more affordable offerings, like CyberPowerPC or Ibuypower, for example. Those machines still have motherboard video outputs.

Laptop sales are up. The iGPUs in those are used to save power when the discreet gpu isn't in use - or if one isn't present at all; not everyone needs a dGPU.

Most do not go about disabling the iGPU in order to utilize more of the dGPU either.

Business, education, general purpose... those sales stomp gaming in total volume sold. Both AMD and Intel are doing well here - Intel even more so, for obvious reasons.

@escksuHey, if you've got some charts/numbers to show in regards to Nvidia's position, I'll gladly eat that up... -

JarredWaltonGPU Reply

This is why there are the additional charts show AIB sales. Intel doesn't compete there (yet, probably not really going to compete much with Xe Graphics either -- at least with Gen1 Xe), so all sales of dedicated cards are strictly AMD vs. Nvidia.CaptainMorgan2006 said:It's also misleading because a significant number of the "AMD GPUs" and "Intel GPUs" are never utilized as such. My Omen desktop came with a 9600k (not kf), and I upgraded to a 9900k (cheaper than the kf at the time), and the Intel Graphics 630 on those chips can't be utilized on my motherboard. However, for accounting purposes, that goes down as two "Intel GPU" sales.