European think tank suggests punitive DUV machine export ban following China's latest round of rare earth export controls

Think tank suggests tighter semiconductor controls amid rare earth tensions.

A European think tank suggests retaliatory trade measures against China, and the trigger appears to be Beijing’s threat to restrict exports of rare earth materials. But the suggested counterstrike would hit closer to home by expanding controls on semiconductor tooling, with ASML's DUV machines in the direct line of sight.

According to a recent report by Bloomberg, a European think tank named the European Council on Foreign Relations (EFCR) has begun mapping out “trade options” should diplomacy fail, amid growing frustration over asymmetric pressure tactics from Beijing.

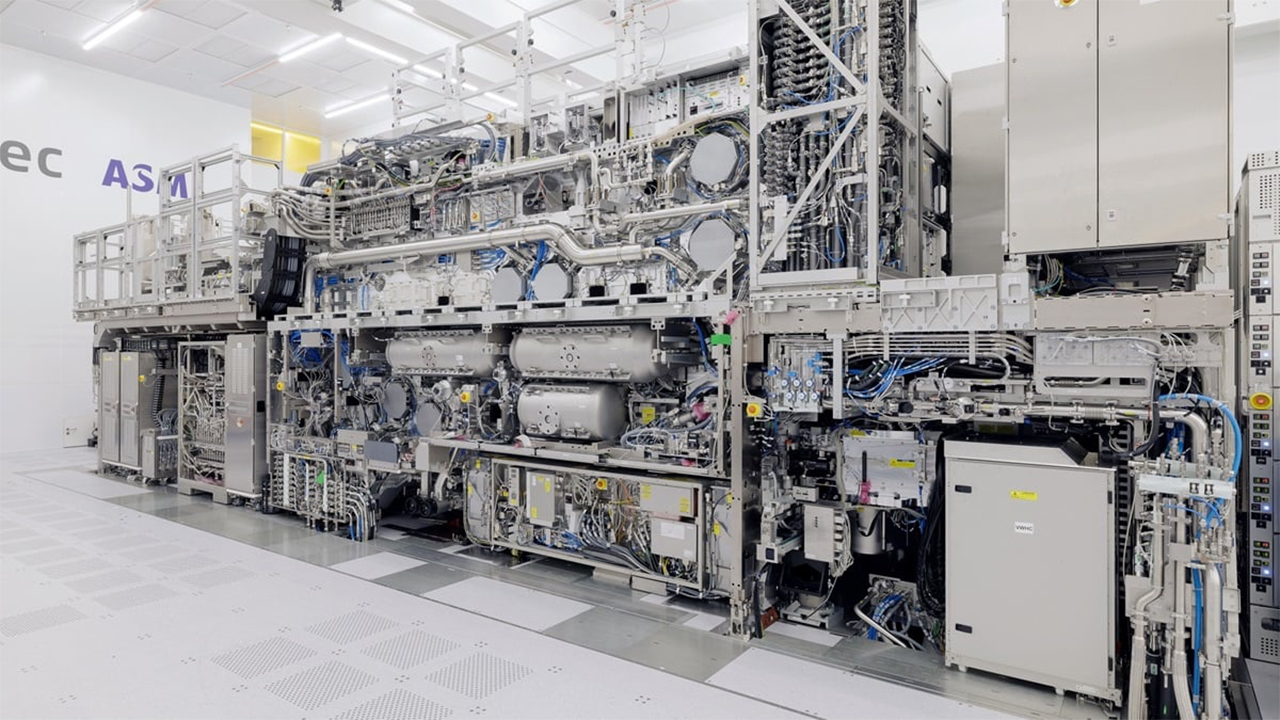

In other words, if China weaponizes rare earths, the EFCR has suggested responding by tightening controls over legacy chip tools still flowing to Chinese fabs. Such measures considered by the EFCR, (which has no formal attachment to the European Commission) would put ASML — the only company in the world that can supply EUV scanners and one of just three capable of building advanced DUV machines — in a difficult position.

25% of revenue weighed up

In Q3 2025, ASML generated €2.4 billion in sales from China, accounting for 42% of system sales revenue and just over 25% of total revenue. More than 90% of those Chinese orders were for DUV systems like the Twinscan NXT:2000i and NXT:1980Di platforms, both of which remain exportable under current Dutch rules.

Unlike ASML’s EUV tools, which are already banned for export to China, these immersion DUV machines are used to fabricate chips on older nodes, and are critical to everything from automotive MCUs to AI accelerators built on older logic.

While the current licensing regime already restricts EUV exports, the think tanks suggest that the same controls could eventually extend to advanced DUV systems. Those tools are not exempt by default — they’ve simply been licensed on a case-by-case basis, and that door could close if diplomatic talks with Beijing break down. Bloomberg's report states that the EFCR is actively exploring those options, mapping out escalation scenarios in parallel with attempts to de-escalate.

If the EFCR's consideration of a ban on DUV exports catches the ear of Dutch authorities who follow through, it could force ASML to walk away from a quarter of its revenue overnight. While ASML has told investors it expects 2026 sales to hold steady even with a decline in China-bound shipments, that guidance assumes a controlled taper, not a blanket ban, as explored by the think tank.

Additionally, ASML continues to fulfil DUV orders that were secured before licensing rules tightened, many of which came from Chinese foundries racing to build up capacity while they still can. If those orders are cancelled or blocked midstream, the company could be left with idle capacity or orphaned inventory that isn’t easily redirected.

It’s tempting to write off DUV as yesterday’s technology. EUV gets all the attention, especially as TSMC and Intel push toward 2nm and beyond. But for China’s domestic foundries — SMIC, HuaHong, Nexchip, and others — DUV is the workhorse platform. Even Huawei’s Kirin 9000S, fabricated at a nominal 7nm, was likely stitched together using multi-patterned DUV.

The problem is that while China has developed domestic alternatives for some fab gear, it still lacks a credible substitute for ASML’s DUV steppers. Canon and Nikon, the other two players in the DUV space, are either capacity-limited or unwilling to challenge Dutch export policy. That would leave Chinese fabs with few options, particularly for immersion lithography.

Deepening tech isolation

If such a ban, as considered by the ECFR, were to pass, it would deepen China’s tech isolation, but also accelerate the buildout of domestic alternatives. SMEE, China’s state-backed lithography firm, has already shipped early-generation tools and is working on immersion platforms.

Meanwhile, SMEE spinoff AMIES recently showcased its latest lithography equipment at an industry event in Shenzhen. Even if performance is years behind, China has shown a willingness to subsidize inefficient infrastructure for the sake of supply chain resilience.

For ASML, cutting off China means forfeiting a quarter of its revenue and potentially triggering retaliatory action against its installed base of thousands of tools currently running across Chinese fabs, which all depend on ASML parts and servicing.

If the think tank's exploration were to pass, a full ban would hurt China in the short term, but hand it a longer-term incentive to accelerate tooling independence. It would squeeze ASML’s financials just as demand from customers in the West begins to normalize. And it would force the Netherlands to pick sides in a trade war it didn’t start.

Update 10/23/2025 8:12am PT: Article amended to reflect that the report came from a think tank.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.