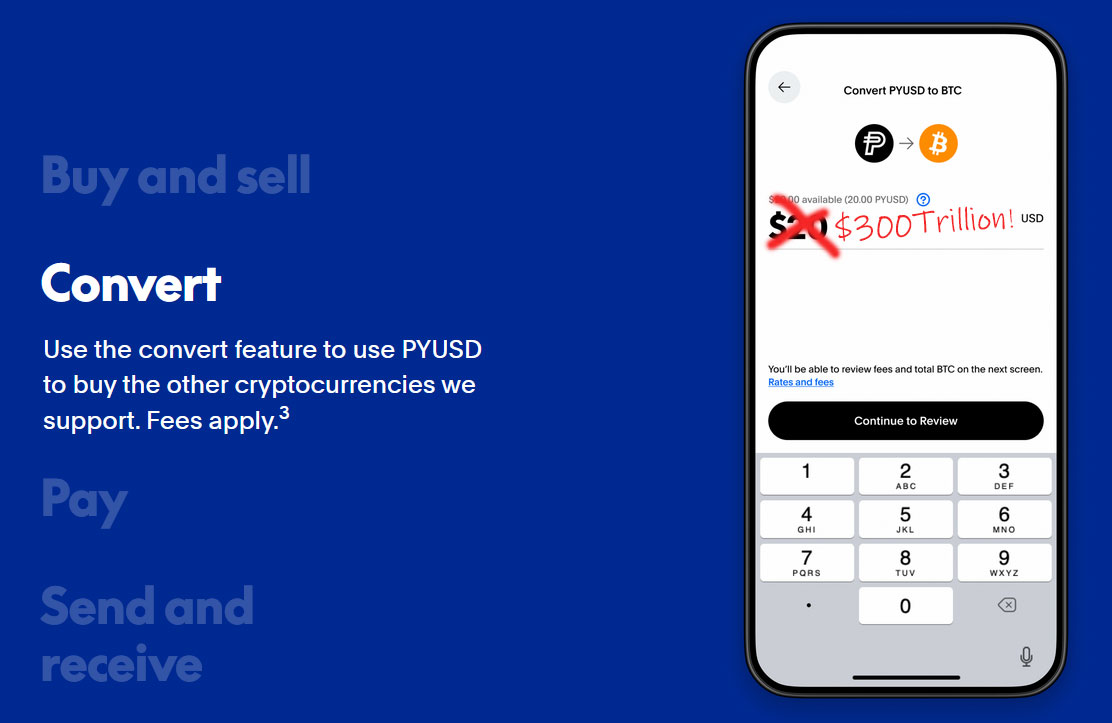

PayPal crypto partner accidentally mints stablecoins worth double the world’s total GDP — Paxos undersells $300 trillion incident as an ‘internal technical error’

PYUSD stablecoin is marketed as being ‘fully backed by US dollar deposits, US treasuries, and similar cash equivalents.’

Even in 2025, some aspects of cryptocurrency seem rather risky, despite assurances that certain coins are fully backed, stable, and secure. A hair-raising case in point hitting the newswires today is provided by PayPal’s crypto partner Paxos, which accidentally minted $300 trillion PYUSD a few hours ago. This so-called ‘stablecoin’ is said to be “fully backed by US dollar deposits, US treasuries, and similar cash equivalents.” Despite that pledge, there is no way that such a gargantuan sum was backed by anyone or anything, as it is roughly equivalent to “more than double the world’s estimated total GDP,” reports CNBC.

An official Paxos newsroom release or blog post hasn’t yet been prepared to provide insight into this fat-finger error by the ‘PayPal USD’ crypto issuer. This seems to go against the firm’s transparency pledges, but perhaps someone is still busy typing out the full details of what caused this error. For now, we have to do with a brief, dismissive social media statement from Paxos, as embedded below.

At 3:12 PM EST, Paxos mistakenly minted excess PYUSD as part of an internal transfer. Paxos immediately identified the error and burned the excess PYUSD. This was an internal technical error. There is no security breach. Customer funds are safe. We have addressed the root…October 15, 2025

“At 3:12 PM EST [October 15], Paxos mistakenly minted excess PYUSD as part of an internal transfer,” reads the intro of the brief statement. “Paxos immediately identified the error and burned the excess PYUSD.” It would be interesting to have a measure of the firm’s definition of ‘immediately.’ However, according to cryptowatchers on platforms like Etherscan, the $300 trillion error persisted for roughly 20 minutes.

Paxos went on to unapologetically dismiss concerns over the gigantic financial blunder. "This was an internal technical error. There is no security breach. Customer funds are safe," it asserted. "We have addressed the root cause," the firm concluded, as a way of reassurance.

The vast sum central to this error bears no relation to the power of PayPal to cover a 1:1 exchange into USD. Market data shows that PYUSD actually has a market capitalization of ~$2.6 billion. It is currently the sixth-largest stablecoin and is set to prosper, as this type of value-backed crypto is becoming more established and broadly supported by banks and payment platforms.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

coolitic Such an error happening for "even" 20 minutes torpedoes all credibility.Reply

All financial systems are expected to be 100% error-less in terms of credits/debits. -

micheal_15 this fake "stablecoin" essentially lets paypal 'invent' millions of dollars of it anytime they want to. So someone (who for legal reasons I shall refer to as (C)hicken (E)gg (O)rganizer) could just invent himself 500 million of them during a transfer and people might not notice. Then he sells them for actual dollars....Reply -

Notton I'm glad I'm not the only person to accidentally fat finger 300,000,000,000,000 instead of 300.Reply -

wwenze1 Crypto: Everything is calculated and hashed with no possibility of error or even attacks outside of majority attackReply -

deepblue08 Reply

Expected and reality is often different. I worked on international financial systems before (using the old payment rails like SWIFT and such), it's a shitshow, humans sending text files to each other hoping the numbers match...this is how banks talks to each other :/coolitic said:Such an error happening for "even" 20 minutes torpedoes all credibility.

All financial systems are expected to be 100% error-less in terms of credits/debits. -

Aaron Priest Reply

Just like the (non)Federal (non)Reserve does.micheal_15 said:this fake "stablecoin" essentially lets paypal 'invent' millions of dollars of it anytime they want to. So someone (who for legal reasons I shall refer to as (C)hicken (E)gg (O)rganizer) could just invent himself 500 million of them during a transfer and people might not notice. Then he sells them for actual dollars....