Nvidia responds to reports that its H20 GPU for China is ending production — next-gen B30A green light "up to the United States government," according to CEO Jensen Huang

Reports claim that Nvidia's AI chip for China is ending

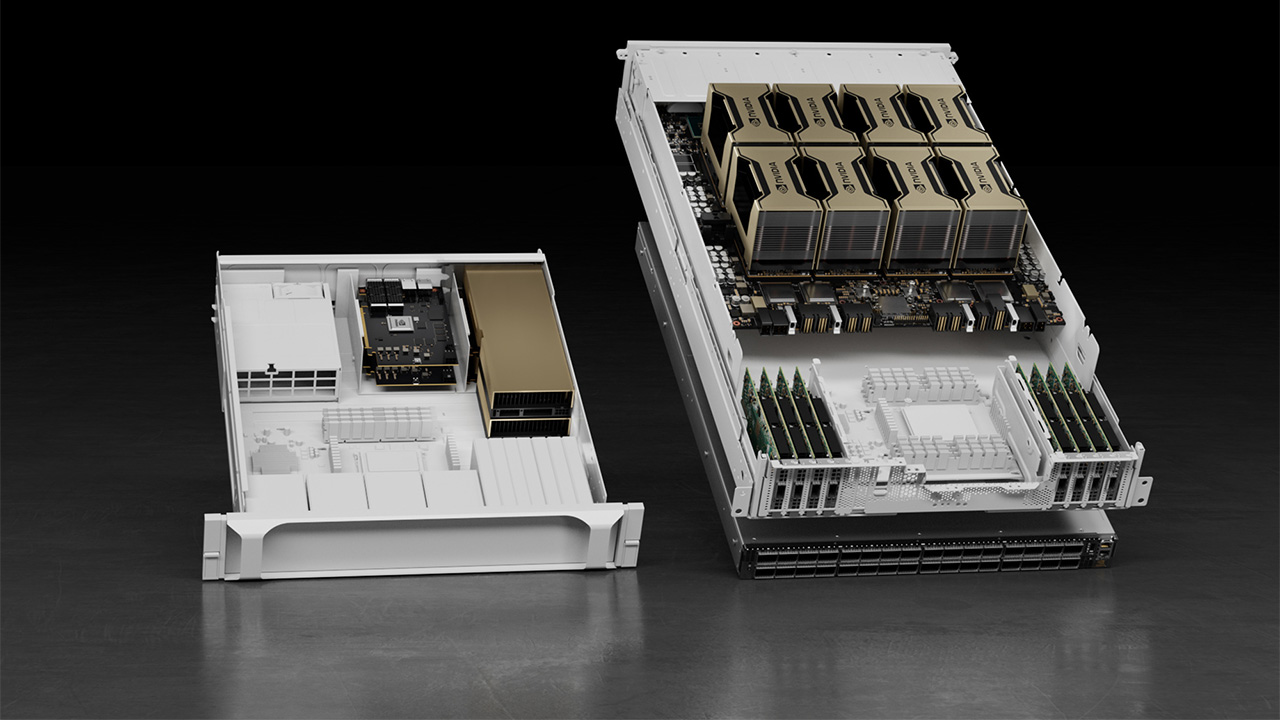

Following a turbulent summer that saw sales of Nvidia's China-only HGX H20 AI chip banned and then unbanned in China, the AI GPU now faces an uncertain future. A new report suggests that Nvidia is abruptly stopping production of the HGX H20, which Nvidia has responded to in a statement provided to Tom's Hardware. This comes soon after reports earlier this week that Nvidia is preparing a successor to the chip, the Blackwell Ultra-based B30A.

A report from The Information claims that Nvidia has asked suppliers to wind down production of H20-related work. According to the report, Nvidia sent these communications to Amkor Technology, which handles packaging for the H20, and Samsung Electronics, which provides the High Bandwidth Memory (HBM) for the AI chip. This could potentially signal that production of the H20 is winding down, but that leaves the door open to more questions.

When quizzed on whether or not the H20 would remain in production, an Nvidia spokesperson told Tom's Hardware, "We constantly manage our supply chain to address market conditions". While this isn't an exact response to our question about whether or not the H20 is still in production, it implies that some degree of the communications from Nvidia to Amkor and Samsung do indeed hold some weight.

Nvidia responds

Nvidia also insists that the H20 is not a political tool or has security backdoors, with a spokesperson for the company stating, "As both governments recognize, the H20 is not a military product or for government infrastructure". Cybersecurity was also on the mind, with Nvidia once again insisting that the H20 has no security backdoors, despite the CAC's claims: "NVIDIA does not have 'backdoors' in our chips that would give anyone a remote way to access or control them. The market can use the H20 with confidence."

This is a sentiment echoed by CEO Jensen Huang, who spoke to journalists in Taipei, Taiwan: "We have made very clear and put to rest that H20 has no security backdoors, there are no such things, there never has, and so hopefully the response that we've given to the Chinese government will be sufficient".

In between rumors of the H20 seemingly winding down production, and the perceived highlighted risk of security backdoors, another factor has emerged: A potential successor to the H20 itself, a new high-powered chip, specifically for China.

Earlier this week, reports emerged that the company was working on a de facto successor to the H20, which will comply with existing export control rules, and could be sold on the Chinese market. The Blackwell Ultra-based B30A is a substantially more powerful chip than the H20, which beats the full-fat H100 in many ways, but remains significantly slower than the B300. Samples are expected to land in September. But the product has yet to be greenlit by the U.S. Government. The earliest that commercial units could be shipped would be by the end of 2025, to early 2026.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Huang further stressed: "Offering a new product to China for the data center, AI data centers, the follow-on to H20, that's not our decision to make. It's up to of course the United States government, and we're in dialogue with them, but it's too soon to know".

Nvidia is caught between two global superpowers: The U.S. Government and the People's Republic of China. It's an unenviable situation, with complex factors at play, including the race to develop the most advanced AI models and local fabrication. China is making moves to reduce reliance on U.S. hardware with a new strategic alliance to reduce fragmentation, and the open-sourcing of CANN, in a bid to reduce reliance on Nvidia's CUDA.

Nvidia's HGX H20 has long been a point of contention for the company, the U.S. Government, and the People's Republic of China. As the H20 is commonly used to develop AI applications in China, Nvidia's chips are likely being used for training leading AI models, such as DeepSeek R2.

The HGX H20 itself is a significantly scaled-down version of Nvidia's H100 GPU, which is approximately 3.3 to 6.6 times faster than the H20. China has access to rapid hardware, such as Huawei's rack-scale CloudMatrix 384, but a reliance on Nvidia's CUDA-shaped moat has thrown a wrench into China's AI aspirations.

Despite attempts to switch to Huawei platforms for training the new DeepSeek R2 model, the company has reportedly now switched back to using Nvidia hardware instead, highlighting the strategic importance of high-powered AI hardware. However, in April 2025, sales of the H20 to China were banned, causing Nvidia to write off $5.5 billion in inventory.

This decision was later reversed in mid-July 2025. China's access to Nvidia's H20 chips was no longer hampered. With the floodgates opened, the inventory of existing H20 stock quickly became limited. So, Nvidia reportedly put in an order for 300,000 AI GPUs with TSMC in late July. This deal is believed to be worth around $3.9 billion, if each H20 GPU is valued between $12,000 - $14,000 per unit (via Reuters).

Then, the U.S. wanted a slice of the pie, with the government requesting that 15% of each GPU sold to China be diverted into federal coffers. Days later, the Cyberspace Administration of China (CAC) asked major companies to pause new H20 purchases, as it investigated potential security risks, a claim which Nvidia has since rebuffed.

Whether China's efforts will be successful remains to be seen. However, one thing is clear. The demand for high-powered chips remains strong, but whether or not Nvidia will be able to provide them for Chinese customers is a question only the U.S. Government can answer.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Sayem Ahmed is the Subscription Editor at Tom's Hardware. He covers a broad range of deep dives into hardware both new and old, including the CPUs, GPUs, and everything else that uses a semiconductor.